Unite the Minerals

I'm Ludo Lugnani and this is Ziplaw: an independent newsletter explaining how news stories impact law firms so you can stand out in applications.

Are you new here? Get free emails to your inbox.

Today's read: 8 minutes

Zipmemo

- 🇪🇺 EU's Targeted Sanctions: The EU's eyeing sanctions on three Chinese and one Indian company over their cozy ties with Russia. If the member states give it the thumbs up, it'll be a first for businesses in China and India.

- 🏢 Latham & Watkins' Strategy Shift: Latham & Watkins is dialling back on its Hong Kong lawyers' access to international data, thanks to Beijing's tighter grip. It's a sign of changing times, treating Hong Kong more like the mainland.

- 🚢 Russia's Oil Tanker Troubles: Since the US imposed sanctions on October 10, a significant portion of Russia's oil tanker fleet has been immobilized, with about 25 of the 50 targeted vessels unable to engage in cargo operations.

- 📦 Yodel's New Chapter: The Barclay family is on the verge of transferring ownership of Yodel to a new consortium, led by the founder of Shift, to steer clear of potential administration.

- 🏎️ Aston Martin's Roadblock: Aston Martin's at a crossroads, chatting with bankers to dodge a debt disaster. They're eyeing their first operating profit in six years while juggling a hefty debt load.

Today's story

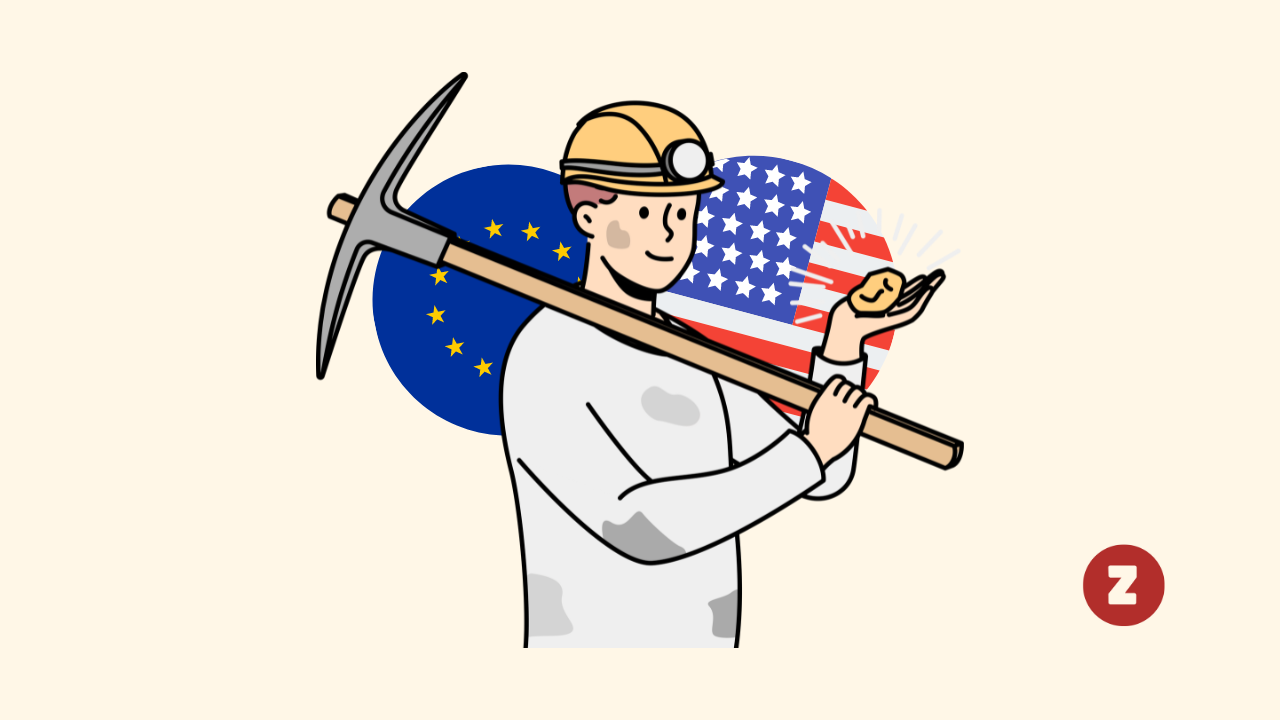

The US and EU are considering joining forces in their efforts to secure critical minerals to strengthen their position against China's dominance in the sector.

