Evergrande collapses

Hi this is ZipLaw! We explain how news stories impact law firms so you can stand out in your applications.

Are you new here? Get free emails to your inbox.

Today we're talking about:

- 🏠 Evergrande collapses

- 🇻🇳 Vietnam is set for growth

- 📉 Inflation drops?

MEMO

- 💼 Amazon-iRobot Deal Off: Amazon's dropped its $1.4 billion bid for robot vacuum maker iRobot, facing pushback from the EU. They're coughing up a $94 million breakup fee, while iRobot gears up to cut 31% of its staff.

- 🧠 Neuralink's Human Trial: Elon Musk's Neuralink just took a leap by implanting its 'Telepathy' device in a person, aiming to let users control gadgets with their minds. They've spotted some promising brain activity. Not alone in the race, competitors like Blackrock Neurotech have been doing similar stuff.

- 🚗 Renault Hits the Brakes on EV Listing: Renault's ditching its plans to spin off its electric car division, pointing fingers at the shaky market. Even as the EV market cools off, Toyota's still king of the car world, outdoing Volkswagen with over 11 million rides sold last year.

- 🌕 Japan's Moon Mission: Japan's SLIM spacecraft is back in action on the Moon, overcoming a solar panel glitch. As the fifth country to achieve a lunar landing, Japan's JAXA looks to unravel lunar mysteries, building on the momentum of India's Chandrayaan-3.

