Roundup: Hong Kong’s Bitcoin Play

Hi this is ZipLaw! We know how much you love our Sunday roundups, so we'll now be sending you a mid-week one every Wednesday. Enjoy ❤️

Are you new here? Get free emails to your inbox.

Here’s what we’re serving today:

- 💸 Hong Kong's Bitcoin play

- 🇪🇺 EU's Trade Tensions with China

- 🤖 Adobe's AI IP problem

🗞️ News Briefing

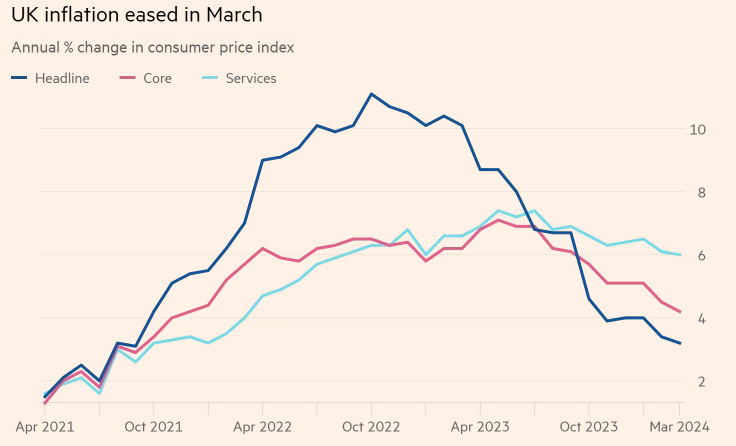

- 🇬🇧 UK's Cooling Inflation: UK inflation fell to a 2.5-year low of 3.2% in March, spurred by decreasing food prices. Although still above the Bank of England's 2% target, the trend might open doors for potential interest rate cuts.

- 🇦🇺 Australia's Defence Pivot: Australia announced its first national defence strategy, emphasizing a shift towards the Asia-Pacific to address China's growing influence. Defence spending is set to rise to 2.4% of GDP, reflecting an increase from the current 2.1%.

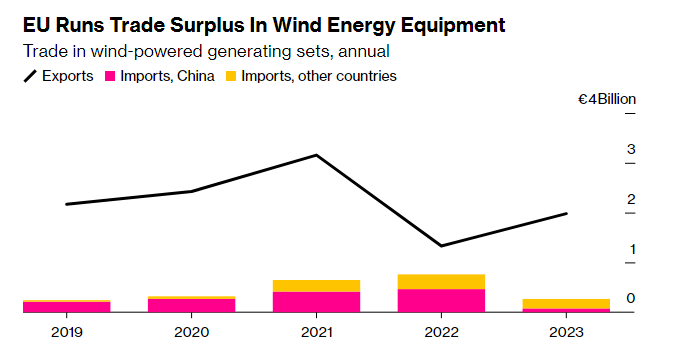

- 💨 Wind Power's Swift Growth: Last year, wind farms globally added a whopping 117 gigawatts of capacity, marking a 50% boost from 2022. However, the Global Wind Energy Council notes that this pace must accelerate to meet COP28’s annual target of 320GW by 2030.

- 🌐 OpenAI's Asian Expansion: OpenAI expands into Asia with a new Tokyo office, offering Japanese companies early access to a tailored GPT-4 model. This move aims to enhance partnerships with major tech firms like Daikin and Toyota Connected.

- 🌍 New Sanctions on Iran: In response to Iran's attack on Israel, the US and EU are lining up fresh sanctions targeting Iran’s missile and drone programs.

Hong Kong's Bitcoin play

In Short: Hong Kong is positioning itself as a crypto leader by giving conditional nods to asset managers for launching Bitcoin and Ether ETFs.

What the hell is a Bitcoin ETF?

- A Bitcoin ETF, or Exchange-Traded Fund, is a type of investment fund that tracks the price of Bitcoin, allowing investors to buy shares of the ETF through traditional stock markets without needing to directly purchase or hold Bitcoin themselves.

- Think of it like this: Imagine Bitcoin is gold. Instead of buying pieces of gold and figuring out where to safely keep them, you can buy shares in a fund that owns the gold for you. This fund then mirrors the price of gold. If gold’s price goes up, the value of your shares in the fund goes up similarly. A Bitcoin ETF works in the same way but with Bitcoin as the asset it tracks.

