Google is in Trouble

Are you new here? Get free emails to your inbox.

Hi this is ZipLaw! This is our Roundup Newsletter where we run through all the top news stories of this past week and explain how they impact law firms so you can stand out in applications.

Here’s what we’re serving today:

- Google is in trouble 🔍

- EU launches probe on Chinese EVs 🚗

- What's going on in the UK housing market? 🇬🇧

- Arm's record IPO 📈

- Mexico overtakes China as US' best supplier 🇲🇽

Google is in trouble

Remember when Google was just that cool search engine that helped you find cat videos? Well, times have changed, and now they're in the hot seat for some big-time legal drama.

Here's all you need to know.

1. Why is Everyone Mad at Google?

Imagine you're at a party, and there's only one entrance. Google's the bouncer, deciding who gets in. They've allegedly paid big bucks to be the main man, making sure their search engine is the go-to on devices. This means rivals like DuckDuckGo and Bing are left in the cold, struggling to get the data they need to up their game.

2. Google's Defence

Google's like, "Chill, guys. It's just business." They compare their deals to cereal companies paying for prime shelf space. So, think of Google as the Frosties of the internet – sure, they're front and centre, but if you really want those off-brand cornflakes, they're still there. You just have to reach a bit.

3. The Big "What If"

If the court sides with the "Google is too bossy" camp, things could get spicy. We might see Google having to sell off parts of its empire, like its Android system. Or, they might have to share their search data with rivals. Imagine sharing your secret grandma's cookie recipe with the entire neighbourhood. Ouch.

This isn't Google's first rodeo. They've faced other antitrust cases, especially around online advertising. And Europe? They've been giving Google the side-eye for years, slapping them with fines and more rules.

⚖️ How does this impact Law Firms?

Antitrust and Competition:

- Monopoly Investigations: Lawyers in this department will be swamped with assessing Google's alleged monopolistic practices. They'll be diving deep into agreements between Google and other tech companies to determine if they unfairly restrict competition. This involves a lot of document reviews, witness interviews, and potentially even dawn raids.

- Defence in Antitrust Proceedings: If the US Justice Department's allegations gain traction, Google will need a robust defence. Lawyers will be tasked with defending Google's agreements, comparing them to standard industry practices, and arguing that their actions don't stifle competition but rather promote innovation.

Commercial and Contract:

- Contractual Review: Given the focus on Google's agreements with other tech companies, commercial lawyers will be in high demand to review these contracts. They'll be assessing the legality of these agreements and ensuring future contracts are watertight and less susceptible to antitrust scrutiny.

- Negotiation and Renegotiation: If any of Google's existing contracts are deemed problematic, lawyers will be needed to renegotiate terms with partners, ensuring that they're compliant while still favourable for Google.

Data Protection:

- Data Sharing Assessments: If the court mandates Google to share its search data with rivals, there will be significant concerns around data protection. Lawyers will be required to ensure that any data sharing complies with GDPR, CCPA, and other data protection regulations.

- Advisory on Data Collection: Given the importance of data in this case, lawyers will also be advising Google on best practices for data collection, ensuring they're not overstepping boundaries and remain compliant with international data protection standards.

EU launches probe on Chinese EVs

Remember when you were a kid, and you'd get mad when someone else had a cooler toy than you? Well, the EU is kinda feeling that way about Chinese electric cars.

Here's what you need to know.

1. The EU's "Not Cool, China" Moment

The EU is giving Chinese electric vehicles the side-eye. Why? They think these cars are "distorting" the EU market. Imagine China showing up to the playground with a shiny new toy and everyone ditching their old toys to play with China's. Ursula von der Leyen, the European Commission president (basically the playground monitor), is like, "Hold up! That toy might not be safe!" She's launching a big ol' investigation into these vehicles.

2. Déjà Vu or Just History Repeating?

This isn't the first time the EU has been wary of Chinese products. Flashback to the early 2010s: the EU's solar industry was almost KO'd by cheap Chinese imports. The EU's trying to avoid a repeat of that disaster. If Chinese carmakers are found breaking trade rules, they could face some hefty tariffs.

What does China make of this? China's not thrilled about the EU's investigation into their electric cars. They're calling it a "naked protectionist act." They're warning that this could put a damper on their relationship with the EU. It's like when two friends have a falling out over a game of Monopoly (we've all been there...).

⚖️ How does this impact Law Firms?

Trade and International:

- Trade Dispute Resolution: Lawyers specialising in trade law will be in high demand to advise and represent Chinese electric vehicle manufacturers in potential disputes arising from the EU's investigation. This could involve challenging the basis of the EU's claims or negotiating settlements.

