Thames (Under)Water

Hi this is ZipLaw! We explain how news stories impact law firms so you can stand out in your applications.

Are you new here? Get free emails to your inbox.

Here’s what we’re serving today:

- 🔋 Energy: Methane in Focus at COP28

- 📉 Insolvency: What's going on at Thames Water?

- 📰 Snippets: Spotify cuts staff

- 🔍 ZipTracker: Reed Smith lead on Tesco dispute

🔋 Energy

Methane in Focus at COP28

In Short

The Biden administration takes a bold step at the COP28 summit, finalizing tough new rules to curb methane emissions from the oil and gas industry.

What's the Big Announcement?

At the COP28 climate summit in Dubai, the Biden administration and the US Environmental Protection Agency (EPA) rolled out beefed-up mandates aimed at the oil and gas sector's methane emissions.

In simple terms, they require companies to:

- Fix Leaks: Companies must regularly inspect their oil and gas operations and repair any equipment that is leaking methane.

- Limit Gas Flaring: The mandates include a phased-in ban on routinely burning off (flaring) natural gas at oil wells, a process that can release methane into the atmosphere.

Why does this matter?

Methane is a strong greenhouse gas, significantly contributing to climate change. By enforcing these mandates to reduce methane emissions, the US hopes to reduce the environmental impact of the oil and gas industry, helping to slow down global warming and protect the environment.

The fact the US pushed this through is ALSO a big deal, because it will likely have ripple effects throughout the world. Here's why:

- Global Influence of US Policies: The United States is a major player in global energy markets and environmental policy. Their regulations can set important precedents and get other countries to follow suit.

- International Operations of Companies: Many oil and gas companies operate globally and their attempts to comply with comply with the US regulations could influence their practices in other countries, including adopting similar standards globally for consistency and efficiency.

- Supply Chain and Market Dynamics: The regulations may affect international supply chains and market dynamics. For example, increased costs or operational changes required to comply with the new US regulations could influence global prices and practices in the oil and gas industry.

- Investor and Consumer Pressure: There is growing global investor and consumer awareness and concern about environmental issues. Regulations in a major market like the US can increase expectations and pressure on companies in other markets to demonstrate their commitment to reducing emissions.

Other must-know news from COP28:

- 118 countries signed a pledge to triple global renewable energy capacity by 2030. A smaller group of 22 nations agreed to a separate goal of tripling nuclear energy capacity by 2050.