- But why? It makes investing in Bitcoin easier and safer for regular investors who might be unfamiliar with the complexities of buying and securely storing cryptocurrencies. They can buy and sell shares of the Bitcoin ETF just like they would shares of any other company on the stock market.

What’s going on?

Hong Kong's financial regulators are making waves in the crypto world by tentatively approving the launch of direct investment spot-Bitcoin and Ether ETFs. Companies like Harvest Global Investments and a joint effort between HashKey Capital and Bosera Asset Management have received these initial thumbs-ups. This move is part of a broader push to rival global hubs like Singapore and Dubai, aiming to rejuvenate its status as a top financial center with cutting-edge digital asset offerings.

The Securities & Futures Commission (SFC) of Hong Kong has outlined that these approvals are conditional, awaiting further clearances, signaling a cautious yet progressive approach towards crypto integration. Besides, other firms are lining up for virtual asset management services, broadening the scope for future crypto-related products.

Why does it matter?

This step is pivotal as it marks a progressive shift in embracing cryptocurrency through a regulated, structured market approach, potentially setting a global benchmark. The unique 'in-kind' subscription and redemption mechanism of these ETFs might offer more efficient, cost-effective investment opportunities compared to the typical cash-based systems in the U.S., enhancing their attractiveness to both individual and institutional investors.

The successful implementation of these ETFs could not only boost investor confidence in volatile crypto markets but also solidify Hong Kong’s reputation as a forward-thinking financial hub in the digital age, influencing broader market acceptance and stability in cryptocurrency investments.

⚖️ How does this impact Law Firms?

Financial Regulation:

- ETF Structure and Compliance: Lawyers will be advising asset managers on the structuring of these new Bitcoin and Ether ETFs to ensure compliance with both Hong Kong’s Securities & Futures Commission (SFC) regulations and international standards. This includes drafting fund prospectuses, creating robust governance frameworks, and ensuring transparent reporting mechanisms. Their clients, primarily asset management firms, will rely on legal guidance to navigate the complexities of crypto-related financial products while mitigating risks related to regulatory scrutiny.

- Licensing and Authorisation: Legal experts will assist clients in obtaining necessary approvals and licenses from regulatory bodies such as the SFC. This includes preparing and reviewing application materials, advising on the regulatory implications of crypto investments, and representing firms in communications with regulators. The aim is to secure a smooth approval process and to ensure ongoing compliance, which is crucial for maintaining the licenses needed to operate in this rapidly evolving market segment.

Technology and Intellectual Property:

- Crypto Asset Safeguarding and Custody Solutions: Lawyers will guide technology providers and custodians on the legal aspects of developing and implementing digital asset custody solutions. This work involves drafting and negotiating terms of service, addressing liability issues, and ensuring compliance with cybersecurity regulations. Clients will include technology firms and financial institutions looking to offer secure and compliant custody services for digital assets, which is a foundational aspect of operating ETFs that directly hold cryptocurrencies.

- Patent and Technology Licensing: Legal professionals will aid in the patenting of new technologies and in drafting licensing agreements related to cryptocurrency trading and management platforms. This ensures that intellectual property rights are protected and monetised effectively, particularly as innovations in blockchain technology continue to evolve. The client base here includes tech companies and startups specializing in blockchain applications, seeking to safeguard their innovations while capitalizing on the burgeoning market for crypto-related technologies.

Corporate and Securities Law:

- Investment Advising and Compliance: Lawyers will counsel investment advisors and asset managers on how to integrate these new ETF offerings into their portfolios while adhering to both local and international investment regulations. This includes advice on fund advertisement, investor disclosures, and the fiduciary duties associated with managing investor funds in volatile markets like those for Bitcoin and Ether.

- Public Offerings and Securities Filings: Legal guidance will be critical when these ETFs transition from approval to actual listing and trading on the Hong Kong Exchanges and Clearing Ltd. Lawyers will manage the drafting of public offering documents, ensuring accurate and compliant disclosure of potential risks and benefits to investors. Additionally, they will oversee the securities filings required for these new financial products, facilitating their successful integration into the broader market. Their clients will include the asset managers launching these ETFs, who must meet stringent requirements in terms of transparency and investor protection.

EU's Trade Tensions with China

In Short: The European Commission is stepping up its game against China with multiple trade investigations, aiming to secure fair competition and lessen reliance on Chinese imports in key industries.

What’s going on?