What’s going on?

Imagine the US and EU as two superheroes contemplating a team-up to tackle a common foe: China's stronghold on critical minerals. These minerals are the unsung heroes behind your favourite tech gadgets, electric cars, and green technologies. The plan? Blend the EU's broad policy strokes with the US's project-specific approach into a powerhouse alliance, tentatively dubbed the “minerals security partnership forum.”

The backstory here involves a bit of a plot twist. The EU had its sights set on unveiling its own initiative, but plans got shelved, prompting this potential blockbuster collaboration. The idea is to streamline efforts, ensuring the dynamic duo speaks with one voice to countries sitting on these precious resources. Their mission? To establish a more diversified, less China-dependent supply chain for minerals that are literally the building blocks of a sustainable future.

Why does it matter?

The US and EU are essentially trying to rewrite the rulebook on how the world accesses and uses these critical resources. By setting new standards on investment, trade, and environmental practices, they're hoping to offer a compelling alternative to China's way of doing business.

However, it's not all smooth sailing. Developing new mining and refining projects is a marathon, not a sprint, fraught with financial, environmental, and political hurdles. Plus, there's a recognition that replacing China's central role in the mineral markets is a tall order, if not impossible, in the near term.

As the US and EU gear up to possibly unveil their united front in March, all eyes will be on how this alliance shapes the future landscape of critical minerals. The potential implications are huge, from boosting green tech innovation to reshaping geopolitical alliances.

How does this impact Law Firms' clients?

Clients most affected by this development will include multinational corporations, particularly those in the technology, automotive, and renewable energy sectors that rely heavily on critical minerals for manufacturing. Mining and natural resource companies, as well as investors and financial institutions with stakes in the green energy transition, will be significantly impacted.

Opportunities: This collaboration presents significant opportunities, particularly for renewable energy and technology sectors, by potentially opening up new markets and investment channels. Companies might leverage increased Western investment and favourable regulatory landscapes to diversify supply chains and forge strategic partnerships in compliant regions.

Challenges: Clients will face challenges related to complex compliance requirements and geopolitical risks. The evolving regulatory framework will demand compliance with new international standards, encompassing environmental and employment practices. Additionally, geopolitical tensions and supply chain dependencies on China introduce risks that companies must manage proactively.

How does this impact Law Firms?

International Trade and Investment:

- Negotiating and Drafting Agreements: Lawyers in this department will be instrumental in structuring, negotiating, and drafting complex international agreements between the US, EU, and resource-rich nations. These agreements will encompass a range of critical issues, including investment, trade, environmental standards, and employment rights, tailored to the unique demands of the critical minerals sector. Lawyers will ensure these agreements comply with international law and protect the interests of their clients, whether they are governmental entities or private sector investors.

- Regulatory Compliance and Due Diligence: Legal experts will guide clients through the labyrinth of regulatory requirements related to international trade and investment in critical minerals. This includes conducting thorough due diligence on potential projects to identify legal, environmental, and geopolitical risks. Lawyers will also advise on compliance with both home country regulations and the legal frameworks of host countries, ensuring that investments are not only profitable but also sustainable and ethical.

Environmental and Energy Law:

- Environmental Impact Assessments: As projects related to critical minerals often have significant environmental implications, lawyers will be heavily involved in conducting and reviewing Environmental Impact Assessments (EIAs). They will ensure that mining and refining projects meet stringent environmental standards and advise on mitigating any adverse effects, thereby facilitating regulatory approvals and safeguarding against legal challenges.

- Renewable Energy Project Development: Given the critical role of minerals in green technologies, lawyers in this department will also see increased demand for their expertise in renewable energy project development. This includes advising on regulatory compliance, securing permits, negotiating supply chain agreements for critical minerals, and addressing any legal issues that arise during project implementation, from land acquisition to operational phase.

