This Hidden Trend is reshaping the PE market

We love hidden trends because they’re gold dust in law firm applications. And we’ve spotted one that’s quietly reshaping the market.

Welcome to the world of private credit — where a deal trend is flying under the radar.

Today, we break down what it is and why law firms are paying close attention.

What’s actually happening?

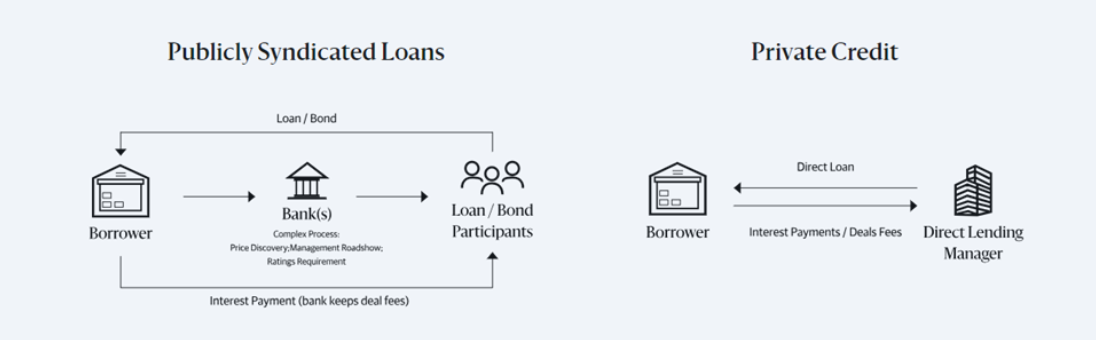

Private credit firms lend money to companies, often those owned by private equity (PE). Normally, those loans are repaid when the PE fund exits the business — through a sale, IPO, or refinancing.

But exits have dried up.

So instead of waiting years for repayment, credit managers are doing “continuation deals.” That means:

- The manager sets up a new fund (a continuation vehicle)

- That new fund buys loans from the old fund

- Cash is returned to the original investors

- The same assets keep ticking along in a new structure

In 2025, these continuation deals hit $15bn globally, up from under $4bn the year before. That’s not a blip — that’s a structural shift.

💡What's a private credit firm? Think of a private credit firm as a lender that sits outside the traditional banking system. Instead of a high-street bank or investment bank providing loans, private credit firms raise money from investors (like pension funds, insurers and sovereign wealth funds) and use that capital to lend directly to companies, often in bespoke, privately negotiated deals.

Why are firms doing this now?

Join ZipLaw+ to continue reading