Drill, baby, drill

Hi this is ZipLaw! We explain how news stories impact law firms so you can stand out in your applications.

Are you new here? Get free emails to your inbox.

Here’s what we’re serving today:

- Sunak brings back gas licences

- Pharma regs push suppliers to the US

- Alphabet-Match settle Google Play dispute

- Is a recession coming?

Drill, baby, drill

In Short: The UK's PM Rishi Sunak is set to reinstate annual auctions for oil and gas licenses in the North Sea—a strategic move pre-election.

What's going on?

Imagine playing Monopoly, but instead of buying properties, you're bidding on chunks of the sea floor. That's what's happening in the North Sea, except with less fake money and more real stakes—energy independence and environmental concerns, to be precise.

Companies shell out £9,000 just to throw their hats in the ring, hoping to secure exclusive rights to drill, albeit with a leash of environmental checks and balances.

A Production Conundrum

Now, you might think, "More licenses, more oil, right?" Not quite. Picture trying to squeeze the last bit of toothpaste out of an almost empty tube—that's the North Sea oil situation.

Even if you roll the dice and win a license, it could take ages to strike black gold. And with a production scene that’s more vintage than a 90s comeback, the fresh flow from these fields is more of a trickle than a flood.

Drilling at home sounds like a cosy plan for energy security—like knitting your own sweater instead of buying one. But here’s the twist: the UK often exports the crude it produces and then imports fuel.

Meanwhile, the Labour Party is ready to halt the drilling game if it checkmates in the next election.

⚖️ How does this impact Law Firms?

Energy and Natural Resources:

- Regulatory Compliance and Licensing: Solicitors in this field will see a surge in work as they assist companies in navigating the regulatory landscape associated with new oil and gas exploration licenses. They'll be responsible for preparing and submitting license applications and ensuring that all operations comply with environmental regulations and the UK's net zero commitments.

- Environmental Impact Assessments: Legal professionals will be busy conducting due diligence and advising on the environmental impact assessments required for new exploration and production projects. They'll work to ensure that clients' activities are in line with both national and international environmental standards, potentially involving negotiations with regulatory bodies or representation in legal disputes concerning environmental compliance.

Commercial Contracts:

- Drafting and Negotiation of Agreements: Lawyers specialising in commercial contracts will be tasked with drafting and negotiating a multitude of agreements related to oil and gas exploration, including joint venture agreements, drilling contracts, and service agreements. They'll ensure that the contracts are robust and protect their clients' interests, especially in a volatile market.

- Dispute Resolution: As new contracts are formed and competition intensifies, disputes are likely to arise. Lawyers will represent clients in arbitrations and litigations over contractual disagreements, license terms, and operational responsibilities. Their work will be vital in resolving these disputes efficiently to minimise disruption to their clients' business operations.

Project Finance and Development:

- Financing Agreements: With an increase in oil and gas projects, there will be a heightened need for specialist advice on the complex financing arrangements required to fund these developments. Lawyers will prepare and negotiate the terms of financing agreements, ensuring compliance with financial regulations and protecting clients' interests in these high-value transactions.

- Infrastructure Development: Solicitors will also advise on the legal aspects of infrastructure development necessary for new exploration and production sites. This will include the negotiation of construction contracts, advising on planning law, and ensuring lawful acquisition of rights over land or sea bed, including dealing with any objections or legal challenges that may arise during the development phase.

Toyota to roll out solid-state batteries

In Short: Novo Nordisk, the Danish drug behemoth, might give the US a bigger piece of its pie at the expense of Europe if the EU tightens the screws on pharma regulations.

Transatlantic Troubles

Imagine Europe and the US are two bakeries. Novo Nordisk is the master baker who's been splitting its time between the two. But now, the EU bakery is considering a new recipe that makes it harder for our baker to profit from its creations.

In short, the EU plans to slice the time a new drug is exclusive to the creator. This has Novo eyeing the US oven, which suddenly seems a lot more appealing.

The Innovation Impasse

Think of market exclusivity as a front-row ticket to the "Drug Rockstars" concert. Everyone wants it, but there's a limited time to bask in the glory. The EU's proposed cut from 10 years to 8 could mean fewer drug discoveries.

This could ultimately result in a €2 billion drop in the research budget and about 50 fewer treatments.

The EU's regulatory reform might trigger a Big Pharma migration. It's not just about where the drugs are made; it's about where the medical minds meet and the biotech blooms.

⚖️ How does this impact Law Firms?

Intellectual Property (IP):

- Patent Strategy and Litigation: Lawyers in the IP department will likely see an uptick in patent-related work, developing strategies to maximise patent protection and market exclusivity periods for new drugs under the changing regulatory landscape. They'll also be called upon to defend these strategies in litigation, ensuring the extended exclusivity for clients who meet the EU's new criteria.

