Failing Stock Market?

Today we run through the top news stories of the week and explain how they impact law firms.

Are you new here? Get free emails to your inbox.

Here’s what we’re serving today:

- 💸 Markets: Is the London Stock Exchange failing?

- 🤖 IP: What happens when AI messes up?

- 📦 Trade: Why Temu, Shein are a big problem

- 🔋 Energy: Is the Energy Crisis over?

- 🏠Property: Bargain hunting

MEMO

- 🚀 Nvidia's Boom: Nvidia's revenue soared to $22.1bn, up 265% from last year, netting a $12.3bn profit. With a $1.7trn valuation, it's driving the S&P 500's rally, despite supply struggles.

- 📉 Out of money: China saw a drastic fall in foreign direct investment to $33bn in 2023, the lowest since 1993, amid economic challenges.

- 💸 Falling prices: Energy bills are set to fall to the lowest level in two years, dropping 12% to £1,690 from April. The fall is expected to help bring down inflation below 2% — a well-timed boost for the Tories.

- 🌕 Lunar Tumble: Texas-based Intuitive Machines' historic moon landing ended with the spacecraft toppling, but remaining stable at the targeted site.

💸 Markets

Is the UK Stock Market failing?

In Short: In a growing trend that would make Love Island proud, public companies are dumping the London Stock Exchange (LSE) to couple up with US exchanges.

What’s going on?

London's stock market is like a grand old theatre that's seeing fewer blockbuster premieres. The latest act? Pharma company Indivior is mulling over a big move to the US, seduced by the allure of larger investor crowds and the spotlight of major US indexes. This is part of a growing exodus that's seen key players like CRH Plc and Ferguson Plc pack up for the US. Even the tech sensation Arm Holdings chose New York over London.

Why are companies leaving?

- Bigger market, more money: Companies are moving their stock market listings from the UK to the US due to the larger and deeper financial markets available in the US, which offer a stronger investor pool and the potential for higher business valuations.

- Valuation Gap: Due to a big valuation gap between the UK and US markets, UK companies are trading at a discount compared to their US counterparts. This is made worse by UK investors' seemingly risk-averse nature and preference for dividends, leading to underinvestment in growth sectors like technology.

- Pension Fund Investments: UK pension and insurance funds have significantly reduced their holdings in UK-listed companies, favouring safer fixed-income assets due to changes in accounting practices and investment strategies. This shift away from equities has contributed to the diminishing attractiveness of the London stock market for companies.

Why does it matter?

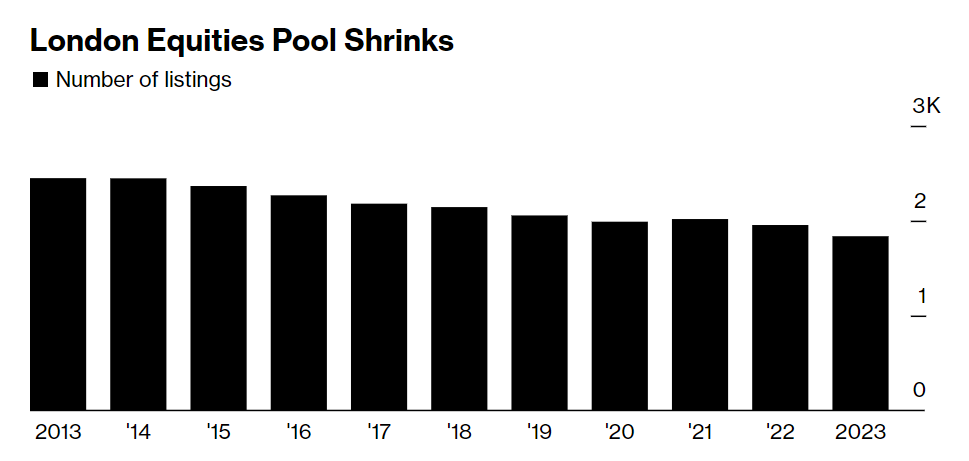

The trend of companies deserting the LSE for US listings is a troubling sign, pointing to a broader dissatisfaction with the market's dynamics, visibility, and valuation opportunities in the UK. With London losing one in five companies over the past five years, the narrative is shifting from isolated incidents to a full-blown trend. This exodus raises alarms not just for market regulators but for the UK's economy as a whole.

⚖️ How does this impact Law Firms?

Join ZipLaw+ to continue reading