- Advisory on Tariffs and Sanctions: If punitive tariffs are imposed, these lawyers will be advising clients on the implications of such tariffs, potential exemptions, and strategies to mitigate the impact on their business operations.

Corporate and Commercial:

- Mergers and Acquisitions (M&A): Given the potential challenges posed by tariffs and regulatory scrutiny, Chinese manufacturers might consider joint ventures or mergers with European entities to bypass certain restrictions. Lawyers would be involved in structuring, negotiating, and finalising these M&A deals.

- Contractual Review and Renegotiation: Lawyers in this department will be reviewing existing contracts between Chinese manufacturers and European distributors or partners to ensure compliance with any new regulations or tariffs. They might also be involved in renegotiating terms to reflect the changed business environment.

Environmental and Product Compliance:

- Regulatory Compliance: As the EU investigates the "distortion" of the market by Chinese electric vehicles, there may be heightened scrutiny on the environmental and safety standards of these vehicles. Lawyers will be advising manufacturers on ensuring their products meet EU standards and regulations.

- Product Liability and Litigation: If any issues arise regarding the safety or performance of the electric vehicles, lawyers will be required to defend manufacturers against potential claims or lawsuits from consumers or business partners in the EU.

What's going on in the UK housing market?

The UK housing market is serving up some piping hot tea, and it's a bit bitter. Remember when we were all stuck at home playing zoom quizzes and making banana bread? Well, house sales have plummeted back to those levels.

So what's going on?

1. House Prices Go...Downwards

The Royal Institution of Chartered Surveyors has been doing some snooping. They found out that house prices are dropping faster than my motivation to exercise during lockdown. We're talking "steepest fall since 2009" kind of drop. And guess what? The experts think it's gonna get worse. Yikes.

2. Mortgage Rates: The Real Villain

Blame the Bank of England. They've been hiking up interest rates like it's a fun trek in the Lake District. But instead of a picturesque view, we get the highest mortgage rates since 2008. So, while we're all dealing with the rising cost of, well, everything, millions are about to feel the pinch even more. Why? Their fixed-rate deals are ending, and they'll have to refinance at these sky-high rates.

3. Renting: The Plot Twist

Now, here's where the plot thickens. With these crazy mortgage rates, more people are looking to rent. But surprise, surprise, landlords are facing high borrowing costs too. And guess who they're passing those costs onto? Yep, the tenants. A survey even found that a third of UK tenants are struggling with rent. In London? Almost half.

⚖️ How does this impact Law Firms?

Property and Real Estate:

- Mortgage Disputes: Given the steep rise in mortgage rates, lawyers specialising in property law will likely see an uptick in disputes related to mortgage agreements. They might be called upon to advise and represent clients who are struggling to meet their mortgage obligations or those challenging the terms of their mortgage agreements.

- Landlord-Tenant Issues: With the rental market seeing increased demand and landlords passing on borrowing costs to tenants, there will be a surge in landlord-tenant disputes. Lawyers will be needed to handle cases related to unfair rent hikes, eviction proceedings, and breaches of tenancy agreements.

Financial Services and Banking:

- Refinancing Negotiations: As many homeowners will be looking to refinance their mortgages due to the end of fixed-rate deals, lawyers in this department will be involved in drafting, reviewing, and negotiating new mortgage terms with banks and other financial institutions.

- Regulatory Compliance: With the Bank of England's intervention and the potential for further regulatory changes around lending and interest rates, lawyers will be tasked with ensuring that banks and financial institutions are compliant with any new regulations or guidelines.

Consumer Protection:

- Unfair Practices Claims: Given the potential for consumers to feel they are being unfairly treated, either through high mortgage rates or increased rental costs, lawyers will see a rise in cases where consumers are claiming unfair practices by banks, financial institutions, or landlords.

- Advisory on Consumer Rights: As more consumers face financial challenges, they will seek legal advice on their rights, especially in relation to mortgages, rentals, and other financial commitments. Lawyers will be needed to advise clients on their rights and potential remedies under the law.

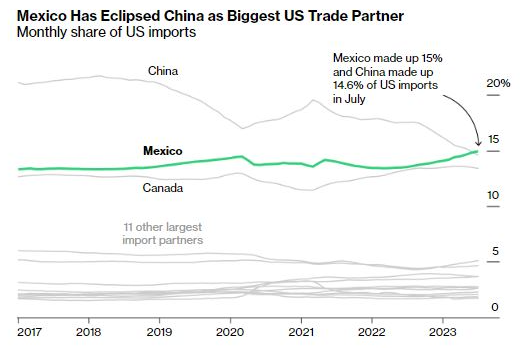

Mexico overtakes China

Mexico's been having a moment. Or several. Their currency is flexing muscles, their stock market's on fire, and foreign investments are already up more than 40% in 2023. Heck, even Tesla's eyeing a $5 billion factory there.

