The Must-Know Private Equity Trend

Private equity is changing fast as giants like Blackstone and KKR fight to remain competitive with new products.

One trend is reshaping how the industry works and offers a huge opportunity for Law Firms.

First, what Is Private Equity?

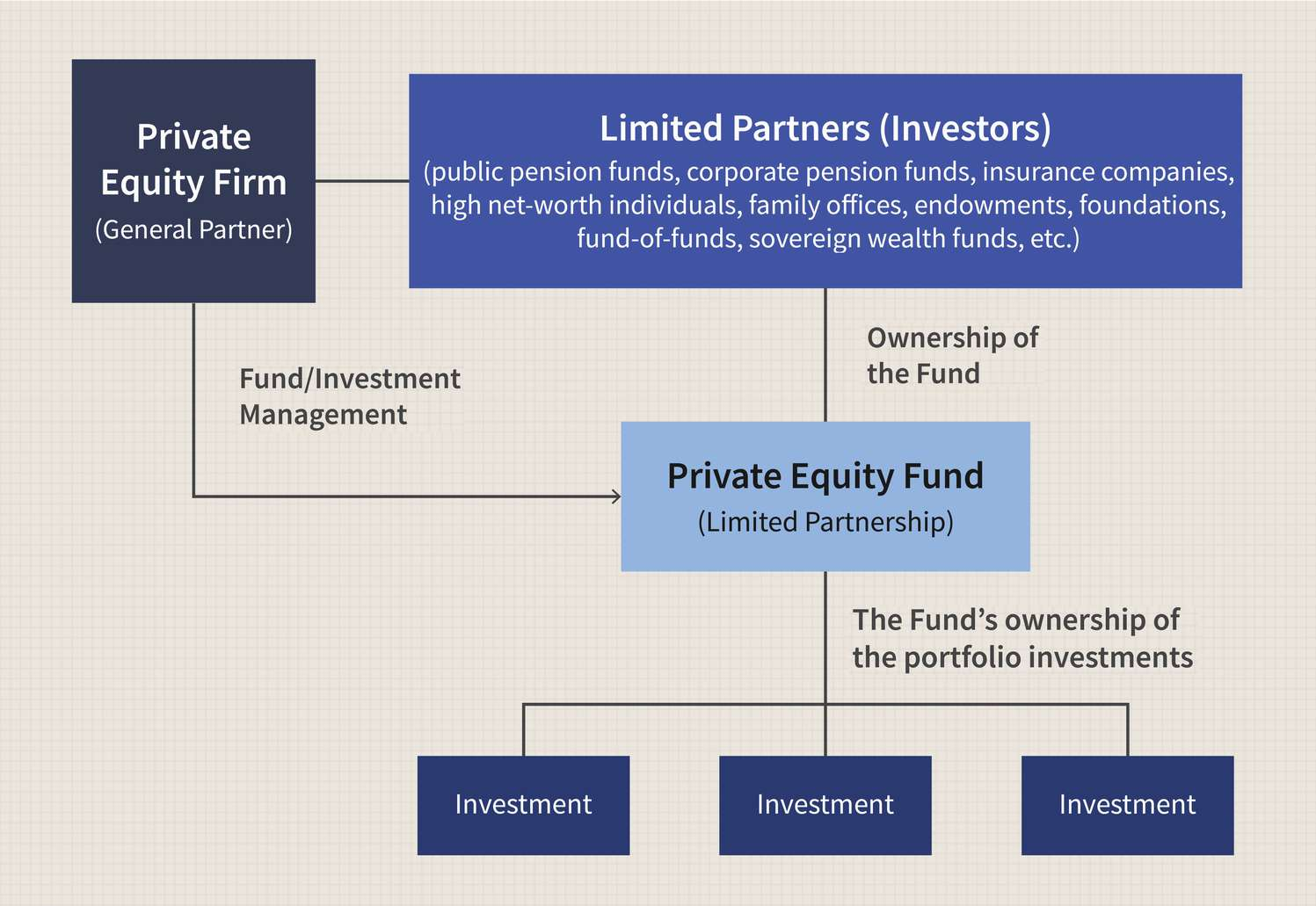

Private equity firms raise money from investors and use it to buy companies that are not listed on the stock market. They usually hold these businesses for several years, trying to improve them before selling them for a profit.

Because these investments are long-term and risky, private equity has traditionally been open only to large, sophisticated investors such as pension funds, insurance companies and governments. Ordinary individuals were largely excluded, and investors often had to commit their money for 10 years or more with no easy way to withdraw early.

This made private equity a powerful but highly exclusive part of the financial world.

Why Private Equity Is Moving into Retail

Investment from large institutions has slowed for a few key reasons:

- Many pension funds are already heavily invested in private equity and don't want to commit even more capital.

- Higher interest rates and market uncertainty have made long-term investments less attractive.