Evergrande collapses

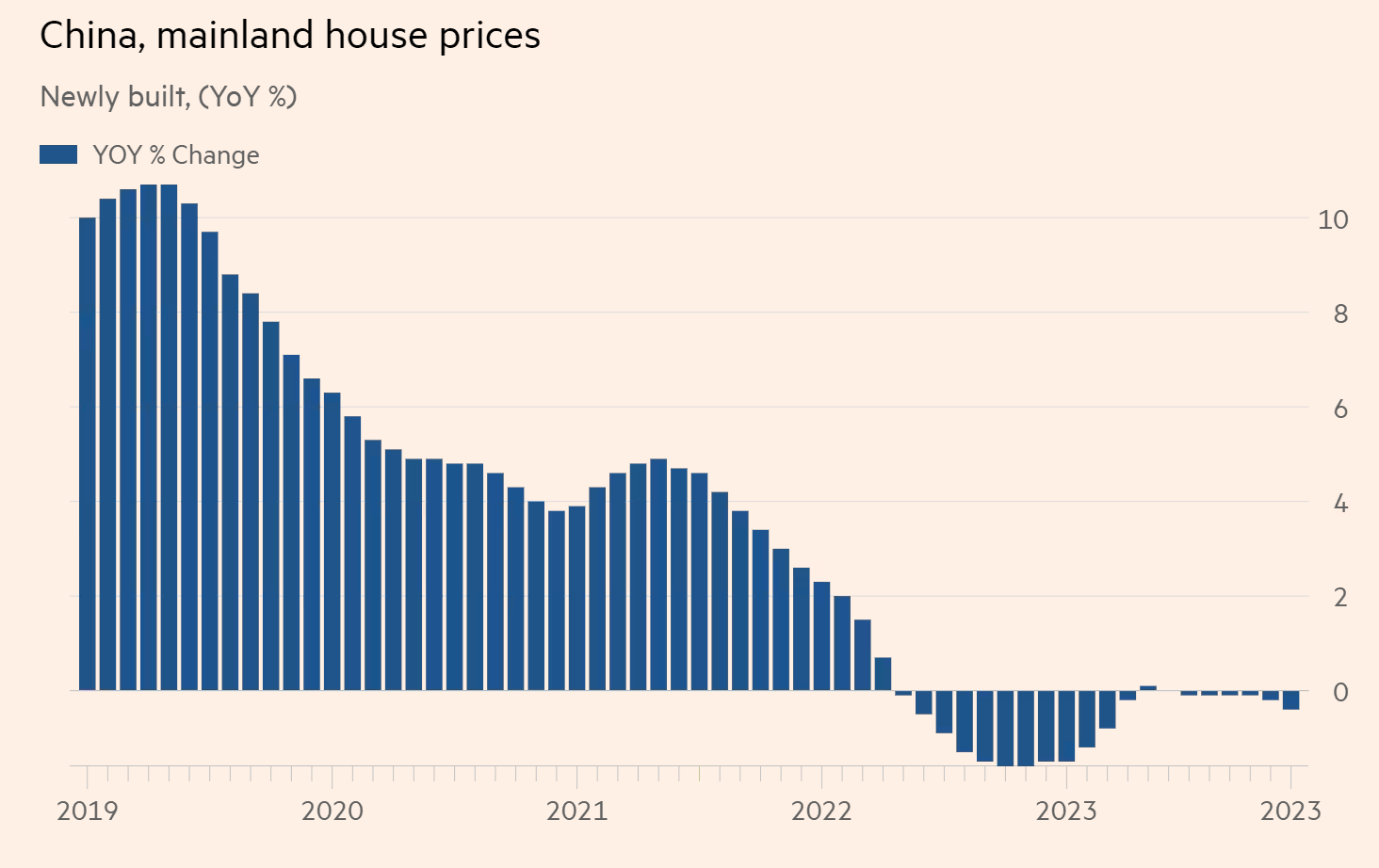

In Short: Evergrande's nosedive into liquidation is more than a hiccup in China's property market; it's a full-blown saga that could make dominos of developers look steady.

What is Going on?

A Hong Kong judge slammed the gavel on Evergrande, initiating its liquidation over a staggering $300 billion debt. This marks the climax of a two-year financial drama for the world's most indebted developer, pushing foreign creditors into a scramble for assets predominantly tucked away in mainland China. Evergrande's downfall is the latest big hit in the broader crisis rattling China's property sector, with a ripple effect that's put a dent in the country's economic confidence.

Why does it matter?

The liquidation of China Evergrande Group, decreed by a Hong Kong court, brings to the forefront a critical issue: the enforceability of such a ruling within mainland China's distinct legal system. With the bulk of Evergrande's assets located in the mainland, the effectiveness of the Hong Kong court's decision becomes a pivotal concern. This scenario is uncharted territory, given Evergrande's massive scale and the complexity of its operations. The unfolding of this case will be closely observed by global investors, as it tests the limits of Hong Kong's legal jurisdiction in China and has broader implications for cross-border legal precedents and investor confidence in the region.

The Evergrande liquidation saga could send shockwaves through the already jittery real estate market. With Evergrande's peers teetering on the brink of similar financial distress, the liquidation process could serve as a bellwether for the fate of other troubled developers. It's like watching the most dramatic episode of a reality TV show where everyone's waiting to see who gets voted off the island next.

⚖️ How does this impact Law Firms?

Insolvency and Restructuring:

- Corporate Restructuring Advice: Lawyers in this department will be swamped with requests for counsel on how to navigate the complexities of corporate restructuring, particularly from clients with exposure to the real estate sector or those directly impacted by Evergrande's liquidation. They'll guide companies through voluntary arrangements, debt restructuring, and negotiations with creditors, ensuring minimal disruption to ongoing operations.

- Liquidation Proceedings: With Evergrande's liquidation making headlines, lawyers will find themselves advising not only companies facing similar financial distress but also creditors and investors caught in the crossfire. They'll be tasked with representing clients in court proceedings, managing asset disposals, and negotiating settlements to recover as much value as possible from the liquidation process.

International Arbitration and Cross-Border Disputes:

- Enforcement of Foreign Judgments: Given the global interest in Evergrande's collapse and the involvement of Hong Kong's legal system, lawyers specialising in international arbitration will see a surge in cases where parties seek to enforce or challenge Hong Kong court rulings in other jurisdictions, particularly in mainland China where Evergrande's assets are primarily located.

- Cross-Border Investment Disputes: As foreign investors grapple with their losses, there will be a significant uptick in demand for lawyers to represent these parties in disputes over failed investments in Evergrande and other Chinese real estate ventures. This will include arbitration under bilateral investment treaties or other international legal mechanisms to recover lost funds or assets.

Real Estate and Property Law:

- Real Estate Transactions and Due Diligence: Lawyers in this department will be busy conducting enhanced due diligence for clients looking to purchase or invest in real estate assets, especially those emerging from Evergrande's liquidation or from other distressed developers. This will involve scrutinising titles, leases, and other property-related documentation to identify potential risks and liabilities.

- Advising on Regulatory Compliance: With the real estate market in flux, property lawyers will also find themselves advising developers, investors, and construction companies on navigating the increasingly complex regulatory environment. This could involve guidance on new government policies aimed at stabilising the market, compliance with existing regulations, and strategies for mitigating the impact of market uncertainties on ongoing and future projects.

Vietnam is set for growth

In Short: Vietnam is strategically positioned for significant economic growth, thanks to a unique combination of geopolitical maneuvering, favourable economic policies, and a surge in global manufacturing interest.

Why is Vietnam growing?

- Geopolitical Strategy: Vietnam has masterfully positioned itself as a pivotal player between major powers like the US and China, enhancing its international stature and attracting attention from global leaders.

