The Must-Know Trend

Hi this is ZipLaw, your golden buzzer newsletter.

Coming up:

🌱 ESG drama is a must-know trend

🤖 Why are US firms leaving China?

🍬 Ozempic is sugar's biggest threat

⚖️ Dentons, Eversheds feature in ZipTracker

Greenwash Crackdown

I often get asked what is the best story to discuss in an application or an interview. In most cases, this will largely depend on your interest.

However, the growing regulatory crackdown on greenwashing is one to keep an eye on if you want to impress law firms.

Wait, what's going on?

In short, the UK's Financial Conduct Authority (FCA) has rolled out some strict anti-greenwashing rules.

Greenwashing happens when a company claims their product is super eco-friendly, but in reality, it’s just a splash of green mixed into a lot of not-so-green practices.

It's a bit like buying a smoothie because the label says it's packed with healthy fruits and veggies. But when you read the fine print, you discover it’s mostly just sugary juice with a tiny splash of spinach.

The rules include things

- Transparency: Firms must ensure all green claims are backed by solid, verifiable evidence.

- Full Disclosure: Any marketing material, fund documentation, or website content must give an accurate representation of the product's sustainability.

- Continuous Monitoring: Firms need to regularly review and update the sustainability status of their products.

This has left banks and asset managers scrambling to check they are compliant and to do all they can to fix any issues.

This is one of the most important trends for you to be aware of right now.

👉 In this Deep Dive we discuss what it means for law firms and their clients so you can impress in interviews!

What happened this week?

- 🛢️ Energy Mega-Merger: ConocoPhillips is buying Marathon Oil for $22.5bn, and Hess shareholders approved a $53bn takeover by Chevron. The deals continue the trend of energy giants merging to cut costs and expand. Btw, is M&A back?! Sure seems like it.

- 🤖 Musk’s AI Success: Elon Musk’s AI venture, xAI, raised $6bn from prominent investors, positioning it as a strong competitor to OpenAI. xAI's chatbot, Grok, is integrated with Musk’s social media platform, X.

- 📬 Royal Mail Acquisition: Czech businessman Daniel Kretinsky’s holding company agreed to buy Britain’s Royal Mail for £5.3bn. Amid an election, Labour will scrutinize Kretinsky's promises to the postal-workers’ union and nationwide delivery costs.

- ⛏️ Failed Mining Deal: BHP’s attempt to acquire Anglo American fell through as Anglo rejected an extension for talks, deeming BHP’s offer unattractive, particularly due to concerns about BHP’s intentions for South African assets.

- 💰 China’s Semiconductor Fund: China launched a $47bn third phase of its state-backed semiconductor fund, supported by government departments and banks, following earlier phases in 2014 and 2019. Read our report here.

- 🛠️ Samsung Workers Strike: Samsung Electronics workers plan industrial action for the first time, demanding better pay and bonuses. The union threatens a full strike if demands aren't met, reflecting changing labor dynamics.

In Law Firm news

Bye China. US law firms are packing their bags and leaving China thanks to a slowdown in financial activity and some tricky business vibes. This is a very important trend to be aware of. Read our full report here.

- Dentons and Travers Smith face off as Sony's Columbia Pictures is suing Wanda Kids for $49 million, claiming the media company failed to pay for shares in Vampire Squid Productions it had agreed to buy.

- Eversheds Sutherland advised Heathrow Express who is is in the hot seat after rehashing breach of contract claims from ex-employees who say their lifelong travel perks were unfairly yanked after they were made redundant.

- Burges Salmon led a £100 million buy-in with the pension schemes of investment and wealth management company Rathbones Group PLC.

Japan Inc. is trapped

Japan Inc. is having a moment. After decades of economic blahs, Japanese companies are finally making bank. We're talking doubled profits, bigger dividends, and the Nikkei 225 index going up by 25% in the past year.

This success story is mostly thanks to Japanese firms going global, especially in the US and China.

- But here's the twist: the US and China are not exactly on friendly terms these days. And that’s putting Japanese businesses in a bit of a pickle. They're being forced to pick sides, and that’s no fun.

Find out what this means for law firms in our report.

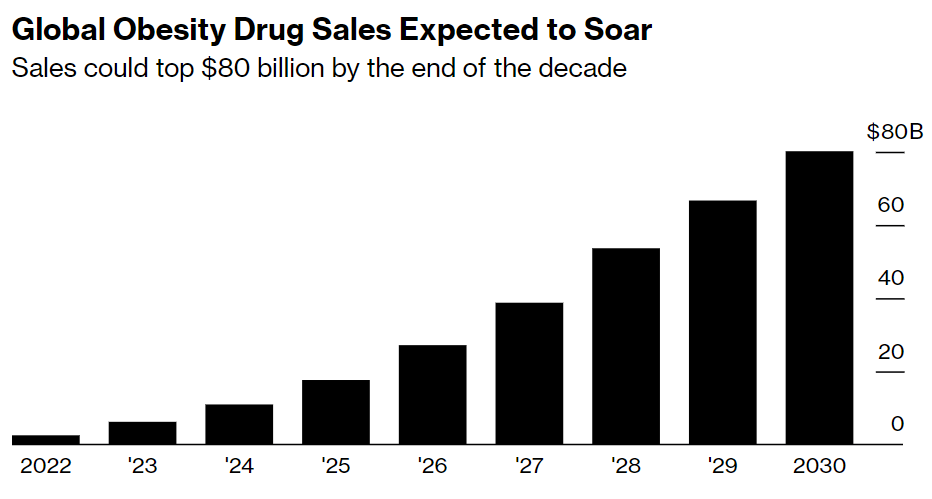

📊 Chart Watch

Ozempic v Sugar

Major retailers like Walmart have already noticed that drugs like Ozempic are hitting food sales. Experts predict these meds could cut US calorie consumption by up to 2.5% by 2035. The real sweet spot? We might see up to a 5% drop in the consumption of baked goods, candies, and soda.

But retailers are not panicking just yet. Why? For one, shifts in demand are still peanuts compared to the rollercoaster of production changes. Plus, sugar is still on the rise in emerging markets, buying some time before the impact hits home.

However, with global obesity drug sales possibly soaring past $80 billion by the end of the decade, sugar traders might want to start paying attention.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here)