Linklaters leads on Raspberry Pi IPO

In Short: Raspberry Pi, renowned for its card-sized computers, has announced plans to float on the London Stock Exchange, providing a much-needed boost for the U.K. capital market, which has struggled to attract new listings.

What is the deal?

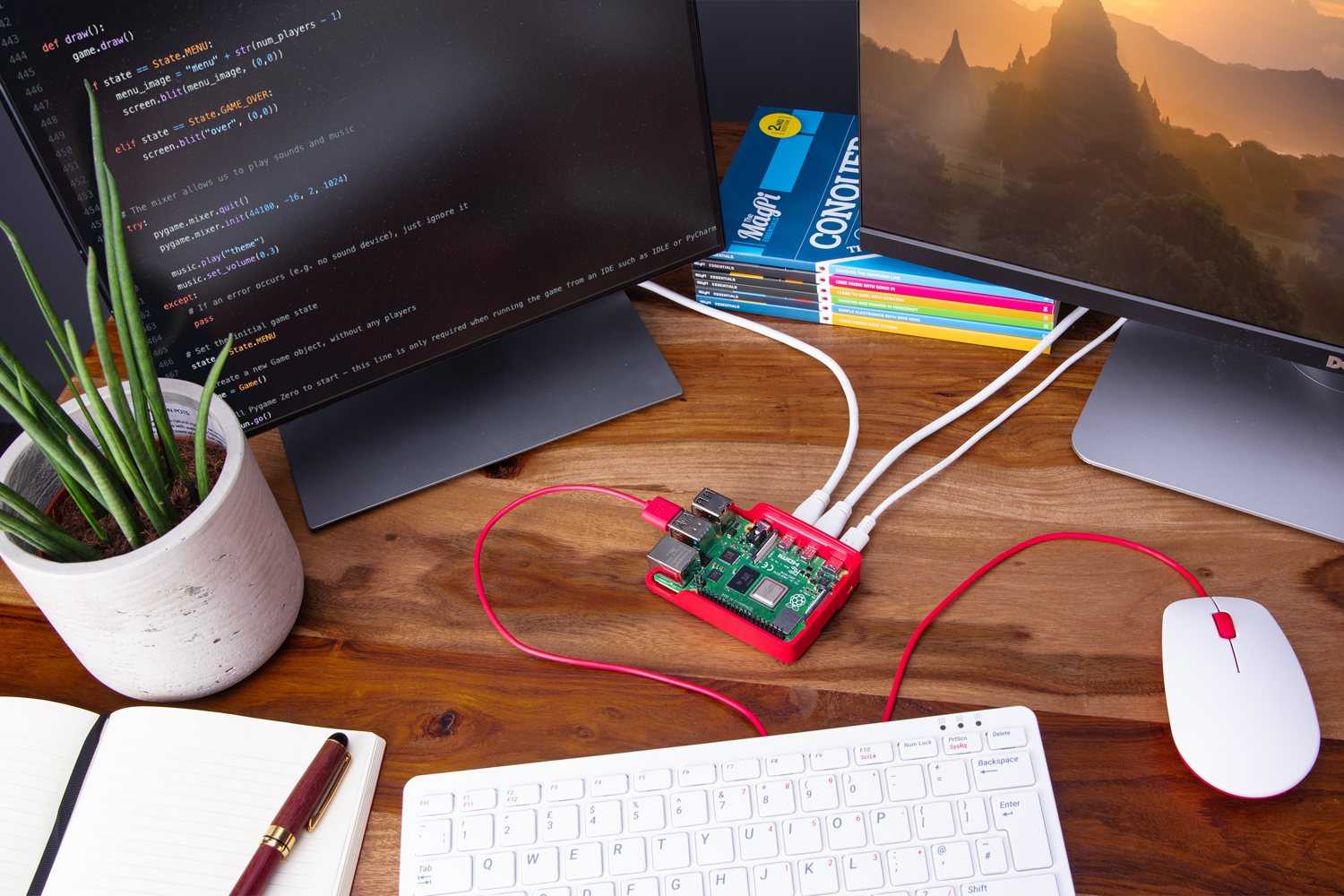

Raspberry Pi, known for its low-cost, high-performance computers, is preparing for an initial public offering (IPO) on the main market of the London Stock Exchange.

The Cambridge-based company, which began trading in 2012 and has sold over 60 million units worldwide, is taking this step to offer new shares to institutional investors globally and retail investors in the U.K. Existing shareholders, including the Raspberry Pi Foundation, Sony, and Arm, will also sell existing shares.

Key Legal Points to discuss in applications & interviews:

- Boost for the U.K. Capital Market: The announcement of Raspberry Pi’s IPO is a significant development for the London Stock Exchange, which has seen a decline in high-growth companies listing there in recent years. This move could signal a turnaround and attract more tech firms to the U.K. market, providing a much-needed influx of new listings.

- Public Participation in IPO: Raspberry Pi’s decision to allow retail investors to participate in the IPO alongside institutional investors is noteworthy. This inclusive approach promotes broader investment opportunities and can help build public trust and interest in the company. It also aligns with recent trends to democratize access to investment opportunities traditionally reserved for institutional investors.

Who is advising on this?

- Raspberry Pi: Linklaters (Team led by partner Jason Manketo, counsel Philippa Gavey, Asad Ahmed, Scott James, and associate William Smith).

How did Linklaters advise on this?

Join ZipLaw+ to continue reading