What does today's Inflation reading mean?

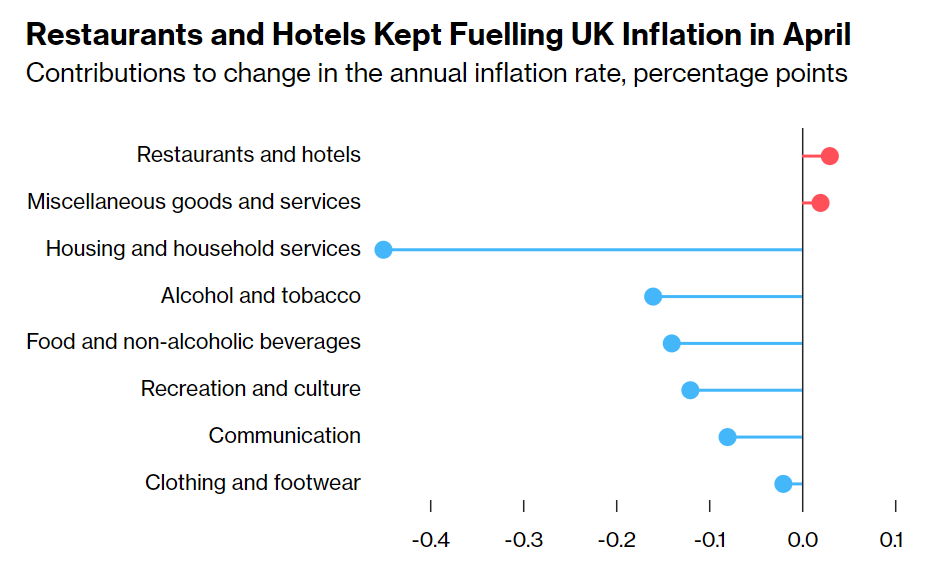

UK inflation didn’t chill out as much as we hoped last month. Thanks to stubbornly high prices at your favourite pubs and restaurants, the Bank of England might have to hold off on those long-awaited interest rate cuts.

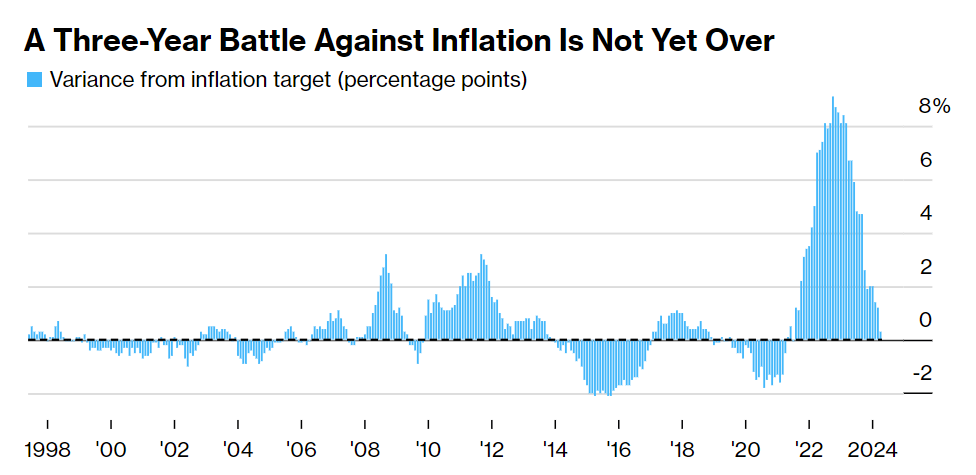

So, what’s the damage? The Consumer Prices Index (CPI) climbed 2.3% from a year ago in April. Sure, that’s down from 3.2% in March and the lowest we’ve seen since summer 2021, but it’s still a bit higher than what the experts were predicting.

Mixed Signals and Persistent Pressures

While inflation is getting closer to the BOE’s 2% target, it might not be enough to trigger an early rate cut. Services inflation, a big focus for the BOE because it reflects domestic pressures, stayed high at 5.9%, only a smidge down from 6% in March and above the expected 5.5%. Turns out, those pay raises everyone’s been getting are keeping service prices stubbornly high.

Core inflation, which ignores those pesky volatile food and energy prices, fell to 3.9% from 4.2%. The drop in the UK’s energy price cap helped, but a little rise in petrol prices kept things from cooling off too much.

Looking Ahead

The unexpected inflation readings have pretty much killed the chance of a June rate cut. August now looks like the start of the easing cycle, with inflation likely to hang around 2% for the rest of the year.

BOE Governor Andrew Bailey was optimistic about a big drop in April’s inflation but hadn’t seen the actual numbers. If the data stays strong, don’t hold your breath for summer rate cuts.