- Regulatory Advice and Compliance: IP lawyers will need to advise pharmaceutical companies on how to comply with the new EU regulations while maintaining patent integrity. This involves assessing the impact of reduced exclusivity periods on existing and future patent portfolios and advising on the strategic filing of patents to maximise protection under the revised rules.

Healthcare and Life Sciences:

- Clinical Trial Agreements: Lawyers will be drafting and negotiating agreements for clinical trials, particularly in light of the shifting focus towards the US. They will need to ensure these contracts reflect the new dynamics and priorities, taking into account cross-border regulatory and compliance issues.

- Market Access and Licensing: Legal practitioners will be busy advising on the ramifications of the EU's “extra mile” provision for gaining additional years of market exclusivity. This includes licensing agreements and ensuring that the distribution of new medicines across the EU complies with the regulations to secure extended protection.

Corporate:

- Mergers and Acquisitions (M&A): Corporate lawyers can expect an increase in M&A activity as pharmaceutical companies may look to acquire or merge with US-based firms in response to the EU regulations. These lawyers will manage the legal aspects of transactions, due diligence processes, and ensure regulatory compliance.

- Investment and Funding Advisories: With potential shifts in where pharmaceutical companies choose to develop new medicines, corporate law departments will need to advise on investments, especially for start-up and biotech funding agreements, to ensure that these reflect the new commercial realities and potential for future returns based on the adjusted exclusivity timelines.

Did you know?

Alphabet the parent company of Google, just settled an antitrust lawsuit with Match Group, the company behind a bunch of dating apps. Match Group had accused Google Play of playing dirty.

The settlement? It's a ceasefire that stops a potentially expensive legal battle. Match Group's apps will stick with Google Play, but they've negotiated a better deal on the fees they have to pay when you decide to pony up for those extra super likes.

The terms? A bit of discount shopping for Match on Google's turf. They've got until March 31, 2024, to implement Google’s User Choice Billing, which means they get to try alternative payment methods. Standard rates are set at 15% for subscriptions and 30% for other transactions through Google’s payment system. If Match uses its own payment options, they get a slightly better deal.

But Alphabet's legal drama isn't over. It's still got a date in court with Epic Games, and that's all about whether Google has been hogging the sandbox and not letting anyone else play with the toys (read: app store distribution and payment policies).

Must-Know Trend

Some of the top financial experts are waving red flags about a possible recession – that's when the economy starts to shrink and everyone from big businesses to your local coffee shop can feel the pinch.

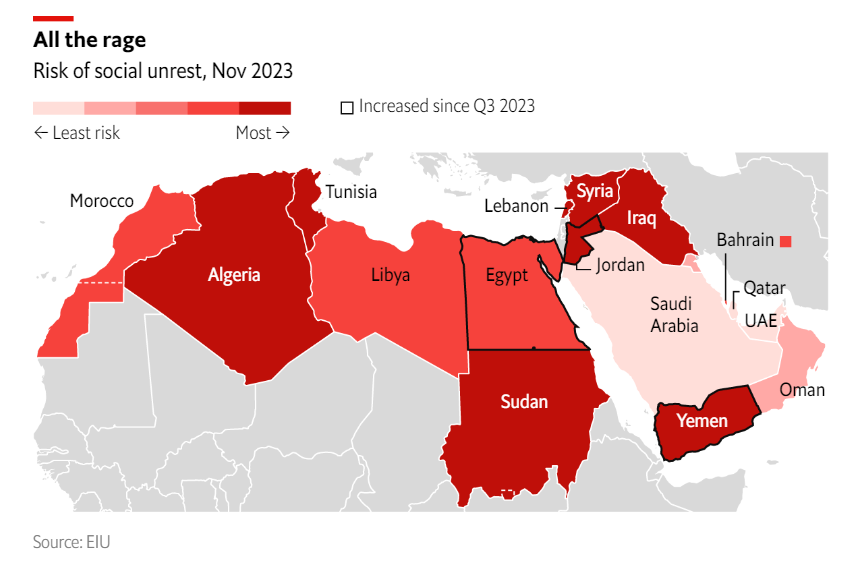

Why are they worried? Two big reasons: the wars in Israel, and Ukraine. These conflicts cause great uncertainty in the markets. When there is uncertainty, it's trickier to do business and if everyone shuts their wallets, the economy doesn’t just slow down, it can hit reverse.

One of the big triggers for the global jitters is oil prices. The Middle East is a heavyweight in the oil game, so trouble there can mean higher prices at the pump for everyone. High oil prices have a domino effect – they can knock everything from the cost of transporting goods to your weekly grocery bill.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).