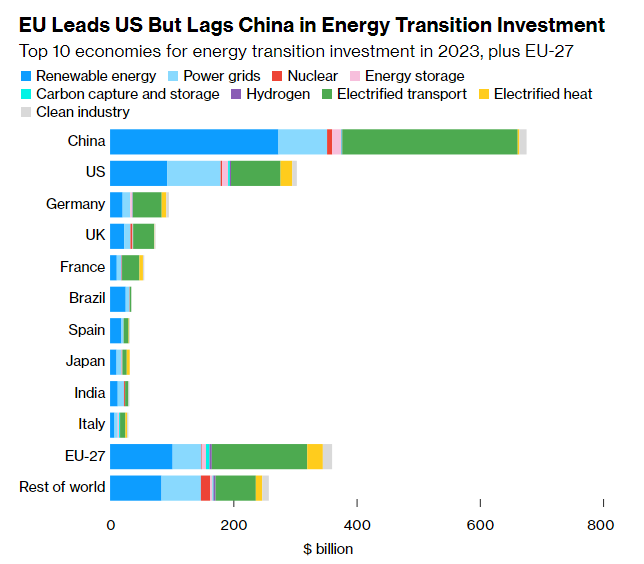

The EU is opening investigations into Chinese subsidies across several sectors, including electric vehicles and renewable energy technologies. This move comes as European leaders vocalize concerns about unfair competition from China, which they believe has distorted markets and influenced political outcomes in the West for decades. These investigations reflect a strategic shift in the EU’s approach to global trade, targeting practices that may allow China to dominate emerging clean-tech markets crucial for Europe's transition to a green economy.

Why does it matter?

This crackdown is pivotal for both economic and strategic reasons. Economically, the EU aims to protect its industries from being undercut by cheaper imports, supporting local production and innovation. Strategically, reducing dependency on Chinese imports in critical sectors like renewable energy and electric vehicles is essential for the EU’s energy security and technological sovereignty.

By reinforcing its trade policy and subsidy regulations, the EU is not only addressing current imbalances but also positioning itself for a sustainable future, where it can compete globally without compromising its economic interests or environmental goals. The outcome of these actions will define the EU’s role in a rapidly changing global economy, emphasizing the need for a balanced approach to international trade and market competition.

⚖️ How does this impact Law Firms?

International Trade and Competition Law:

- Advising on Compliance and Subsidy Investigations: Lawyers will guide companies, particularly in the clean tech and automotive sectors, on navigating the complexities of new EU subsidy investigations and ensuring compliance with EU trade regulations. This includes preparing for audits, responding to EU information requests, and representing clients in proceedings. The legal advice will be crucial for manufacturers and importers who risk facing severe penalties and market exclusion if found non-compliant with EU trade measures.

- Representation in Trade Disputes: Legal experts will represent European companies and government bodies in disputes that may arise from the newly imposed trade measures against China. This involves both defending against potential retaliatory actions from Chinese companies and pursuing claims where European entities face unfair competition. Lawyers will need to be well-versed in both EU and international trade law, prepared to handle complex litigation and negotiation scenarios that could influence market dynamics significantly.

Regulatory and Compliance Law:

- Guidance on EU Foreign Subsidies Regulation: Lawyers will assist clients in understanding and adhering to the EU's new regulatory framework concerning foreign subsidies. This is particularly pertinent for companies involved in bidding for public contracts in sectors like railways and solar parks, where foreign investments are heavily scrutinized. Legal specialists will help ensure that their clients’ proposals are compliant and advise on restructuring deals to meet the new stringent EU standards.

- Compliance Strategies for Import/Export Regulations: As the EU tightens its import controls, lawyers will need to advise importers and exporters on the legal ramifications of the new trade barriers and tariffs. This includes strategic advice on tariff mitigation, reclassifying products, or restructuring supply chains to minimize the financial impact. Legal support will be essential for clients looking to adapt their business practices to remain competitive under the new trade norms.

Environmental and Energy Law:

- Advising on Investment in Renewable Technologies: With the EU's focus on achieving a self-reliant clean tech industry, lawyers will play a pivotal role in advising companies on investments and compliance with the EU’s Net Zero Industry Act. This includes legal guidance on securing subsidies, navigating the regulatory approvals for new projects, and ensuring that these investments align with the EU's environmental targets.

