Merger Meltdown

Hi this is ZipLaw! We explain how news stories impact law firms so you can stand out in your applications.

Are you new here? Get free emails to your inbox.

Here’s what we’re serving today:

- 🖌️ Adobe and Figma end $20bn merger

- 🚢 What happened in the Red Sea?

Adobe-Figma Meltdown

In short: Adobe's $20 billion romance with Figma hit a regulatory brick wall, ending with a billion-dollar break-up fee. Talk about expensive dates!

What is Going On?

Adobe, the old school cool of creative software (think Photoshop), tried to put a ring on Figma, a hotshot in web-based design. But alas, the European Commission and UK's Competition Markets Authority played the strict parents, saying "I don't think so." To finish things off, Adobe will pay Figma a $1 billion termination fee.

Why did Regulators block it?

- Fear of Monopoly: The main worry was that combining Adobe and Figma would create a monopoly in the creative software market. Adobe's already a big player with tools like Photoshop and Illustrator. Adding Figma, a rising star especially in web-based design, might squash competition.

- Reduced Competition and Innovation: There's a belief that when one company dominates a market, it doesn't have to try as hard. Innovation could slow down, and prices might go up.

- Preventing a Meta-Instagram Redux: Remember when Facebook (now Meta) bought Instagram and everybody raised eyebrows about how it might affect competition? Well, regulators saw Adobe-Figma in a similar light. They were concerned this deal could be another case of a tech giant gobbling up a potential competitor to maintain its dominance.

- Impact on Consumers and Choices: If Adobe owned Figma, customers might have fewer choices. This could lead to fewer innovative features or higher prices. It's like if all your streaming services merged into one – convenient, maybe, but likely pricier and less diverse in content.

For the tech industry, this drama highlights the growing scrutiny over tech giants swallowing up smaller players. It's a warning bell: the tech world's matchmaking days might be numbered, with regulators ramping up their scrutiny.

⚖️ How does this impact Law Firms?

Competition and Antitrust Law:

- Merger and Acquisition Reviews: Lawyers in this department will be heavily involved in the scrutiny of future mergers and acquisitions, especially in the tech sector. They'll provide in-depth analyses and advice on compliance with competition laws, helping clients navigate complex regulatory landscapes. This includes preparing detailed submissions to competition authorities and devising strategies to address potential antitrust concerns.

- Litigation and Regulatory Investigations: These legal experts will represent companies in litigation arising from blocked or scrutinised mergers. They'll also advise on responses to regulatory investigations, interpreting and challenging the findings of competition authorities like the UK’s Competition Markets Authority and the European Commission.

Corporate and Commercial Law:

- Contract Drafting and Negotiation: Lawyers will be engaged in drafting, reviewing, and negotiating termination agreements and other contractual arrangements following failed acquisition attempts. This includes handling the specifics of termination fees and other contractual obligations.

- Strategic Advice on Business Transactions: Corporate lawyers will provide strategic advice on alternative business transactions, such as joint ventures or partnerships, especially in cases where full acquisitions are deemed unfeasible due to regulatory hurdles.

Intellectual Property Law:

- IP Strategy and Portfolio Management: Lawyers will advise companies on intellectual property strategy, particularly in ensuring their IP portfolios are robust enough to withstand competitive market pressures. This includes managing patents, trademarks, and other IP assets in light of potential market consolidations.

- IP Litigation and Disputes: There will be an increase in litigation related to IP rights, especially in situations where there's a conflict of interest in the tech sector following failed mergers. Lawyers will handle cases involving alleged IP infringements, licensing disputes, and other related legal conflicts.

BP halts Red Sea Shipments

In short: BP's hitting the brakes on Red Sea shipments due to escalating attacks. The move could cause big problems for the global economy.

What is Going on?

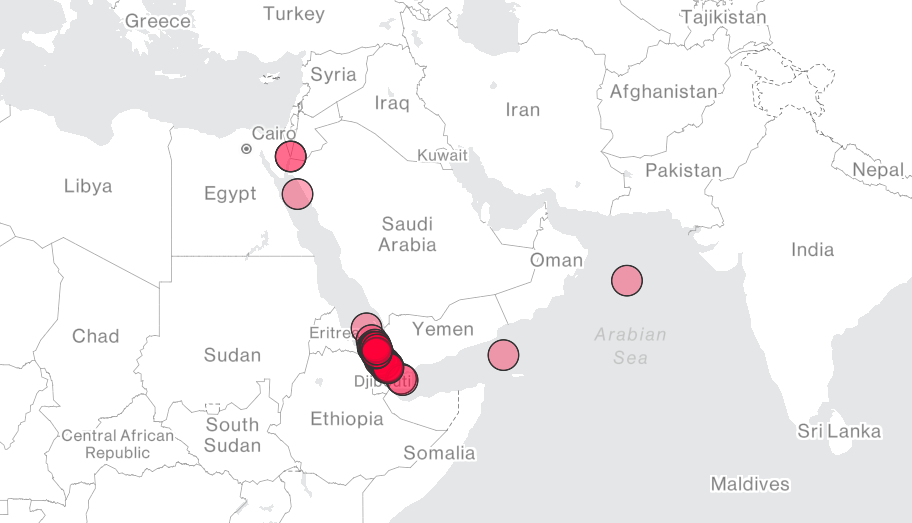

Imagine the Red Sea as the world's busiest maritime highway, now picture it turning into a no-go zone. Why? Well, attacks on merchant vessels are skyrocketing making it very risky for ships to go through there.