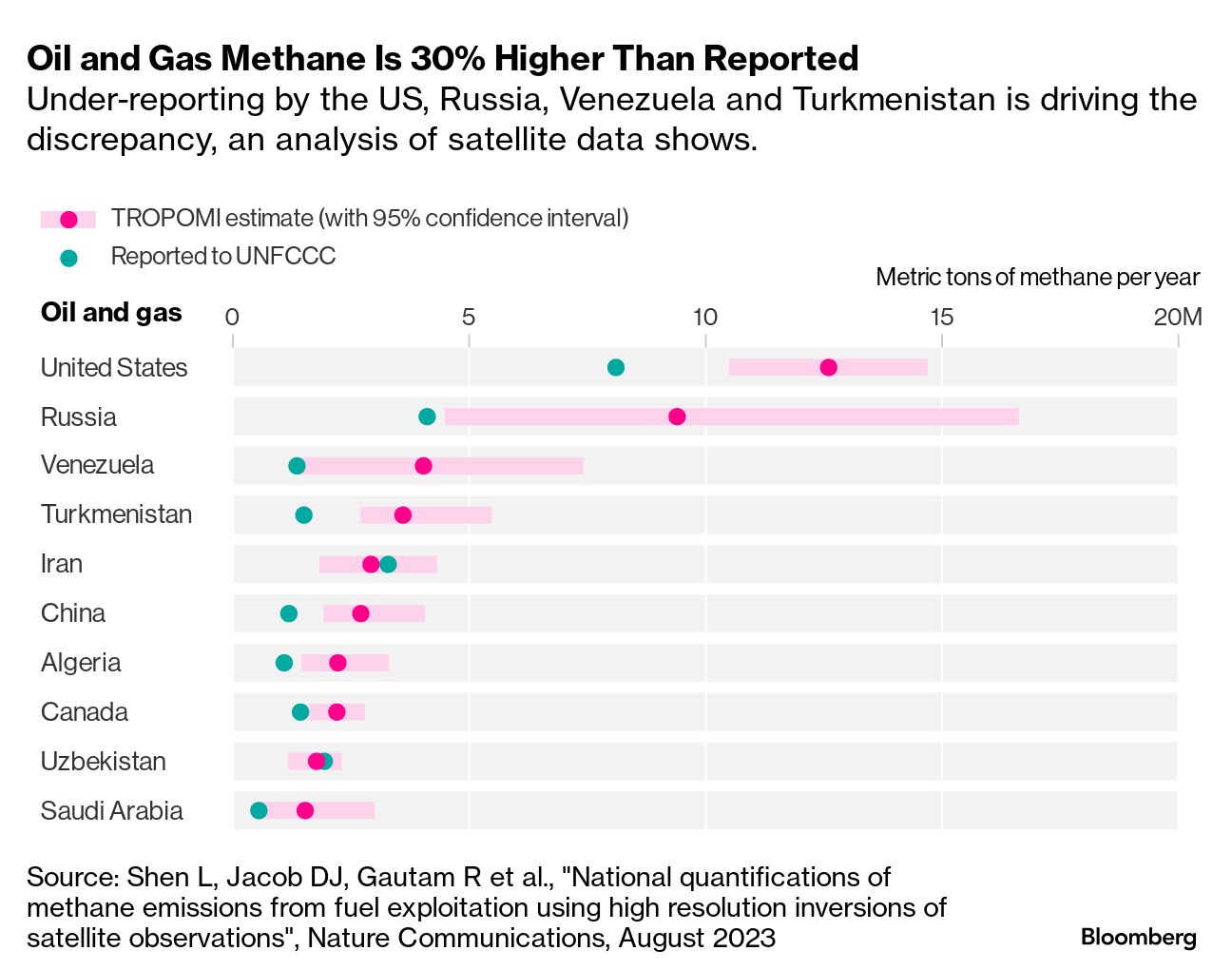

- The non-profit Climate Trace project released new data showing that countries have been dramatically under-reporting their greenhouse gas emissions

⚖️ How does this impact Law Firms?

Environmental Law:

- Regulatory Compliance and Advisory: Lawyers will be increasingly sought after to guide companies, especially in the oil and gas sector, through the maze of new methane regulations. This will involve interpreting the implications of the EPA's mandates, ensuring that UK-based companies operating internationally are in compliance. They will also provide strategic advice on how to adapt business practices to meet these new standards.

- Litigation and Dispute Resolution: With stricter regulations, there's potential for an uptick in disputes and litigation. Environmental lawyers will represent clients in cases involving non-compliance with methane emission regulations. This could range from defending against government enforcement actions to navigating disputes with environmental groups or third-party entities involved in methane monitoring.

Energy Law:

- Contractual Adjustments and Negotiations: Energy sector lawyers will be busy restructuring contracts and agreements to account for the new methane emission rules. This could involve negotiating terms that address liability for methane leaks, or ensuring new technology installations for methane monitoring are reflected in joint venture agreements and other contracts.

- Project Financing and Investment Advice: Lawyers in this field will advise on the financial implications of complying with the new methane emission regulations. This includes guiding investments in new technologies or infrastructures required to meet the standards, and advising on the potential financial risks and rewards of such investments.

Corporate and Commercial Law:

- M&A Due Diligence: In mergers and acquisitions involving energy companies, lawyers will perform enhanced due diligence to assess the target company's compliance with methane emission regulations. This includes evaluating any potential liabilities or risks associated with non-compliance.

- Corporate Strategy and Risk Management: Corporate lawyers will advise businesses on the broader implications of methane regulations on their operations and strategies. This could involve assessing and advising on risk management strategies to mitigate potential financial impacts due to regulatory changes.

📉 Insolvency

What's going on at Thames Water?

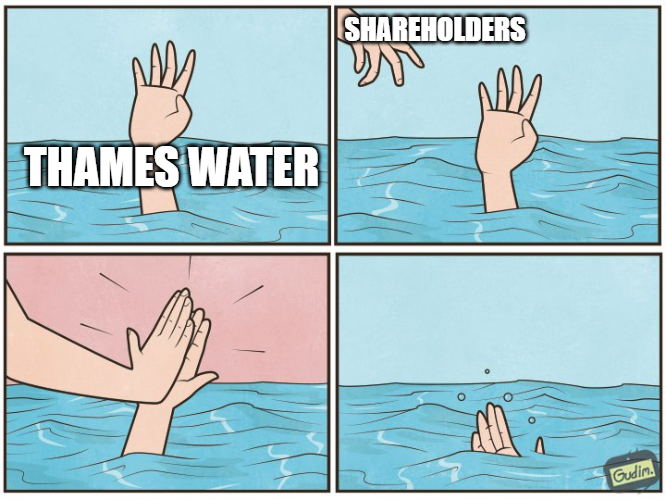

In Short: Thames Water's parent company might be on the brink of a financial drought, with auditors flagging a cash crisis unless shareholders pour in more funds.

What is Going On?

