Car industry’s big inflation problem 🚘️

Happy Friday! Here’s what we’re serving:

- Car industry’s big inflation problem 🚘️

- Korean chip producers pick US 🇺🇸

- Bank of England pumps up rates 🇬🇧

- Law Firm application deadlines ⏲️

Car industry’s big inflation problem 🚘️

Imagine you're hosting the hottest party of the year.

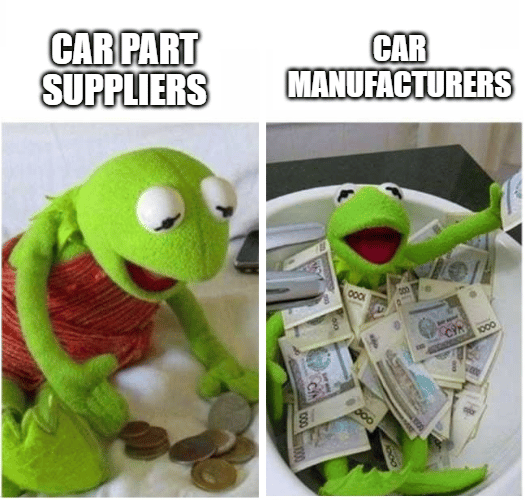

Mercedes-Benz and Renault are the life of the party, showing off their fancy suits, toasting to record profits from skyrocketing vehicle prices.

On the other hand, the guys who actually tailor those suits (aka car parts suppliers) are sitting in the corner, nursing a sad rum and coke.

In short: car manufacturers are rolling in the dough due to sky-high car prices while their suppliers are struggling.

Why, you ask? Well there’s a few reasons:

- Supply-chain disruptions: Global shipping has been more unpredictable than a season finale cliff-hanger. That’s putting a spanner in the works for auto part deliveries.

- Employment issues: Employee unrest is brewing in these firms, adding more fuel to the fire with rising costs, strikes and litigation.

- Rising costs: Material and energy prices have shot up like they're on a space mission. This means higher production costs for suppliers.

- Tech investments: The pressure to develop and integrate new tech, such as EV components, is massive. And innovation ain't cheap.

Supplier Suffering: A Lesson in Contract Pain

Parts suppliers are stuck in long-term, fixed-price contracts with big-name customers.

Imagine agreeing to cater a five-course meal for a price, then seeing the price of ingredients skyrocket, but you can't ask for more money because you signed on the dotted line.

And trying to renegotiate these deals ain’t easy.

The Turnaround? Maybe...

In some good news, vehicle production volumes are picking up, key components are becoming available again, and raw material costs seem to be chilling out.

However, auto parts suppliers still have to navigate auto companies constant hunt for better deals, the EU's push for electric vehicles, and their own rising debt costs.

How does this impact Law Firms?

Bankruptcy and Restructuring:

- Debt Restructuring: As the car parts suppliers grapple with rising debts and financing issues, lawyers in bankruptcy and restructuring departments will likely see a surge in work related to debt restructuring. This includes negotiating terms with creditors, redrafting debt agreements, and advising on debt-for-equity swaps.

- Insolvency Proceedings: If any of the suppliers cannot manage their debt and enter insolvency, bankruptcy lawyers will be called upon to manage insolvency proceedings. This can range from filing bankruptcy petitions, to managing the liquidation or reorganisation of assets, to representing the client in court proceedings.

Commercial and Contracts:

- Contract Renegotiation: Given that many parts suppliers are locked into long-term, fixed-price contracts, there would be a surge in demand for commercial lawyers to aid in contract renegotiation. This would entail reviewing contract clauses, identifying grounds for renegotiation, and then facilitating discussions between parties to reach new agreements.

- Dispute Resolution: If these renegotiations result in disagreements, commercial lawyers may also be needed for dispute resolution. This could involve interpreting contractual terms, identifying potential breaches, and either negotiating settlements or preparing for litigation.

Environmental:

- Advising on Transition to Green Technologies: With the European Union's push for electric vehicles (with a new deal to end sales of new CO2 emitting cars by 2035), ESG lawyers will see an increase in advising on how suppliers can adapt to environmental regulations and transition their operations to be more sustainable. This could include advising on regulatory compliance, structuring green financing deals, and helping to draft corporate sustainability policies.

- Supply Chain Audits: As suppliers face pressure to demonstrate their ESG credentials to automakers and investors, lawyers in this area could also be tasked with conducting supply chain audits. This would involve assessing the environmental and social impact of their supply chains and suggesting improvements to meet ESG standards. Blockchain applications in supply chains could be a growing trend using NFTs attached to shipments to verify their movements along the supply chain.

