Saudi Aramco enter the LNG market

Hi this is ZipLaw! We explain how news stories impact law firms so you can stand out in your applications.

Here’s what we’re serving today:

- Saudi Aramco enter the LNG market

- France says No to delay of Post-Brexit EV Tariffs

- Stephenson Harwood leads on "easy" trade mark dispute

Are you new here? Get free emails to your inbox.

Saudi Aramco enter LNG market

In Short: Saudi Aramco's dropping half a billion dollars on a stake in MidOcean Energy, making its debut in the liquefied natural gas (LNG) scene.

Here’s all you need to know.

1. Diversify, Diversify, Diversify!

Remember when you tried to switch from coffee to green tea because you heard it was healthier? Well, Aramco's doing something similar, but with a few more zeros attached.

They're known for their oil game, but now they're dipping their toes into the LNG pool. Why? Europe's thirsty for it, especially since they're cutting down on their Russian pipeline sips.

Plus, Crown Prince Mohammed bin Salman has this whole Vision 2030 thing going on, pushing Saudi companies to spread their wings and fly (or in this case, invest) internationally.

2. The Aussie Connection

MidOcean Energy, the new apple of Aramco's eye, is busy shopping for interests in four Australian LNG projects. And guess what? They're managed by EIG Global Energy Partners, the same folks who snagged a piece of Aramco's pie last year.

Aramco's been eyeing the LNG scene for a while, even flirting with Russia's Novatek PJSC a few years back. Talk about playing the field!

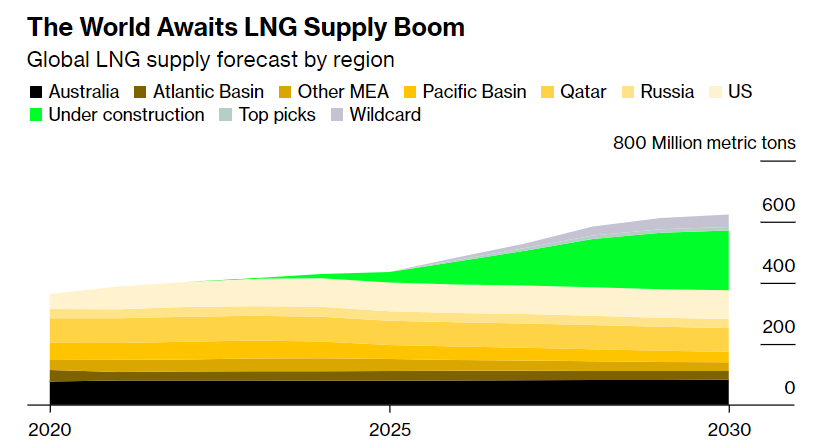

3. Gas-tastic Future Plans

While Saudi Arabia's still riding the oil wave, they're also gassing up for the future. Aramco's throwing a cool $110 billion into the Jafurah gas field, aiming to double their output by 2030. They had dreams of blue hydrogen exports, but with some hiccups in sealing deals, they're now considering LNG exports.

And let's not forget, Aramco's also dabbling in renewables like wind and solar. Because why stick to one when you can have them all?

⚖️ How does this impact Law Firms?

1. Mergers and Acquisitions (M&A):

- Due Diligence: Lawyers in this department will be heavily involved in conducting thorough due diligence on MidOcean Energy and any other potential acquisitions or partnerships Aramco might consider. This will include reviewing financials, contracts, and potential liabilities.

- Drafting and Negotiation: M&A lawyers will be responsible for drafting acquisition agreements, partnership contracts, and other related documents. They'll also be at the forefront of negotiations between Aramco and other entities to ensure the best terms for their client.

2. Energy and Natural Resources:

- Regulatory Compliance: As Aramco expands into the LNG market, lawyers in this department will ensure that all operations comply with international and local energy regulations. This includes environmental standards, safety protocols, and trade regulations.

- Licensing and Permits: These lawyers will assist Aramco in obtaining necessary licenses and permits for LNG exploration, production, and export. This might involve negotiations with governments or regulatory bodies.

3. International Trade and Investment:

- Trade Agreements: With Aramco's interest in exporting LNG and its involvement in international markets, lawyers will be needed to draft, review, and negotiate international trade agreements, ensuring they are favourable and compliant with international law.

- Dispute Resolution: Should any conflicts arise with international partners or in relation to cross-border transactions, these lawyers will represent Aramco in arbitration or other dispute resolution mechanisms.

Trend for Law Firms:

This move by Saudi Aramco signals a broader trend of major oil companies diversifying their portfolios and entering new energy markets. Law firms will interpret this as a sign that they need to bolster their energy and natural resources departments, especially those with expertise in LNG. Additionally, as more companies look to diversify internationally, there will be a growing demand for lawyers skilled in international trade, investment, and arbitration. Firms might also anticipate similar moves by other energy giants and proactively offer their services in these areas.

