The IMF's gloomy meetup

Hi this is ZipLaw! We explain how news stories impact law firms so you can stand out in your applications.

Are you new here? Get free emails to your inbox.

Here’s what we’re serving today:

- IMF and World Bank annual meetings

- Metro Bank's last minute save

- Israel conflict shakes up oil trade

The IMF's gloomy meetup

In Short: The world's finance ministers are meeting in Morocco for the 2023 World Bank-International Monetary Fund annual meetings, and let's just say, the mood's as gloomy as a rainy Monday morning.

Here's all you need to know.

1. Marrakech: More than Just a Vacation Spot

Marrakech is hosting the annual IMF/World Bank meetings. But they're dealing with a buffet of global issues: inflation, climate change, wars, earthquakes... and the rising cost of debt.

This morning we got some interesting news from the IMF:

- The IMF raised its global inflation forecast to 5.8% for the upcoming year, advising central banks to maintain strict policies until inflation pressures ease sustainably. This is an increase from the previous forecast of 5.2%.

- The IMF reduced its economic growth prediction for 2024 and anticipates inflation to overtake central bank targets in most countries until 2025. The global growth forecast for the next year is set at 2.9%, a 0.1% decrease from its July outlook.

2. The IMF's Expensive Lifeline

The main course of the IMF meetup is the rising cost of debt. With global interest rates soaring, countries are finding it harder to borrow money without breaking the bank.

As a result, 60% of Low-Income Countries currently face debt distress (i.e. where they can't pay back what they borrow). LICs are countries with a gross national income per capita of $1,045 or less, eg Chad and Ethiopia.

The IMF, usually the go-to for countries in financial distress, is also feeling the pinch. Their rescue loans are now priced higher. For countries in trouble, it's like going to your favourite discount store and finding out everything's had a price hike.

3. Potential Solutions?

There's talk about putting a cap on how high the IMF can set its lending rates. It's a controversial idea, especially for the big players like the US. It's like suggesting a maximum price for designer handbags; sounds great for the buyer, but the sellers (or in this case, the creditor shareholders) might not be too thrilled.

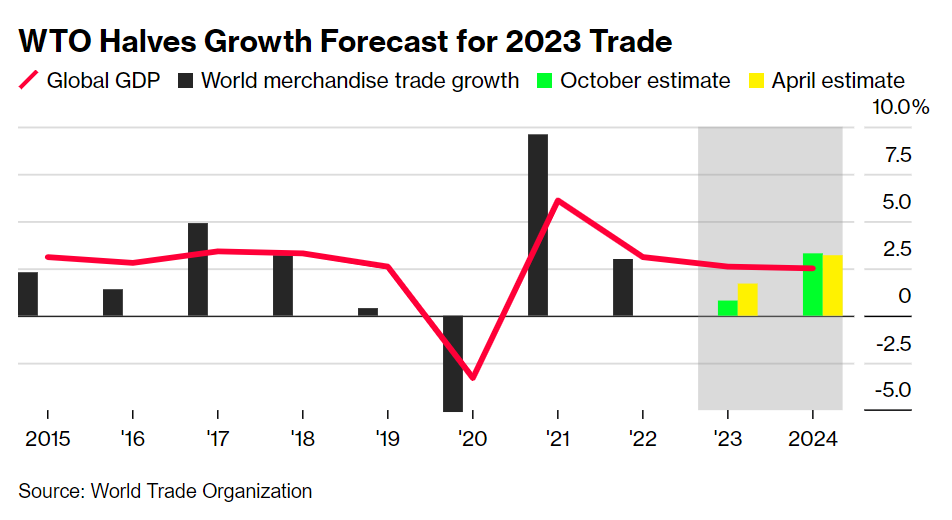

To make matters more complicated, the World Trade Organization (WTO) just slashed its growth forecast for 2023 trade.

⚖️ How does this impact Law Firms?

Banking and Finance:

- Debt Restructuring: Given the rising cost of debt and the distress faced by Low-Income Countries (LICs), lawyers in this department will be involved in advising countries on debt restructuring options. This would involve renegotiating the terms of existing loans, possibly extending maturity dates, reducing interest rates, or even writing off a portion of the debt.