As a result BP has paused all its Red Sea shipments. They're not alone in this maritime game of 'hot potato' – top shipping companies and Norway's Equinor are also saying "no thanks" to the Red Sea route.

Why does it matter?

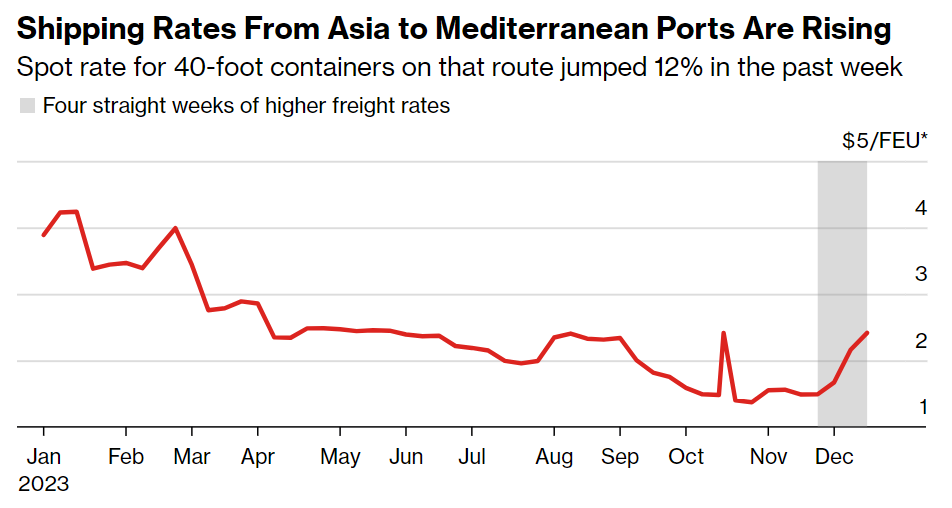

One word: inflation. These disruptions aren't just a headache for sailors; they're a puzzle for the global economy.

Now, there's a few things to keep an eye on here and all of them can contribute to inflation:

- Insurance: The cost of insuring vessels in the Red Sea area is climbing, reflecting the increased risk. The insurance industry is widening the zone classified as high risk, leading to higher insurance costs for a larger number of ships.

- Delayed deliveries: If ships avoid the Red Sea they need to sail around Africa, adding a lot of miles and turning timely deliveries into a "maybe, someday" scenario. These longer voyages mean higher operational costs, and longer routes lead to increased transit times, affecting global supply chains.

- Energy prices: The Red Sea is a critical route for oil and gas shipments. Disruptions can impact the supply of these commodities, leading to higher energy prices. This is especially important for Europe, which relies heavily on liquefied natural gas (LNG) and other energy imports.

⚖️ How does this impact Law Firms?

Maritime and International Trade Law:

- Contractual Dispute Resolution: Lawyers in this field will see a surge in advising shipping companies, insurers, and cargo owners on contractual disputes arising from the rerouted or delayed shipments. They will interpret force majeure clauses and other contractual provisions to determine liability and negotiate settlements or represent clients in arbitration or litigation.

- Insurance Claims and Policy Review: They will be busy handling claims related to attacks on vessels and advising on the adequacy of current insurance coverage. They will also be involved in renegotiating policies to include or exclude certain risks associated with Red Sea transits, particularly in light of the expanded "high-risk" zones by insurance committees.

Energy and Natural Resources Law:

- Supply Chain Disruption Advice: Lawyers specialising in energy law will advise clients, particularly oil and gas companies like BP and Equinor, on the legal implications of supply chain disruptions. This includes revising contracts with suppliers and customers to address delays or defaults due to the rerouting of shipments.

- Regulatory Compliance and Risk Management: These professionals will guide energy companies in complying with new regulations that might emerge due to these geopolitical tensions. They will also play a crucial role in developing risk management strategies to mitigate the impact of such geopolitical issues on their operations and long-term investments.

International Arbitration and Dispute Resolution:

- Representing Clients in International Disputes: Lawyers in this department will represent clients in international arbitrations arising from these maritime disruptions. This includes disputes between shipping companies and cargo owners or between insurers and insured parties.

- Advisory on Sanctions and International Law: Given the geopolitical nature of the conflict, these lawyers will also be advising clients on the implications of international sanctions and laws. They will be advising on compliance with international regulations and representing clients in disputes where international sanctions play a central role.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).