Electric Car Race

Welcome to our weekly Looking Ahead series - a review of the top trends of 2024 plus how they impact law firms!

Today's trend: The Electric Car Race 🚗

Are you new here? Get free emails to your inbox.

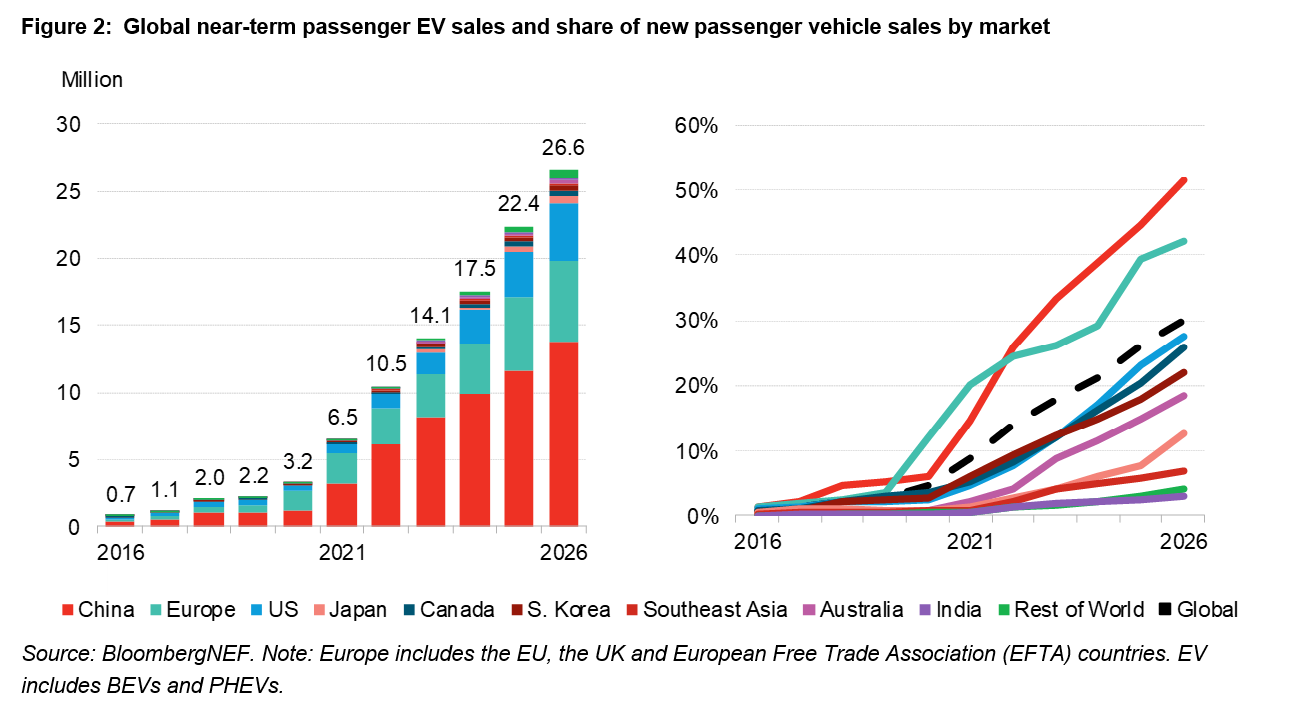

The electric vehicle (EV) industry is already a big deal. Every country in the world wants to set itself up to become one of the leading producers of this growing market, and 2024 will be the year where the race really accelerates.

Top EV Trends of 2024

Here's a breakdown of the key trends to look out for followed by how they impact law firms.

1) 🔋Battery Production: Going Full Turbo

Countries worldwide will be cranking up battery production like there's no tomorrow. We're talking new factories sprouting up faster than viral TikTok dances. And it's not just about quantity. This year the focus will be on building new-gen batteries that can hold more energy, and shortening charging times. Plus, they’re figuring out how to make this all wallet-friendly. Cheaper batteries mean more people can jump on the EV bandwagon without breaking the bank.

2) EVs Going mainstream

EVs are hitting the mainstream faster than the latest smartphone. We can expect governments to continue rolling out the red carpet with tax breaks and sweet incentives. The Chinese government has already invested approximately $30 billion in the EV market through consumer incentives. Meanwhile, the US' Inflation Reduction Act (IRA) was signed into law in August 2022 and offers tax breaks for EV buyers. Plus, as we've seen with the recent Tesla cybertruck, there will be a continued introduction of new models to cater to different consumer needs and price points.

3) Who's the boss? China vs US/EU

This will be one of the biggest trends in the EV market in 2024: China vs US & EU in the world of EVs and batteries. It's like a high-stakes chess game and the prize is being the top EV producer.

On one side, we've got China, the seasoned chess master. They've been able to take a lead in the market for 3 key reasons (which they'll continue to build on in 2024):

- Early Market Development: China's early focus on EVs, backed by strong government support, has allowed it to advance technologically and gain a significant market share with its top performing companies like BYD. China had 78% of global battery-production capacity in 2022. By 2030, it's expected to have 69% of global capacity, enough to produce batteries for 90 million cars annually.

- Subsidies: China's EV subsidies reduced vehicle prices by up to 60,000 yuan (£6,712.36), with ongoing local rebates. Government support created over 500 EV manufacturers, leading to market growth and consolidation. Subsidised, standardised charging stations and battery-swap facilities helped adoption, totalling 6.36 million EV chargers by May 2023.

- Raw Materials & Supply Chains: China has more direct access to critical raw materials needed for battery production, which supports its rapid scale-up in manufacturing. Plus China's established supply chains for electronics and batteries give it a competitive edge in production capabilities.

Then, enter the challengers: the US and EU. They got off to a slow start, sure, but they're learning fast and picking up some clever moves.

Here's what they'll be building on in 2024 to take the crown from China:

- Implementing Policies and Incentives: The US has introduced the IRA, offering subsidies and tax credits for EV-related activities. The EU's Green Deal Industrial Plan aims to boost the region's EV and battery production through funding and subsidies.

- Limited effect? In the year following the IRA, the U.S. saw $55.1 billion in battery manufacturing and $16.1 billion in EV factory investments. However, reliance on Chinese technology limited immediate IRA subsidy eligibility to 10 models. Meanwhile, Germany, France, and Spain launched tax credits and aid for EVs, prompting European automakers like Volkswagen, Stellantis, and Renault to shift towards EV production over the next few years.

- Local Production and Supply Chain Development: Both are heavily investing in setting up local battery manufacturing facilities. In particular, American automakers are expected to receive $140 billion in subsidies over the next decade (not bad). They are working to secure and develop their own supply chains for essential battery materials.

- Research and Sustainable Practices: Increased investment in R&D to innovate in battery technology. Emphasis on sustainable and ethical sourcing of materials and developing recycling capabilities for batteries.

⚖️ How does this impact Law Firms?

Join ZipLaw+ to continue reading