Trade Deals

Hi ZipLawyer! Here's all the news you need to know from last week plus what to look out for this week.

US-UK Trade Deal

President Trump and Prime Minister Keir Starmer have agreed a UK-US trade framework aimed at easing tensions and boosting market access. While many details remain in flux, the deal offers targeted tariff relief and cooperation on future sectors—marking the first major pact under Trump’s new tariff regime.

Key Agreed Points:

- 🇺🇸 US gains: Easier access for American agriculture, chemicals, energy, and industrial goods, including a tariff-free quota of 13,000 metric tons of beef

- 🇬🇧 UK gains: Reduced tariffs on autos (10%), steel, and aluminium, allowing up to 100,000 cars/year at the lower rate

- 🤝 Joint commitments: Negotiations to begin on digital trade, pharmaceuticals, and high-tech cooperation in areas like AI, quantum computing, and aerospace

OpenAI and Microsoft Rewrite Partnership

OpenAI and Microsoft are renegotiating the terms of their multibillion-dollar partnership as the AI company prepares for a major corporate restructuring aimed at allowing a future IPO. The talks could reshape how OpenAI operates, moving it further from its non-profit roots while ensuring Microsoft still gets access to its cutting-edge AI models, like those behind ChatGPT.

- A key issue is how much equity Microsoft receives in exchange for its $13bn+ investment. Microsoft may give up some of its ownership in return for extended access to future OpenAI tech beyond their current deal, which runs to 2030.

OpenAI plans to become a public benefit corporation (PBC) — a for-profit entity with a social mission — similar to rivals Anthropic and xAI. But the shift has sparked criticism, including from Elon Musk, who argues it puts profit ahead of public good.

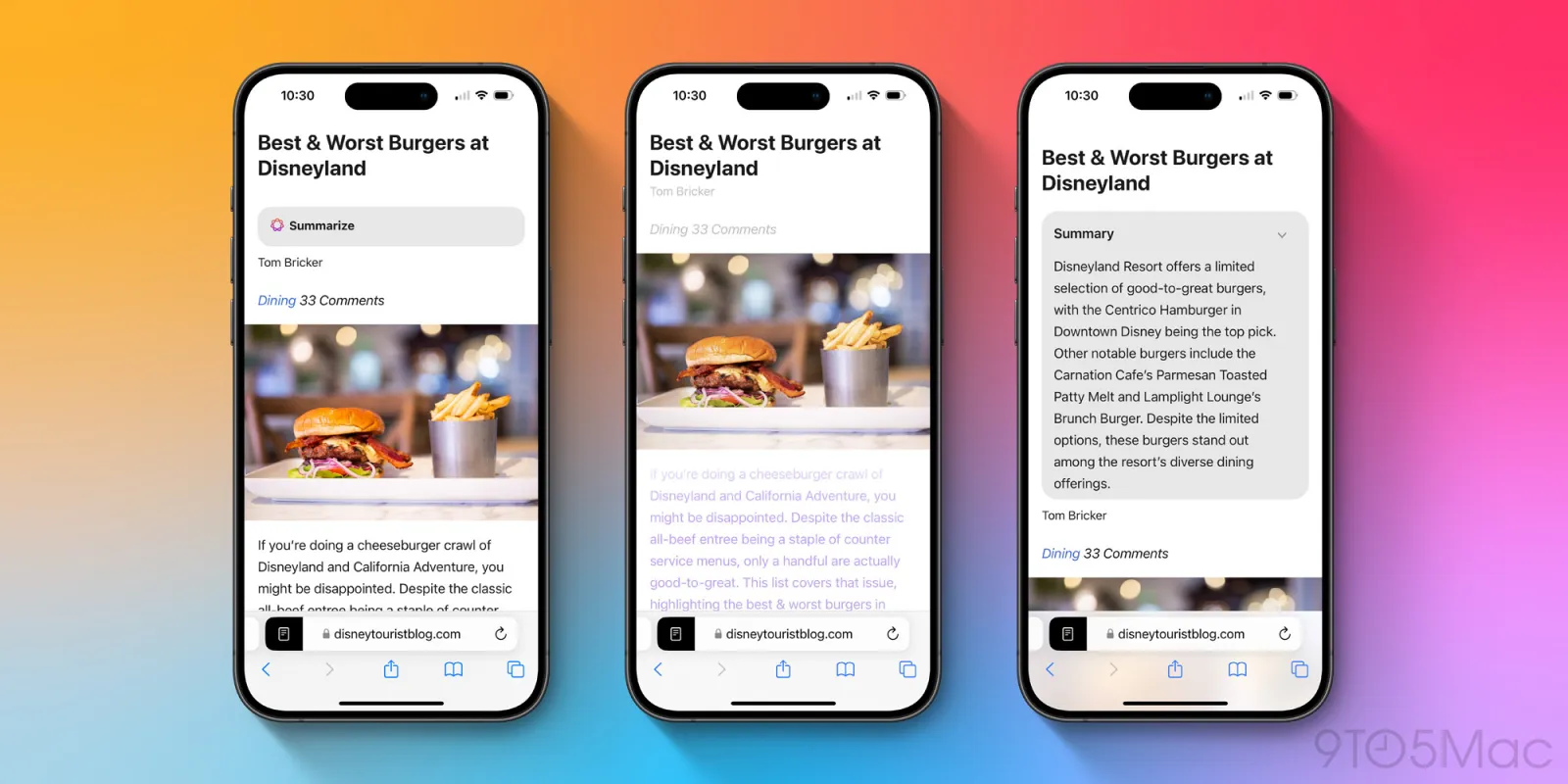

Apple Eyes AI Search

Apple is exploring a major shake-up of Safari, its web browser, by shifting focus to AI-powered search engines—a move that could end its $20 billion-a-year partnership with Google. The disclosure came from Eddy Cue, Apple’s services chief, during a U.S. antitrust trial against Google. Apple currently makes Google the default search engine on its devices, but AI alternatives like ChatGPT, Perplexity, and Anthropic are gaining traction.

