Cocoa Crisis

Hi this is ZipLaw! This is our Roundup Newsletter where we run through all the top news stories of this past week and explain how they impact law firms.

Here’s what we’re serving today:

- 🍫 Why is there a cocoa crisis

- 🌊 Thames Water disaster continues

- 💸 US v Russia: Metal Sanctions showdown

- 🤖 Microsoft‘s surprise AI move

Are you new here? Get free emails to your inbox.

Week in Brief

- 🚗 Tesla Cuts: Amid slowing electric vehicle demand, Tesla is set to cut about 10% of its global workforce, approximately 14,000 jobs. The company also saw two top executives depart, deliveries drop, and intense competition from Chinese carmakers.

- 📈 Global GDP Outlook: The International Monetary Fund (IMF) projects a 3.2% growth in global GDP this year, noting the world economy's resilience and reduced pandemic impact. Key upgrades were in forecasts for the U.S. and Russia, expecting growths of 2.7% and 3.2%, respectively.

- 🇨🇳 China's Economic Performance: China's economy grew 5.3% in the first quarter of 2024, with a notable 6.1% rise in industrial production. However, March saw a struggle in retail sales and a sharp decline in cement output, indicating issues in the property sector.

- 🇬🇧 UK Inflation Update: The UK's annual inflation slowed to 3.2% in March, suggesting the Bank of England might delay interest rate cuts until later in the year. Inflation remains higher than in the Eurozone but lower than in the U.S.

- 💻 Microsoft's Strategic AI Investment: Microsoft invested $1.5 billion in Abu Dhabi's AI tech firm g42, realigning its focus from China to America, supported by the Biden administration.

- 📈 CVC Capital's IPO Plans: CVC Capital Partners, a major European private-equity firm, announced plans to list on the Euronext Amsterdam, revisiting previous IPO considerations disrupted by geopolitical and market instability.

Cocoa Crisis

In Short: Chocolate prices are rising due to supply shortages, and my wallet is about to feel very empty.

What's happening to cocoa?!

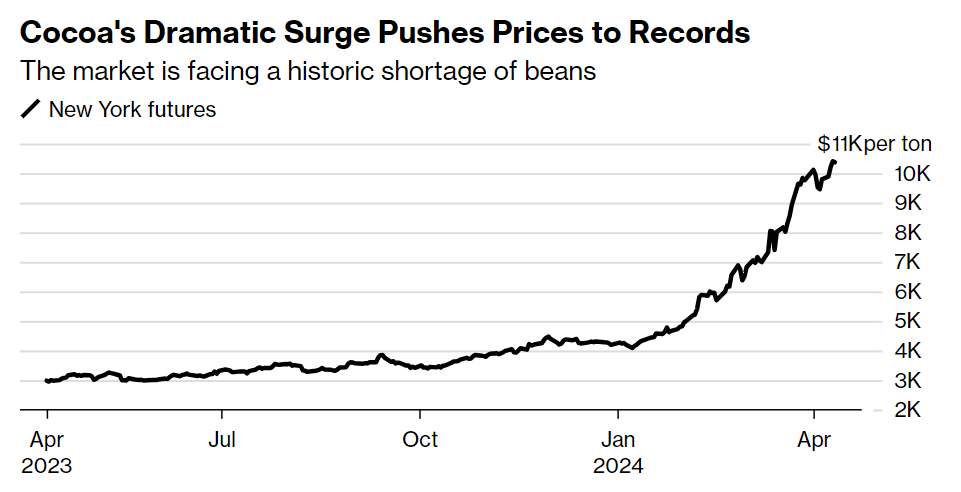

The cocoa market is in turmoil with prices doubling over the past year. Why? Key factors include aging cocoa trees, prevalent diseases, and adverse weather conditions in major producing areas like the Ivory Coast and Ghana.

These challenges have led to a significant drop in production just as global demand remains strong. The sudden price spikes have forced chocolate manufacturers to halt operations and face increased costs, creating a ripple effect throughout the global supply chain.

Why does it matter?

This crisis highlights the vulnerability of relying on limited regions for global cocoa supply and the broader implications for food security and economic stability. With futures trading at historic lows, the market's liquidity is severely compromised, increasing the risk of further volatility and potential business failures.

This situation is a wake-up call for the need for more resilient agricultural practices and diversified sourcing strategies to withstand similar shocks in the future. The cocoa shortage not only impacts chocolate production but also has broader economic implications, affecting everything from local farmers in West Africa to global commodity markets.

💡 Wait, what's a future? Futures trading is a bit like booking a vacation package in advance at a set price. Just as you might pay today for a holiday that you'll take months later, securing the cost regardless of future price changes or availability, trading futures involves agreeing on a price for cocoa now, to be bought or sold at a future date, regardless of how market prices may fluctuate in the meantime.

⚖️ How does this impact Law Firms?

Join ZipLaw+ to continue reading