- Legal Support in Clean Technology Transfers and Licences: As European firms seek to reduce dependence on Chinese clean tech, lawyers will be needed to negotiate technology transfer agreements and secure licensing deals that comply with both national and EU regulations. This ensures that technology transfers uphold intellectual property rights, meet regulatory standards, and contribute to the strategic goals of reducing emissions and enhancing technological sovereignty.

Adobe's AI problem

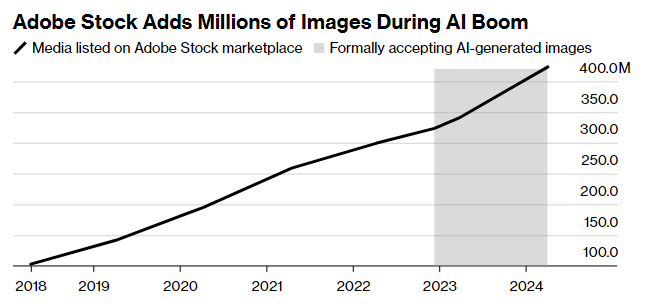

In Short: Adobe's Firefly, promoted as an ethical AI image generator trained on proprietary and public domain images, has also been training on AI-generated images from competitors.

What’s going on?

Adobe set itself apart in the digital creativity market by launching Firefly, an AI tool presented as a paragon of responsible AI usage. The tool was advertised as using only Adobe Stock and public domain images, avoiding the contentious practices of competitors who scrape the internet for training data.

However, disclosures in Adobe’s online communities revealed that about 5% of Firefly’s training dataset included images generated by other AI services, like Midjourney and OpenAI’s Dall-E. This revelation has sparked internal debates and external criticism regarding Adobe’s commitment to transparency and ethical standards in AI development.

Why does it matter?

The inclusion of competitor-generated images in Firefly's training data raises significant ethical and transparency issues. It challenges Adobe’s claims of superior ethical practices and could undermine trust among users and contributors.

This scenario highlights a common dilemma in AI development: balancing rapid technological advancement with ethical integrity. Adobe’s situation illustrates the broader industry challenge of maintaining transparency and ethical conduct, crucial for sustaining user trust and supporting the responsible evolution of AI technologies.

⚖️ How does this impact Law Firms?

Intellectual Property (IP) Law:

- IP Rights Management and Licensing: IP lawyers will be increasingly called upon to negotiate and draft licensing agreements for the use of AI-generated images, ensuring that such creations do not infringe on existing copyrights or trademarks. They will guide clients, including technology firms and content creators, on securing the necessary rights for the AI-generated content and on structuring agreements that protect their IP assets in the evolving digital landscape.

- Dispute Resolution and Litigation: As the lines between AI-generated content and human-created content blur, IP lawyers will find themselves handling more disputes over copyright ownership and infringement. This includes representing clients in litigation where AI has inadvertently created content that mirrors copyrighted materials, advising on the nuances of "authorship" in the digital age, and ensuring proper representation in court to address these complex and emerging legal issues.

Technology and Data Security Law:

- Compliance Advisory on AI Development and Use: Technology lawyers will advise software companies and developers on compliance with UK and international regulations governing AI. This includes guidance on ethical AI use, data sourcing, and the implications of using AI-generated content. These lawyers will help ensure that AI tools like Adobe Firefly comply with legal standards, thus preventing regulatory backlash and fostering trust among users and contributors.

- Risk Management and Data Protection Impact Assessments: Given the sensitivity of data used in training AI systems, lawyers specializing in technology and data security will need to conduct thorough data protection impact assessments for companies. This ensures that all personal data used in training AI meets the strict standards set by laws like the GDPR. They will also provide ongoing advice on risk management strategies to mitigate potential legal issues arising from AI deployment.

Commercial Law:

- Contract Drafting and Review: Commercial lawyers will find themselves drafting and reviewing a plethora of contracts related to AI tool development and deployment. This includes service agreements, terms of use, and collaboration contracts between AI tool providers and their clients or data providers. They will ensure that such contracts are robust and clear on the obligations and rights of all parties, particularly focusing on liability clauses in the case of AI failures or mishaps.

- Corporate Governance and Strategy Advice: Lawyers in commercial departments will also advise companies on the strategic implications of integrating AI into their business models. This involves counselling on corporate governance structures to oversee AI initiatives, ensuring that these structures comply with existing laws and best practices while aligning with the company’s broader strategic goals. This legal guidance is crucial for companies navigating the complex interplay between innovation, corporate responsibility, and compliance in the AI space.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).