Meanwhile, the US is looking to cut reliance on its biggest geopolitical rival (China) and bring supply chains closer to home investment. Mexico is the perfect solution for them and as a result investment in the country is booming. In fact, in July, Mexico even eclipsed China as the US’s biggest trade partner.

1. The Good, The Bad, and The Infrastructure

Already, the investments that Mexico is attracting are putting its infrastructure under growing strain, amid bottlenecks created by erratic power transmission, limited industrial space, and water scarcity.

Take Monterrey as an example. Their electrical grid is like an old phone trying to run the latest OS – it just can't keep up. And it's not just electricity; there's limited industrial space and water's becoming a luxury. So, while parts of Mexico are booming like a 90s rave, there are some serious party crashers.

2. Big picture

For the US, it's like switching from a long-distance relationship to dating the next-door neighbour. Closer ties, easier logistics, and maybe fewer geopolitical spats. For China? It's a wake-up call. The business Cold War is heating up, and the US is diversifying its trade portfolio. For Mexico? A golden opportunity to become a top supplier of one of the richest countries in the world (play Eminem, Lose Yourself...).

⚖️ How does this impact Law Firms?

International Trade and Compliance:

- Trade Agreement Analysis: Lawyers in this department will be deeply involved in reviewing and advising on the nuances of trade agreements between Mexico, the US, and China. Given the shift in trade dynamics, understanding the implications of existing agreements and potential changes will be crucial.

- Supply Chain Compliance: As companies shift their supply chains due to geopolitical tensions, lawyers will be needed to ensure that these changes comply with international trade laws, tariffs, and sanctions. Commercial lawyers will be assisting in drafting and negotiating the contractual agreements to make this possible.

Corporate and M&A (Mergers and Acquisitions):

- Foreign Direct Investment (FDI) Advisory: With the surge in foreign direct investment in Mexico, lawyers will be advising international companies on the legal aspects of setting up operations, joint ventures, or acquiring local businesses in Mexico.

- Due Diligence: As companies like Tesla and others look to set up or expand their operations in Mexico, M&A lawyers will be involved in conducting due diligence on potential acquisitions or partnerships, ensuring that they are legally sound and free from potential liabilities.

Infrastructure and Project Finance:

- Infrastructure Project Contracts: Given the strain on Mexico's infrastructure, there will be a push for new infrastructure projects. Lawyers will be involved in drafting, reviewing, and negotiating contracts for these infrastructure projects, ensuring that terms are favourable and risks are mitigated.

- Financing Agreements: As these infrastructure projects require significant capital, lawyers will be instrumental in structuring and negotiating financing agreements with banks, private investors, and other financial institutions, ensuring that the terms are in the best interests of their clients.

Arm's record IPO

Odds are if you read the news in the past two weeks you will have heard a lot about Arm. So as the semiconductor company launched its IPO on Thursday we thought it was our duty to sprinkle some Zipmagic to explain why everyone is obsessed with them.

1. Who's Arm and Why Should I Care?

Arm is a chip designer. They whip up the core components of the chips in almost every smartphone. They believe that 70% of the world’s population use Arm-based technology. Without its designs, the iPhone and other smartphones would not work.

2. What's Their Game Plan?

Arm's looking beyond smartphones. They're eyeing the big, power-hungry data centres. Think of it like this: if smartphones are scooters, data centres are the monster trucks of the tech world. And Arm believes their energy-efficient designs, honed in the world of battery-powered phones, are perfect for these energy-guzzling beasts. Nvidia, the LeBron James of AI, already uses Arm's tech in their latest "superchip". So, Arm's basically saying, "Why not everyone else?"

3. Who's in the Arm Fan Club?

Amazon, Samsung, Apple... basically, the tech world's cool kids. Arm's tech is in billions of devices. Switching away from them? That's like trying to quit coffee on a Monday morning. Not gonna happen. Especially when 99% of the 1.4 billion smartphones sold every year use Arm's designs. And now, even the big tech giants are using Arm's blueprints for their data centres. So, they're not just in your pocket; they're in the cloud too.

So how did it do? On its Nasdaq debut, the share price surged 25%, valuing the company at $65bn. This is $34bn above SoftBank's 2016 purchase price, $25bn more than Nvidia's 2020 offer, $1bn above SoftBank's recent valuation, and 125 times Arm's last year's profit.

⚖️ How does this impact Law Firms?