- Loan Agreements: As the IMF's rescue loans are now priced higher, countries will need legal advice when entering into these agreements. Lawyers will be responsible for drafting, reviewing, and negotiating the terms of these loan agreements to ensure that the borrowing country understands and can meet its obligations.

International Trade and Regulation:

- Trade Disputes: With the World Trade Organization (WTO) slashing its growth forecast for 2023 trade, there may be an increase in trade disputes. Lawyers in this department will be involved in representing countries or entities in trade disputes, ensuring compliance with WTO rules and regulations.

- Regulatory Compliance: If there are changes in international trade regulations or new caps on lending rates, lawyers will be required to advise countries and financial institutions on compliance with these new rules, ensuring that they do not face penalties or sanctions.

Environmental and Climate Change Law:

- Climate Change Advisory: Climate change is another key topic being discussed at the IMF meetup. Lawyers specialising in environmental law will be advising clients on compliance with new environmental regulations, especially those aimed at limiting global warming. This could involve advising businesses on how to reduce their carbon footprint, ensuring compliance with any new carbon pricing mechanisms, and representing clients in disputes related to environmental regulations.

- Sustainable Finance: As the discussion around multilateral development bank reform to tackle climate change intensifies, lawyers will be advising clients on sustainable finance opportunities. This includes guiding businesses on accessing green finance, ensuring that any green bonds or loans meet international standard

Metro Bank's last minute save

In Short: Metro Bank's got money troubles, but a Colombian billionaire's swooping in to save the day.

1. The Billionaire Bailout:

Imagine you're drowning in a pool of debt, and suddenly, Aquaman (or in this case, Jaime Gilinski Bacal) dives in to save you. That's Metro Bank right now.

After weekend-long negotiations, Metro Bank secured a £325mn lifeline. The hero of our story, Mr. Bacal, is throwing in a whopping £102mn. And what does he get? Well, besides a shiny new bank, he's set to become the majority shareholder. Think of it as buying a fixer-upper, but instead of a house, it's a bank.

2. The Debt Do-Over:

Metro's also refinancing £600mn of its debt. What does that mean? Well, imagine you've borrowed a bunch of toys from your friends. Over time, you realize you can't give them all back in the same condition.

So, you return some toys slightly "used" (or missing a few pieces). That's Metro Bank with its debt. They're refinancing £600mn, and some bondholders are getting only 55-60% of what they initially invested. It's like lending someone a full chocolate bar and getting back just over half (based on a true choco story).

Meanwhile, Metro's planning to sell off £3bn in residential mortgages. Think of it as a garage sale, but for mortgages. This move is expected to beef up the bank's financial muscles.

⚖️ How does this impact Law Firms?

Banking and Finance:

- Capital Raising and Debt Restructuring: Lawyers in this department will be heavily involved in drafting, reviewing, and negotiating the terms of the financing deal. This includes the £325mn capital raise and the £600mn debt refinancing. They'll ensure that the terms are favourable for their clients, whether they're representing Metro Bank, the investors, or the bondholders.

- Regulatory Compliance: Given the involvement of the Bank of England and the regulatory requirements surrounding capital ratios, lawyers will be needed to ensure that all aspects of the financing deal are compliant with current banking regulations. This might involve liaising with regulatory bodies, interpreting new guidelines, and advising on the structuring of the deal to meet these requirements.

Mergers and Acquisitions (M&A):

- Asset Sales and Acquisitions: With Metro Bank considering selling off some of its assets and other banks potentially interested in buying, M&A lawyers will be in demand. They'll be responsible for conducting due diligence, drafting sale and purchase agreements, and ensuring that any transfers of assets are legally sound and beneficial for their clients.

- Change of Control Transactions: Given that Jaime Gilinski Bacal is set to become the majority shareholder, lawyers will be needed to oversee this change of control. This includes ensuring that the transaction complies with all relevant regulations, and that all shareholder rights are upheld.

Corporate Governance and Securities:

- Equity Transactions: With the introduction of fresh equity from Metro’s largest shareholders and the pricing of the stock issued as part of the equity raise, lawyers specialising in securities will be required. They'll be responsible for ensuring that the issuance of new shares is compliant with securities laws and that shareholder rights are protected.

