Saudi Arabia Preps Aramco Share Sale

In Short: Saudi Arabia is set to sell more shares of its oil giant Aramco, aiming to rake in over $10 billion.

👋 Are you new here? Get free emails to your inbox.

What's Going On?

Alright, here's the scoop: Saudi Arabia is getting ready to sell off another chunk of Aramco, their mega oil company. Think of it like a massive garage sale, but with oil shares instead of old furniture. The official announcement could drop as soon as Sunday, and they’ll be taking orders from eager buyers until next Thursday.

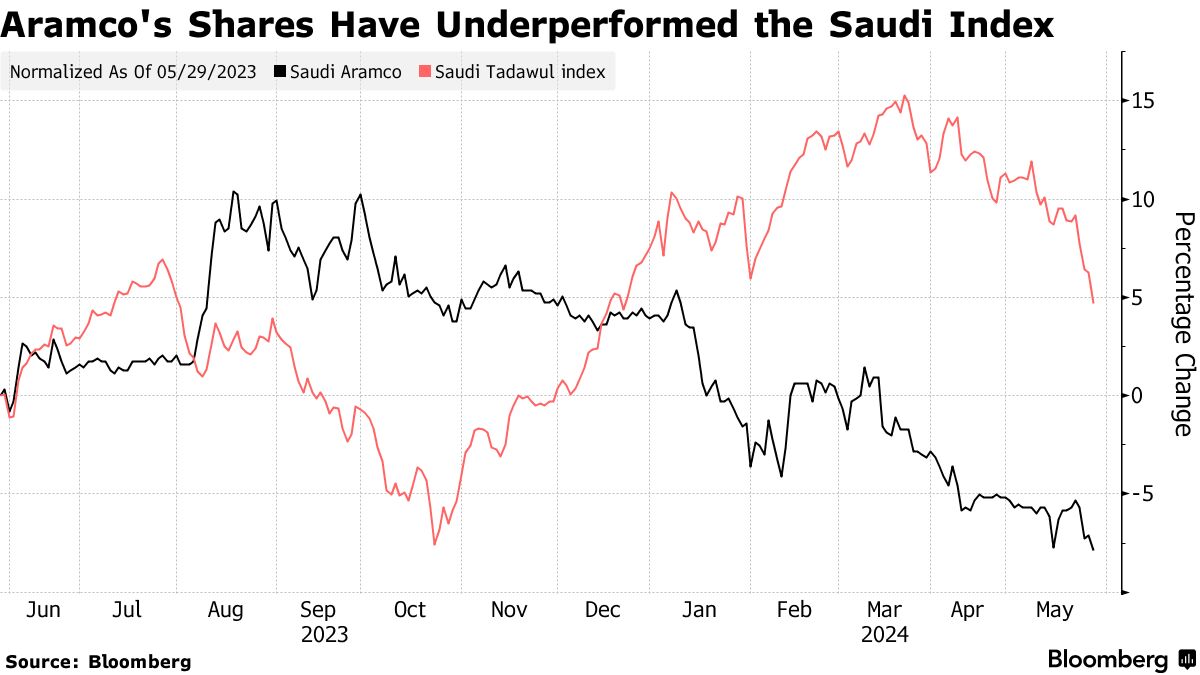

Investors from the Middle East and Europe are already lining up with more than $10 billion in their pockets, ready to snag some shares. These shares will probably be sold at a discount – up to 10% off the current trading price. This sale comes just after Aramco’s stock hit its lowest point in over a year, which, let’s be honest, is like trying to sell your car right after a fender bender.

- To make this happen, Saudi Arabia is calling in the big guns: Citigroup, Goldman Sachs, and HSBC, among others. This isn’t their first rodeo – remember, they raised $30 billion in Aramco's IPO nearly five years ago, the biggest stock sale ever.

What Does This Mean?

This share sale is a big deal for Saudi Arabia. The kingdom still owns a whopping 82% of Aramco and needs some extra cash to fund Crown Prince Mohammed bin Salman’s grand plans – think high-tech cities, sports complexes, and AI projects. It's like needing to sell a few things to fund your dream vacation, but on a much, much bigger scale.

- Here's the catch: oil prices aren’t exactly playing nice. Saudi Arabia needs oil prices close to $100 a barrel to keep their budget in check, but prices are hovering around $85 and could drop even more. This makes the share sale a smart move to bring in some much-needed funds.

This sale also comes at a time when the global market is a bit jittery about fossil fuels and climate change. Aramco’s generous dividends are tempting, but their shares are pricier than those of competitors like Exxon Mobil and Shell.

Plus, Saudi Arabia is on an IPO spree – they've had a string of new share sales that have investors throwing money around like confetti, making the market a bit chaotic. So, as Saudi Arabia gears up for this major financial move, everyone’s watching to see how it plays out.

How does this impact Law Firms?

Join ZipLaw+ to continue reading