Korean chip producers pick US 🇺🇸

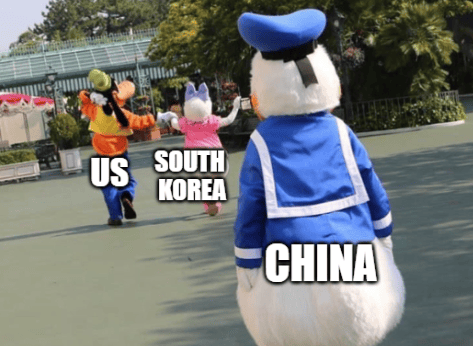

Picture this: You're at a high stakes poker table, and you're South Korea.

On one side, you've got the US, and on the other, there's China.

And what's at stake? It's tech, baby! Batteries, semiconductors, and all that jazz.

So, let's break it down.

South Korean big shots like Samsung, SK Hynix, and LG Energy Solution are about to rake in billions of dollars.

Why? Because the Biden administration has a new bestie and it ain't China.

They're sweet-talking South Korea into upping its tech game on US soil by offering top chip manufacturers tons of money via subsidies, to run off in the horizon while nudging China out of the picture.

But there’s a catch - they've got to adhere to a ton of US rules, including a 'No Play' policy with Chinese firms. It's like being invited to the cool kids' table, but you can't bring your old friends.

China ain't taking this lying down.

They're halting exports of gallium and germanium (two metals crucial for chipmaking) and throwing shade at US chip companies by producing the chips in-house.

Now South Korea's stuck in the middle, wondering if they're next on the hit-list. But it seems they’ve already started to swerve away from China.

Zip listening in on China’s strategy

Shift Happens

In 2022, for the first time since 2004, South Korea exported more goods to the US than to China. That's a bigger pivot than Ross moving his couch in Friends.

Now, the challenge for them is to make the most of the US’ money, dodge Beijing's wrath, and still come out tops in this global power poker game.

But with South Korea juggling an America-leaning trade policy and Beijing's mounting crankiness, the ride's about to get bumpy.

In the end, it's like an epic game of tech musical chairs, with South Korea zigzagging between the US and China. And as the music speeds up, we're all waiting to see who will be left standing when it stops.

How does this impact Law Firms?

International Trade:

- Trade Agreement Negotiations: Trade lawyers will see an uptick in activity, specifically working with South Korean companies to negotiate trade agreements that balance the interests of the U.S. and South Korean tech industries while also complying with Chinese regulations. For instance, if Samsung wishes to further invest in American facilities, lawyers would be engaged in constructing an agreement that safeguards Samsung's interests.

- Tariffs and Import/Export Restrictions: With China retaliating by imposing export restrictions on key metals, there will be an increased need for legal advice on navigating tariffs and restrictions. For instance, they may need to help SK Hynix understand and respond to new import/export rules, and how they impact their supply chains.

Corporate:

- Mergers and Acquisitions (M&A): As South Korean companies might look to invest more in the U.S. or diversify their markets, M&A lawyers will be instrumental in facilitating these transactions. For example, LG Energy Solution might plan to acquire a U.S. battery manufacturing company to increase its presence in the US market.

- Structural Alterations: In the light of shifting geopolitical alliances, corporate lawyers will be needed to advise on potential structural changes within companies. These could be changes in investment strategies or reorganization of international subsidiaries.

Intellectual Property (IP):

- Patent Filings and Litigation: With increasing tech prowess, IP lawyers will see more action in filing and defending patents, especially in contentious areas like semiconductor technology. They might, for instance, work with Samsung Electronics on filing patents for their latest chip technology in the U.S.

- Trade Secret Protection: As companies navigate this tricky geopolitical landscape, safeguarding trade secrets will be paramount. Lawyers could help SK Hynix set up procedures to protect proprietary information amidst these international tensions.

BoE pumps rates to new High 🇬🇧

The Bank of England (BoE) just cranked up the interest rate to a 15-year high of 5.25%.

Picture it like your gym membership. The BoE just turned the treadmill speed up, making you work harder, sweat more, and borrow less.

But fear not, ⚖️ they've got our backs, promising to keep things 'sufficiently restrictive for sufficiently long'. Kinda reassuring... right?

Question is what happens next? Some committee members wanted an even bigger hike, others less so. Meanwhile inflation is falling. But don't pop the champagne yet. The bank is expecting economic growth to slow down.

Fresh Start Friday ⭐️

It’s the end of the week (yay!) but it could also be the start of your next big career adventure.

Here’s our super briefing on the top job deadlines expiring soon!