Clogged Up Ports

Hi this is ZipLaw! This is our mid-week Roundup where we run through the week's top news stories and explain how they impact law firms.

Are you new here? Get free emails to your inbox.

Here’s what we’re serving today:

- 👗 FTC investigates Capri $8.5bn deal

- 💸 WTH is a Bitcoin Halving?!

- 🚢 Med ports are clogged up, here's why

FTC's Fashion Power Play

In Short: The FTC is challenging Tapestry Inc.'s proposed $8.5 billion takeover of Capri Holdings marking a pivotal moment in antitrust enforcement in the fashion sector.

What’s going on?

Tapestry, the corporate parent of Coach, Kate Spade, and Stuart Weitzman, aims to acquire Capri Holdings, which includes Michael Kors, Versace, and Jimmy Choo. This merger would significantly reshape the accessible luxury market. However, the FTC has unanimously decided to block the deal, citing potential negative impacts on competition and consumer prices.

Why is the FTC blocking it?

- Price Concerns: The merger could lead to higher prices for consumers in the affordable luxury sector.

- Reduced Competition: Combining two major players could stifle competition in terms of pricing, innovation, and brand diversity.

- Employee Impact: The merger is also suspected of potentially harming wages and benefits for the companies' combined workforce of 33,000.

Why does it matter?

This isn't just about who gets to sell more handbags. The implications of this deal—or its blockage—are vast. Tapestry's strategy involves replicating their successful revitalization of the Coach brand across Capri's properties, potentially creating a powerhouse capable of challenging European luxury behemoths like LVMH. If the FTC succeeds in stopping them, it could put a damper on similar big-ticket mergers in the fashion industry and beyond.

Plus with both companies holding significant market shares in different regions—Coach in China and Michael Kors in Europe—the merger could have reshaped global market dynamics.

⚖️ How does this impact Law Firms?

Competition Law:

- Merger Clearance and Regulatory Submissions: Lawyers will be heavily involved in preparing detailed submissions to competition authorities, such as the Competition and Markets Authority (CMA) in the UK, arguing the case for the merger's approval. This involves conducting a thorough analysis of market impact, including how the merger might affect competition and consumer choice in the luxury fashion sector. Clients would include major corporations seeking to expand through acquisitions, who are concerned about navigating the increasingly complex regulatory environment.

- Defence Against Antitrust Claims: Lawyers will also represent clients in defending against any antitrust litigation that may arise from the merger. This includes gathering evidence to counter claims of potential market monopolisation and preparing defence strategies for both in-house tribunal proceedings and potential court cases. The legal team will need to work closely with economic experts to provide quantitative analyses that demonstrate the merger's benefits to consumers without substantially lessening competition.

Corporate Finance and Securities:

- Financing Arrangements: Lawyers will facilitate the structuring, negotiation, and documentation of financing arrangements needed to fund the acquisition. This includes advising on the issuance of bonds or other securities to raise capital for the merger. Clients in these scenarios are typically large corporations and financial institutions looking to ensure that their financial undertakings are legally sound and optimally structured to protect their investments.

- Regulatory Compliance and Disclosure: Corporate finance lawyers will also ensure that all financial disclosures related to the merger are compliant with securities regulations. They will prepare and review filings to regulatory bodies, including detailed prospectuses if new shares are issued as part of the financing arrangements. They will advise clients on the legal implications of their disclosure and reporting obligations, helping them to avoid sanctions or penalties from regulatory authorities.

Employment Law:

- Restructuring and Redundancy Procedures: Post-merger integration often leads to restructuring of workforces. Employment lawyers will be needed to advise on lawful implementation of redundancy procedures, ensuring that all actions are compliant with employment laws and that any termination packages are fairly negotiated. Clients would include corporations aiming to integrate new acquisitions into their existing structures without falling foul of legal protections afforded to employees.

- Transfer of Employees: Lawyers will assist in the transfer of employees between entities, which includes advising on the application of TUPE (Transfer of Undertakings Protection of Employment) regulations in the UK. They will need to manage the legal aspects of employee rights during the transfer process, ensuring that all contractual terms are upheld and that the transition is seamless from a legal standpoint. Clients will be looking for guidance on how to harmonise employee terms and conditions across merged entities while mitigating any potential litigation risks from disgruntled employees.

WTH is a Bitcoin Halving?

Heard about a Bitcoin halving? Wondering what the hell it means? You're not alone.

But don't worry, we got you covered. In short, during a "halving," the rewards for mining new Bitcoins are cut in half. This automatic shift is designed to control inflation by reducing the influx of new coins into circulation, much like tapering off the supply of a precious metal.