- Economic Dynamics: The country has embraced a "China + 1" strategy, (i.e. a business strategy to avoid investing only in China and diversify business into other countries) becoming an essential alternative for companies diversifying their manufacturing bases away from China, which has led to a surge in foreign direct investment.

- Business Environment: Vietnam offers a compelling mix of competitive labour costs, a young and skilled workforce, and enticing government incentives, making it an increasingly attractive destination for international businesses and investors.

Why does it matter?

Vietnam's growth story is significant not just for the country itself but for the global economic landscape. As it continues to strengthen its trade and investment ties, Vietnam is emerging as a critical node in the international supply chain, reducing reliance on traditional manufacturing hubs like China.

This shift has broader implications for global trade dynamics, offering a glimpse into a future where economic power is more diffused and countries like Vietnam play pivotal roles in global commerce.

⚖️ How does this impact Law Firms?

International Trade and Investment:

- Navigating Bilateral Agreements: Lawyers in this department will find themselves busy advising multinational corporations on the intricacies of entering or expanding their presence in Vietnam, given its enhanced geopolitical status and strategic partnerships. They will draft and negotiate contracts that align with both local Vietnamese laws and international trade agreements, particularly focusing on sectors like manufacturing and technology where Vietnam is seeing substantial growth.

- Compliance with Local Regulations: As companies look to invest in Vietnam, lawyers will be essential in ensuring compliance with Vietnam's investment policies, tax incentives, and business regulations. This will involve conducting due diligence, obtaining necessary permits, and advising on corporate structure to optimise tax and legal benefits. Clients will range from tech giants diversifying their manufacturing bases to small and medium-sized enterprises entering the Vietnamese market for the first time.

Environmental Law:

- Sustainable Investment Advising: With Vietnam's economic boom and its commitment to green energy, lawyers will guide investment in sustainable projects, such as wind and solar energy. This will involve negotiating terms of investment, ensuring compliance with environmental regulations, and advising on potential subsidies or incentives available for green projects.

- Compliance and Litigation: Lawyers will also be tasked with advising companies on environmental compliance, particularly those in the manufacturing sector transitioning to cleaner energy sources or those new to the stringent environmental landscape of Vietnam. In cases of non-compliance, they will represent these companies in legal proceedings, mitigating risks and addressing any environmental harm that may have occurred.

Corporate and M&A:

- Facilitating Mergers and Acquisitions: As foreign investment surges, the demand for legal expertise in structuring, negotiating, and finalising mergers and acquisitions (M&A) will rise. Lawyers will assist clients in due diligence processes, ensuring that potential investments or partnerships in Vietnam do not entail unforeseen legal or financial risks, particularly in sectors like electronics and textiles where the influx is significant.

- Corporate Restructuring: Companies entering the Vietnamese market or expanding their operations will require legal guidance on corporate restructuring to align with Vietnam's business laws and international trade agreements. This will include advising on the establishment of subsidiaries, joint ventures, or strategic alliances, ensuring that these new corporate structures are compliant with local laws and optimised for operational efficiency and tax benefits.

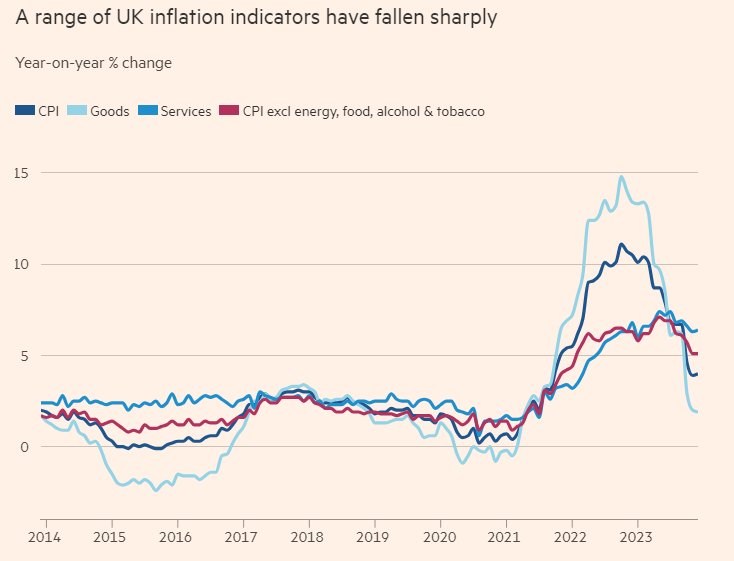

📊 Chart of the day

Analysts predict that the Bank of England will likely report significant and unexpected progress in reducing inflation this week. However, it is not anticipated to start lowering interest rates immediately. The consensus is that the bank will maintain the current rate of 5.25% for the fourth consecutive month during its initial meeting of the year on Thursday.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).