Auditors at PwC have raised the alarm: if the company doesn't get a cash infusion from shareholders, it might just tap out by April. And here's the kicker: there's a £190m loan in the mix with no plan for refinancing.

Now, Thames Water isn't just any company; it's the UK's largest water supplier, hydrating about 15 million homes. Amidst this, the UK government started sketching a 'what if' scenario for Thames Water's potential collapse, because let's face it, drowning in debt isn't a good look.

And there's more drama: Thames Water's CFO, Alastair Cochran, told MPs they got a £500m equity boost from their shareholders. But plot twist – it was actually a £515m loan, and not just any loan, but one with a spicy 8% interest rate!

The company insists it's financially stable, with a promise of £750m more in shareholder equity. But with a debt mountain high enough to ski down, it's like putting a Band-Aid on a broken dam. Will the shareholders step up, or will Thames Water be left high and dry?

⚖️ How does this impact Law Firms?

Corporate Finance:

- Debt Restructuring and Refinancing: Lawyers in this department will be crucial in advising Thames Water and its parent company, Kemble Water Holdings, on restructuring their significant debts. This will involve negotiating terms with creditors, drafting agreements for debt refinancing, and ensuring compliance with financial regulations.

- Equity Financing and Shareholder Agreements: The need for new equity injections suggests a potential increase in work related to drafting and negotiating terms of new equity investments. Lawyers will be instrumental in preparing shareholder agreements and advising on the legal implications of new equity financing, particularly in light of the company's existing debt structure.

Environmental Law:

- Regulatory Compliance: With the potential investigation into Thames Water's operations, environmental lawyers will be busy ensuring that the company is compliant with all environmental regulations. This includes advising on potential liabilities, conducting environmental audits, and representing the company in any regulatory proceedings.

- Risk Management and Advisory Services: Lawyers will provide strategic advice to Thames Water on managing environmental risks associated with their operations. This includes preparing for potential legal challenges related to environmental issues and advising on sustainable practices to mitigate future legal and reputational risks.

Insolvency and Restructuring:

- Insolvency Proceedings: If Thames Water's financial situation deteriorates, lawyers specializing in insolvency will be required to advise on potential insolvency proceedings. This includes navigating the complex legal and financial aspects of administration or liquidation processes and advising on the rights and obligations of all parties involved.

- Stakeholder Negotiations: These lawyers will also engage in negotiations with stakeholders, including creditors, employees, and suppliers, to manage the implications of any financial restructuring or insolvency. They will draft and review agreements and advise on the legal ramifications of various restructuring options.

Snippets

🎵 Spotify plans to trim its team, letting go of nearly 20% of its staff, as the company braces for a significant economic slowdown.

💸A Hong Kong court has postponed the Evergrande liquidation hearing, giving the real estate giant until next month to develop a restructuring strategy that pleases its creditors.

🛢️ Venezuelan citizens cast their votes in favor of claiming a resource-rich region in neighboring Guyana, known for its oil and minerals, in a recent referendum.

🇹🇷 Turkey continues to grapple with soaring inflation, which stayed above 60% in November, highlighting the long road ahead before the effects of the government's hefty interest rate hikes can be felt in the economy.

💰 Bitcoin's value surged to nearly $42,000 on Monday, indicating a potential rebound for the crypto market after a year marred by scandals and challenges.

🔍 ZipTracker

Tesco vs. Cloud Software Dispute

In Short: Tesco Stores settled with Cloud Software Operations, a U.S. intelligence software company, over a £85.8 million dispute regarding unpaid software fees and disputed software usage.

Case Background and Current Status:

Cloud Software sued Tesco in April 2022 for alleged contract breaches, claiming Tesco used more software units than permitted and owed £85.8 million in fees. Tesco countered, challenging the accuracy of Cloud Software's audit. The parties have now reached a confidential settlement, with proceedings paused following a Tomlin order.

Key Legal Points to discuss in applications & interviews:

- Contractual Obligations and Breach Analysis: The case underscores the importance of precise contractual terms regarding software usage and the implications of alleged breaches. Understanding how breaches are identified and quantified, especially in complex IT contracts, is critical.

- Audit Accuracy and Disputes: The role of third-party audits in contract disputes is highlighted here. The challenge by Tesco against the audit's methodology and findings points to the need for clear, transparent, and agreed-upon audit procedures in contracts.

- Settlement Dynamics and Confidentiality: The settlement, particularly with a Tomlin order, illustrates strategic decisions in litigation. Understanding why parties may choose to settle confidentially, and the implications of such settlements, is important for legal professionals.

Who is advising on this?

- Tesco: Nigel Tozzi QC and Matthew Lavy of 4 Pump Court, instructed by Tesco's legal department.

- Cloud Software: Lawrence Akka QC and Matthew McGhee of Twenty Essex, instructed by Reed Smith.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).