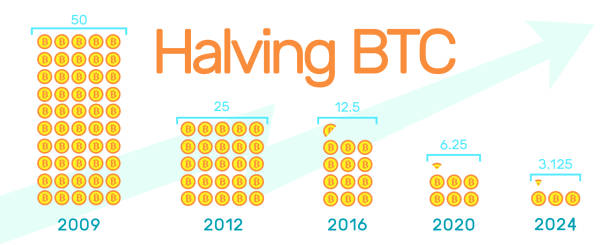

How does it work? Well, Bitcoin miners solve complex mathematical problems to secure the network and validate transactions. When they succeed, they "mine" new coins. Originally, these crypto prospectors earned 50 Bitcoins per block. After several halvings, the reward is now just 6.25 coins and will drop to about 3.125 coins in the next halving.

What does this mean for the Bitcoin world and our real world?

For starters, it's intended to boost Bitcoin's value by making it scarcer. Environmentally, though, each halving has a silver lining. With rewards halved, less profitable mining operations might shut down, potentially reducing the overall energy consumption of the network. However, as the stakes get higher with fewer coins up for grabs, the remaining miners might ramp up their operations to stay competitive, potentially negating any environmental benefits. It's a double-edged sword, balancing economic incentive against environmental impact.

Container Crunch: Ports at Breaking Point

In Short: Ports around the western Mediterranean are overflowing, as disruptions in the Red Sea push more traffic to facilities like Algeciras, Barcelona, and Tangier-Med, complicating Europe’s supply chains and potentially hiking up costs for consumers.

What’s going on?

Imagine the busiest shopping day, but instead of people, it's giant container ships, and instead of a store, it's the Mediterranean's largest ports. That's currently the scene at key ports such as Algeciras in Spain and Tangier-Med in Morocco. These ports, vital for trans-shipping goods across Europe, are jam-packed. This overflow is the result of Houthi attacks on shipping in the Red Sea, prompting many vessels to reroute around the Cape of Good Hope and avoid the Suez Canal.

But what's the big deal with these ships taking a bit of a detour? Well, it means longer journeys and ships all arriving at once, rather than spread out. Ports like Barcelona are seeing a 17% increase in container traffic compared to last year. The ripple effect? More ships waiting at sea, increased storage times for goods, and congested terminals struggling to unload and redistribute these goods efficiently.

Why does it matter?

This isn't just about ships taking longer scenic routes. This congestion hits the wallet—both of businesses and potentially, yours. Companies face higher costs as they pay for longer storage of goods and manage the unpredictability of deliveries. These costs might trickle down to consumers, affecting prices on everything from cars to consumer goods.

Moreover, if ports can't move goods efficiently, it's not just a logistics headache; it impacts supply chains across Europe. Manufacturers might face delays in getting parts, retailers could see shortages, and overall, it could contribute to inflationary pressures if the demand remains constant while supply struggles to keep up.

⚖️ How does this impact Law Firms?

Maritime and Transport Law:

- Contract Disputes and Renegotiations: Lawyers specialising in maritime and transport law will likely see an uptick in advising shipping companies, manufacturers, and logistics firms on the ramifications of contract breaches due to delays. This might include renegotiating terms of carriage, liability for late delivery, and managing force majeure claims. Clients concerned about safeguarding their operations against prolonged transit times will require robust legal strategies to mitigate risks associated with disrupted shipping routes.

- Insurance Claims and Advisory: With the increase in traffic and subsequent congestion at ports, maritime lawyers will also be heavily involved in advising on and processing insurance claims related to cargo damage and delays. For insurance companies and their insured parties, understanding the nuances of policy coverage limits and exclusions in such congested conditions will be crucial. Lawyers will navigate these complexities to ensure that claims are handled efficiently, and policyholders are adequately compensated for losses incurred due to logistical disruptions.

Commercial Litigation:

- Breach of Supply Chain Contracts: Lawyers in the commercial litigation sector will find themselves busy handling cases where suppliers fail to meet their contractual obligations due to the port congestions. This work will involve representing retailers and manufacturers in litigation or arbitration proceedings to recover losses from suppliers who could not deliver goods on time. Clients will rely on legal guidance to manage the impact of such disruptions on their business continuity and reputation.

- Advisory on Risk Management: As companies grapple with increased operational risks due to port overcapacity and rerouted shipping lanes, commercial litigators will also provide preemptive advice on risk management strategies. This includes drafting and reviewing terms in new contracts that specifically address potential delays and disruptions, ensuring that their clients are better protected against future uncertainties in supply chains.

Regulatory and Compliance Law:

- Customs and Import Compliance: Lawyers will guide companies through the increasingly complex landscape of customs regulations which may change in response to new shipping patterns and port congestions. They'll ensure compliance with import/export laws, helping clients navigate the bureaucratic intricacies that could delay their shipments further. This role is vital for businesses that are adjusting their logistics strategies and need to understand how these adjustments affect their legal obligations.

- Environmental Compliance: With the change in shipping routes and the potential environmental impact of increased sea traffic around ports, regulatory lawyers will also play a critical role in advising clients on environmental compliance. This includes assessing and mitigating the environmental risks associated with rerouting ships and the associated increase in emissions, as well as ensuring compliance with international maritime pollution regulations. Businesses concerned about their environmental footprint and regulatory scrutiny will seek legal expertise to maintain compliance and corporate responsibility standards amidst these operational challenges.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).