Corporate and Securities:

- IPO Advisory: Given the massive initial public offering (IPO) of Arm Ltd., lawyers specialising in corporate and securities law will be heavily involved in advising on the IPO process. This includes ensuring compliance with regulatory requirements, drafting and reviewing prospectus documents, and liaising with the stock exchange and regulatory bodies.

- Shareholder Relations and Transactions: Post-IPO, these lawyers will be instrumental in managing shareholder relations, especially given SoftBank's significant stake in the company. They will also handle any subsequent share transactions, rights issues, or other corporate actions related to the company's listed status.

Mergers and Acquisitions (M&A):

- Deal Structuring and Negotiation: The story mentions previous acquisition attempts, such as Nvidia's failed bid. M&A lawyers will be in demand to structure, negotiate, and execute potential future deals, ensuring they meet all legal and regulatory requirements.

- Regulatory Approvals and Due Diligence: Any future acquisition or merger attempts will require comprehensive due diligence to assess potential risks and rewards. Additionally, securing regulatory approvals, especially in a sector as strategic as semiconductors, will be crucial. M&A lawyers will work closely with regulatory bodies to ensure any deal meets the necessary criteria.

Intellectual Property (IP):

- Licensing Agreements: Arm Ltd. designs core semiconductor components and licenses the blueprints. IP lawyers will be crucial in drafting, reviewing, and negotiating these licensing agreements to ensure they are watertight and protect Arm's intellectual property rights.

- IP Protection and Litigation: With the strategic importance of Arm's designs and the vast number of devices using their technology, there's potential for IP infringements. IP lawyers will be on the frontline, ensuring that Arm's intellectual property is protected, and if necessary, pursuing litigation against any parties that infringe on their rights.

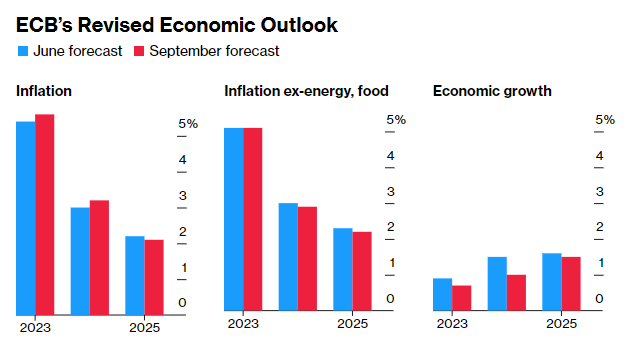

Chart of the Week

The European Central Bank (ECB) is on a mission: combat inflation. How? By hiking interest rates for the 10th time. Imagine turning up your treadmill speed every week to sweat more. That's the ECB, but with the Eurozone's economy.

They've pushed the rate to 4% hoping to control inflation. But here's the twist: the euro took a dip, and bonds are celebrating. Why? Traders think the ECB might be done with their rate-raising antics. It's like thinking the movie's villain is defeated, but there's still 30 minutes left.

And the plot thickens! Other big financial players, like the Federal Reserve and the Bank of England, are gearing up to make their moves next Wednesday and Thursday.

Quick Hits

- 📈 U.S. inflation rose to 3.7% in August, largely due to costlier petrol from Saudi Arabia and Russia's oil output cuts. The core inflation rate, excluding food and energy, fell to 4.3%.

- ⛽ Bernard Looney resigned as BP's CEO amid scrutiny over personal relationships with colleagues. Appointed in 2020, Looney had emphasized renewables and net-zero emissions by 2050.

- 📱 Apple introduced iPhone 15 with a USB-C port, mandated by the EU. This change makes Lightning accessories obsolete but broadens device compatibility.

- 🚗 United Auto Workers began strikes at Detroit carmakers over wages and job security. Workers walked out from Ford in Michigan, General Motors in Missouri, and Stellantis in Ohio. Talks between the union and automakers remain inconclusive.

Law Firm news

- Osborne Clarke opened an office in Miami, bringing on board an experienced information technology and international dispute lawyer, Javier Fernández-Samaniego, who was the managing partner of the boutique Samaniego Law.

- Reynolds Porter Chamberlain announced on Monday that it has snagged the former head of the corporate practice at Ince & Co. This move bolsters its expertise in equity capital markets transactions and corporate deals involving publicly listed companies.

- Macfarlanes has welcomed a private funds specialist as a partner from Sidley Austin, marking the second transition from the BigLaw giant to the London-based firm this year.

- On Wednesday, Société Générale SA questioned if a London court has the authority to oversee its €140 million negligence claim against Clifford Chance. The bank alleges that the global law firm botched a hefty dispute over gold bullion.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).