Cue said Apple has had talks with several AI providers and may add more to Safari—though they likely won’t become the default just yet. He admitted Google's deal still offers the best financial return, but AI’s rapid progress means change is coming.

Tesla Falls

Tesla saw a dramatic fall in car sales across Europe in April: down 46% in Germany, 50% in France, and 62% in the UK. The decline suggests growing competition from local electric vehicle (EV) makers and possibly a shift in consumer attitudes towards Tesla’s brand.

At the same time, Foxconn, the Taiwanese company famous for assembling iPhones, is entering the EV market. It has partnered with Mitsubishi to develop electric cars through its Foxtron subsidiary, with production planned in Taiwan and initial sales in Australia and New Zealand. Foxconn is also in talks with Nissan, hinting at a larger push into the car industry. As EV demand rises worldwide, more tech firms are joining the race, but the market is becoming crowded.

Like our roundup? Join ZipLaw+ to get one like this every day of the week!

Interest Rates Roundup

The Federal Reserve kept interest rates unchanged at 4.25%–4.5% for the third time in a row, saying it’s still worried about both inflation (rising prices) and unemployment. The situation has been made more uncertain by President Trump’s tariffs, which are disrupting global trade. Despite a strong U.S. job market in April, Trump is publicly pressuring Fed Chair Jerome Powell to lower rates—calling him a “total stiff.”

- Around the world: Other central banks are already loosening policy. China cut its main interest rate to 1.4% and eased lending rules to pump more money into its economy ahead of key trade talks with the U.S. The Bank of England also lowered its rate slightly, even though UK inflation is expected to rise due to higher energy bills.

Worth Knowing

🎢 Disney beat expectations with strong streaming and theme park revenue, led by Disney+ and Hulu. The company also unveiled plans for a new Abu Dhabi theme park—its first in the Middle East—highlighting a push for global expansion. With films underperforming, streaming and parks are keeping profits afloat as Disney competes with Netflix and Amazon.

🌬️ Orsted, the world’s largest developer of offshore wind farms, has cancelled its Hornsea 4 project off the coast of Yorkshire. The project was supposed to provide electricity to 1 million UK homes and play a big role in meeting Britain’s net-zero emissions target by 2030. But rising costs, supply chain delays, and planning challenges made it unworkable "in its current form."

🤝 India and Pakistan have agreed to an immediate ceasefire, ending their worst military clash in over 20 years. U.S. President Donald Trump took credit for brokering the deal, announcing on Truth Social that a U.S.-mediated agreement was reached after a long night of talks.

Unlock 400+ cases, deals, news about your favourite law firms to impress in applications and ACs!

➡️ Week Ahead

Monday: EU finance ministers meet in Brussels; Canada unveils new cabinet led by Mark Carney

Why it matters: EU fiscal talks shape bloc-wide spending, debt, and reform policy—critical for law firms advising multinationals. Canada’s new leadership will influence trade, energy policy, and North American diplomacy.

Tuesday: Trump visits Saudi Arabia, Qatar and UAE; US and India report CPI; UK jobs data; SoftBank earnings

Why it matters: Trump’s Middle East trip could reshape foreign policy and defence deals; CPI data sets the tone for interest rates; UK jobs figures give a snapshot of labour market health; SoftBank earnings reveal sentiment in tech and venture capital.

Wednesday: Inflation reports from Germany, Spain, Japan and Argentina; NATO ministerial meeting in Turkey; Tencent earnings

Why it matters: Inflation prints test central bank strategies in major economies; NATO’s gathering may shift defence spending and security policy; Tencent earnings shed light on China’s tech and gaming ecosystem amid regulatory scrutiny.

Thursday: US retail sales; UK GDP figures; Mexico central bank expected to cut 50bps; Walmart and Alibaba earnings

Why it matters: Consumer spending and GDP data are key to recession fears; a Mexican rate cut signals monetary easing in emerging markets; retail earnings show how consumers are reacting to inflation and digital shifts.

Friday: Japan and Russia report GDP

Why it matters: Economic growth data from these major players influence global forecasts and commodity markets—especially with Russia under sanctions and Japan navigating sluggish growth.

Term of the Week

A Takeover Premium is the extra amount a buyer offers over a company's current market price to entice shareholders to sell. It's like offering your friend £2 for a £1.50 chocolate bar because you really want it. This premium compensates shareholders for giving up future potential gains and reflects the buyer's eagerness to acquire the company.

- 👀 See it in practice: U.S. food delivery giant DoorDash announced a £2.9 billion takeover of UK-based Deliveroo. DoorDash is offering 180 pence per share, which is a 29% premium over Deliveroo's previous share price of 140p. This generous offer aims to secure shareholder approval and expand DoorDash's footprint into the UK and Europe.

🙋 Did you find this helpful? If so, please let us know by voting below!