- Disclosure and Reporting: Given the significant changes in Metro Bank's financial structure and ownership, there will be a need for accurate disclosure to the market. Lawyers will be involved in drafting prospectuses, shareholder resolutions, and other disclosure documents to ensure they meet regulatory standards and provide accurate information to current and potential investors.

Trend Interpretation:

This story spells out a trend of increased regulatory scrutiny in the banking sector, especially when there's a potential change in control or significant financial restructuring. Law firms will interpret this as a need to bolster their banking and finance, M&A, and corporate governance departments. They'll likely invest in training and resources to ensure they're well-equipped to handle complex transactions and navigate the intricate web of regulations that govern the banking industry in the UK.

Chart of Day

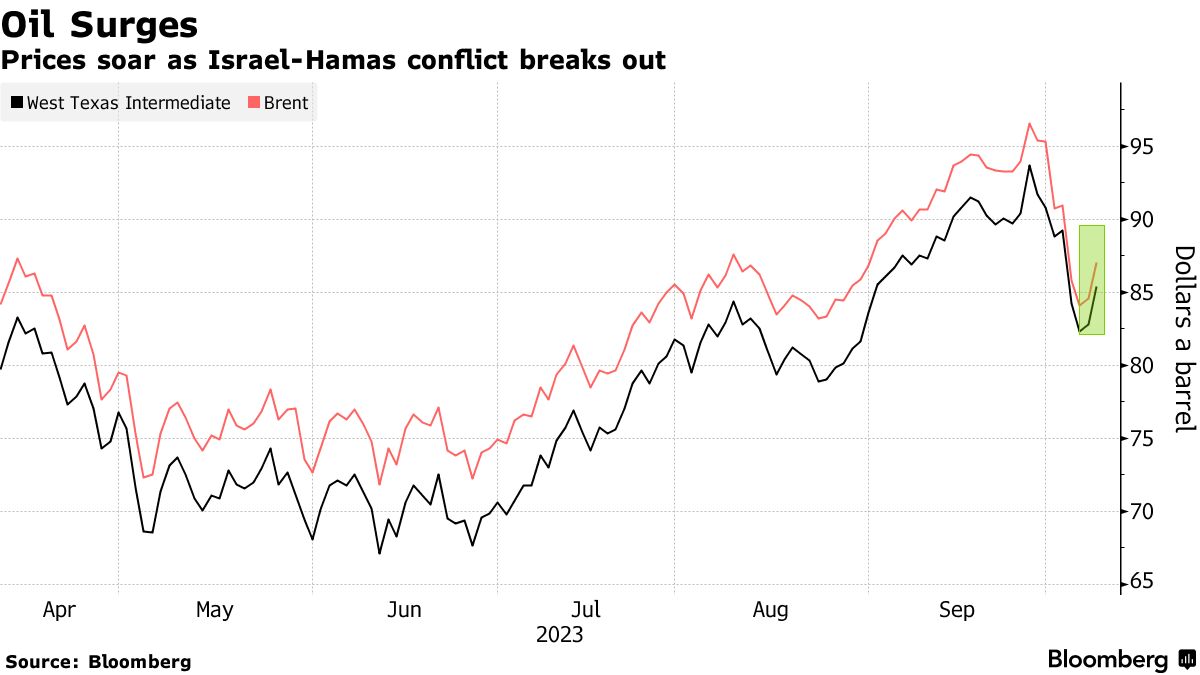

Oil prices have risen sharply following an unexpected attack on Israel by Hamas, leading to heightened tensions in the Middle East. The conflict resulted in over 1,100 deaths in just a few days. This turmoil caused US crude futures to spike by 5.4%, exceeding $87 a barrel at one point.

Although Israel isn't a significant contributor to global oil supply, the conflict could involve the US and Iran, the latter having boosted its crude supply recently.

There are concerns that if the US retaliates against Iran, suspecting its involvement in the attack, it might disrupt the vital Strait of Hormuz, through which a significant portion of the world's oil passes. Iran has denied any involvement.

Note: Our thoughts and prayers are with anyone affected by the conflict in Israel and Palestine. We pray for a swift end to the violence and all hostilities.

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).