France says No to delay of Post-Brexit EV Tariffs

In Short: France is throwing a spanner in the works, potentially blocking a delay in post-Brexit tariffs on electric vehicles between the UK and EU. This could hit carmakers' wallets hard. Let's break it down.

1. France's Stance: Guarding the EU Fortress

Think of the EU as a club. Most members, especially Germany, are considering giving the UK a bit more time to adjust to new rules. But France? They're the bouncer at the door, arms crossed, not letting anyone bend the rules. Their concern? If they delay the tariffs, it might look like they're giving in to the UK, which could deter potential battery investments in the EU. And here's the twist: some big French car companies, like Renault and Stellantis, might actually get hurt by this.

2. The Tariff Tangle: What's at Stake?

Here's the nitty-gritty: if an electric vehicle (EV) traded between the UK and the EU has less than 45% of its value coming from the EU, it could be slapped with a 10% tariff. Imagine buying a designer handbag and then being told you have to pay extra because it's not "European" enough. Carmakers are hoping for a three-year extension to adjust. If not, they could be staring down the barrel of a €4.3 billion loss over three years. And while Europe squabbles, China is waiting in the wings, ready to capitalize.

3. The EU's Inner Drama: A House Divided

Within the EU, there's a bit of a disagreement. Thierry Breton, who hails from France, believes the EU shouldn't change the Brexit agreements just to appease the car industry. On the other hand, Valdis Dombrovskis, the EU's trade chief, is more optimistic. He believes there's a way to sidestep tariffs without altering the original Brexit deal. Because if they don't find a middle ground, it's China that stands to benefit the most.

⚖️ How does this impact Law Firms?

Trade and Customs Law:

- Tariff Consultations: Lawyers specialising in trade and customs will be swamped with consultations from car manufacturers and other stakeholders on how to navigate the post-Brexit tariffs. They'll be deciphering the specifics of the tariffs, advising on how to minimise costs, and ensuring compliance with the new trade regulations.

- Dispute Resolution: In the event of disagreements over tariff applications or classifications, these lawyers will represent clients in disputes, either through arbitration or before trade tribunals, to ensure that tariffs are applied fairly and correctly.

Corporate and M&A Law:

- Strategic Partnerships: As European carmakers might look to increase their EU-based value to avoid tariffs, corporate lawyers will be involved in facilitating partnerships, joint ventures, or mergers with EU-based suppliers, especially battery manufacturers.

- Restructuring: If tariffs make certain operations unprofitable, companies might need to restructure. Lawyers will advise on the legal implications of such moves, ensuring that they're carried out in compliance with employment laws, contractual obligations, and other relevant regulations.

EU Regulatory and Compliance Law:

- Regulatory Advisory: Lawyers in this department will advise clients on the evolving regulatory landscape post-Brexit, especially as it pertains to the automotive and battery sectors. They'll ensure that businesses are not just compliant today, but are also prepared for potential future shifts in the regulatory environment.

- Lobbying and Representation: Given the stakes, many companies will want to influence the decision-making process. Lawyers will assist in crafting arguments, gathering evidence, and representing their clients' interests before EU bodies, ensuring their voices are heard in the ongoing deliberations.

Easy Does It... Or Does It?

Summary: EasyGroup, the owner of easyJet and easyHotel, has accused Premier Inn Hotels of trademark infringement for using the word "easy" in their slogan. The claim alleges that Premier Inn's "rest easy" campaign could confuse customers due to its similarity with easyHotel's branding.

Key Points to Take Away:

- Strength of a Trademark: EasyGroup's claim emphasizes the strength and reputation of their "easy" trademark. They argue that the word "easy" in the hotel industry is so strongly associated with their brand that any use by Premier Inn would inevitably lead to confusion. It's like if Batman suddenly started wearing Spiderman's suit; you'd be confused, right? This point underscores the importance of understanding the weight and recognition a trademark holds in its respective industry.

- Intentional Infringement vs. Coincidence: EasyGroup alleges that Premier Inn intentionally used the "easy" term to capitalize on their brand's reputation. The claim suggests that Premier Inn "made a deliberate decision to live dangerously." This highlights the legal debate around whether a company's use of a term is a genuine coincidence or a calculated risk to benefit from another brand's reputation.

- Validity of Trademarks: EasyGroup's move to challenge the validity of Premier Inn's "rest easy" trademark, which was filed in February 2021, brings to light the complexities of trademark law. Just because a trademark is granted doesn't mean it's invincible. It's like getting a driver's license but still being pulled over for bad driving. This point emphasizes the importance of not only securing trademarks but also ensuring they stand up to scrutiny and challenges.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).