Problem is private equity firms need fresh capital to keep growing so they're now eyeing up retail investors and retirement savers, particularly in the US, as a huge alternative.

- Why? Recent regulatory changes have made it easier for private equity to be included in retirement accounts such as 401(k)s, unlocking access to a huge pool of long-term savings.

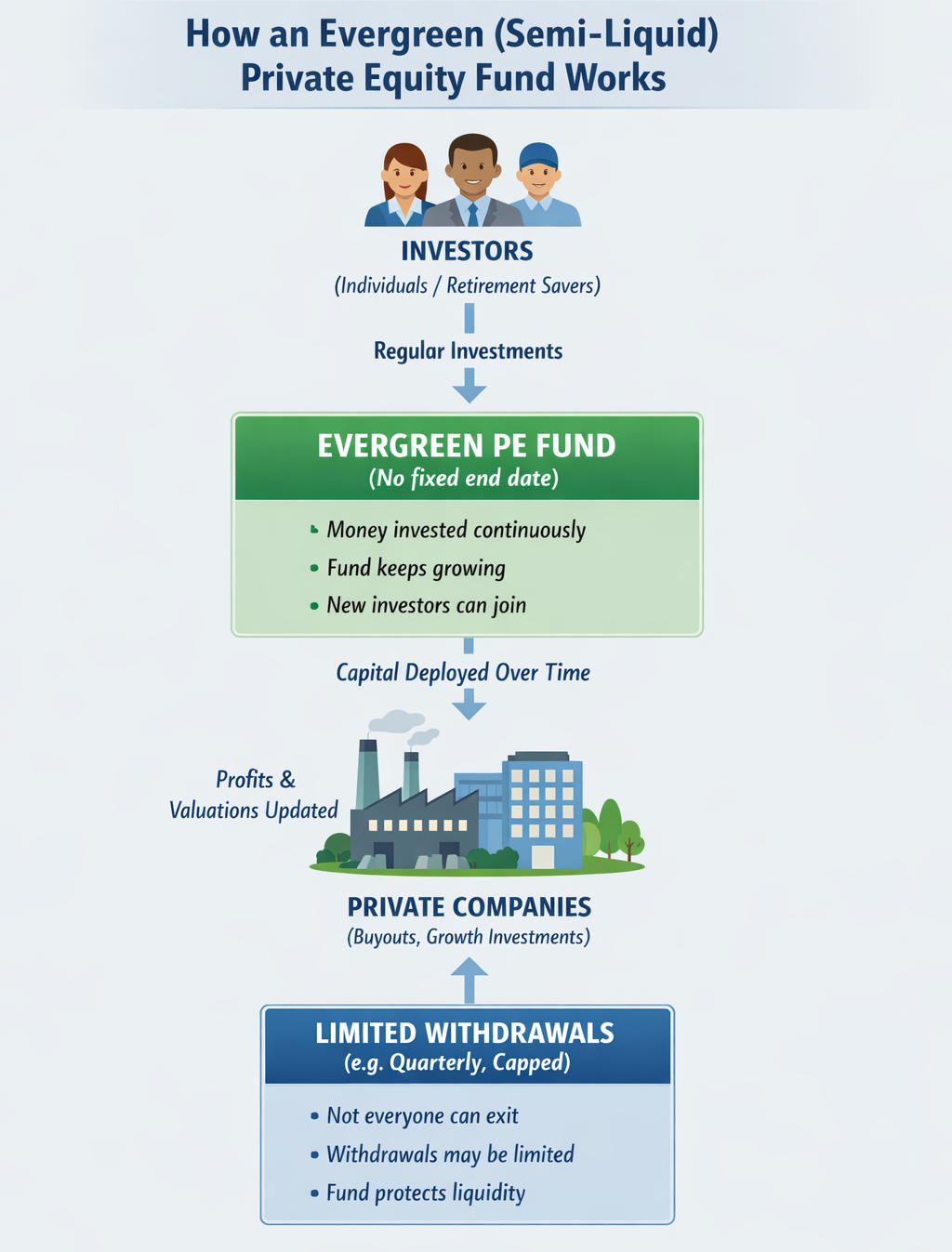

But private equity giants (think Blackstone, KKR etc.) realised they needed to offer something new to entice these investors and they launched “evergreen” or semi-liquid funds.

These are fancy terms for funds that allow investors to add money over time and, in some cases, withdraw it periodically, rather than locking it away for a decade. This makes private equity feel more accessible, even though the underlying investments remain complex and long-term.

Why does this matter?

Private equity’s move into retail signals a deeper change in how the industry operates.

Firms are no longer just competing quietly for pension fund money. They are now fighting for individual investors, where performance comparisons are more visible and investors can move their money if they are unhappy. That has increased competition, reduced fees, and put greater pressure on firms to deliver consistent returns.

In short, private equity is starting to behave less like an exclusive club and more like a mass-market financial business.

How does this impact Law Firms?

Join ZipLaw+ to continue reading