Corporate and Commercial Law:

- Joint Ventures and Strategic Alliances: Lawyers will play a pivotal role in structuring and negotiating joint ventures and strategic alliances between Western companies and local entities in resource-rich countries. This involves drafting detailed agreements that cover equity arrangements, governance structures, profit-sharing, and dispute resolution mechanisms, ensuring that such collaborations are mutually beneficial and compliant with local and international laws.

- Intellectual Property Protection: As these partnerships and projects will likely involve significant technological innovation and know-how, particularly in the extraction and processing of critical minerals, there will be a substantial need for legal expertise in protecting intellectual property rights. Lawyers will assist in patent filings, trade secret protections, and drafting non-disclosure agreements to safeguard proprietary technologies and processes involved in the critical minerals supply chain.

One thing that caught my eye

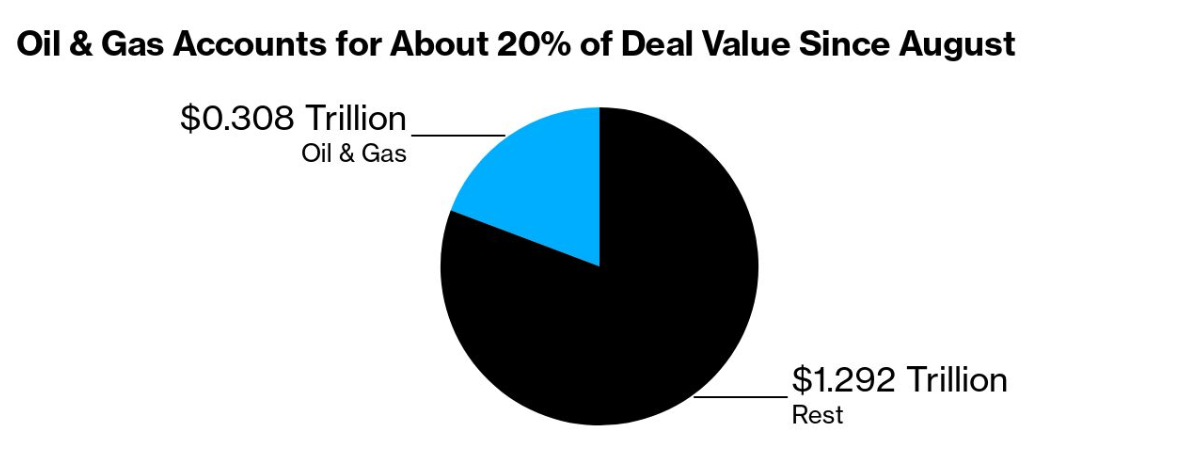

Despite the global M&A scene hitting a bit of a rough patch, the oil and gas industry is buzzing with activity. Over recent months, the industry has been posting some eye-popping numbers, with deals in the oil and gas sector making up a cool 20% of global deal value since last August. That's pretty impressive, right?

A big chunk of this action is happening in the U.S., especially in the Permian Basin. This area is pretty much the heart of U.S. oil production, stretching under Texas and New Mexico. It's where Diamondback Energy recently made waves by snapping up Endeavor Energy Resources for a whopping $26 billion, creating a Permian powerhouse.

Why the Permian, you ask? Well, it turns out drilling there is kinder on the wallet compared to other spots. This has set off a frenzy of mega-deals, with big names like Exxon Mobil and Chevron leading the charge with their own billion-dollar dances.

Despite all the talk about moving away from fossil fuels, the demand for oil isn't dipping. It's actually expected to climb through the 2030s. With the big players pretty much set, the action is likely to move to the smaller and mid-sized companies. Just look at Occidental, which recently forked out over $10 billion for CrownRock.

And get this – 2023 was the third biggest year for oil and gas M&A, and 2024 is already looking over 300% better year-on-year. It's safe to say, it's a pretty exciting time for energy dealmakers!

Zipmemes

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).