Weekend Memo: Streaming War

Welcome to our Weekend Memo! Here's all the news you need to know from this past week.

🎬 Paramount-Netflix battle

🤖 Trump's Nvidia chip deal

✈️ Boeing to win order race

🚀 SpaceX targets 2026 IPO

🧑💻 Linklaters leads on Microsoft dispute

🗺️ Latham, Travers on software bid

💳 Ashurst, CC, Weil on payments deal

Top 3 News of the Week

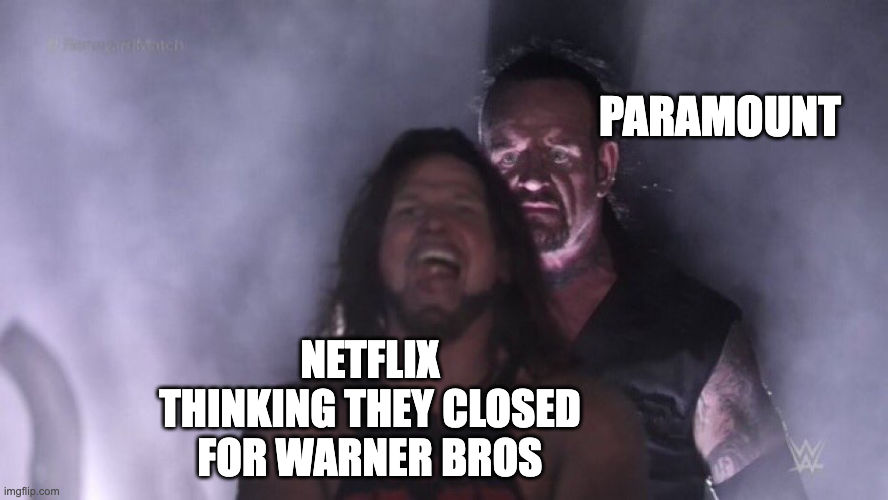

🎬 Hollywood just entered full Hunger Games mode. Netflix kicked off a friendly $83bn bid for Warner Bros Discovery — only for Paramount to storm in with a hostile $108bn offer for the whole company. Trump immediately hinted he might block Netflix’s deal on antitrust grounds. Paramount’s owner, David Ellison (backed by dad Larry Ellison of Oracle), reportedly phoned Trump right after Netflix’s announcement. Paramount had long been the favourite Warner Bros comes with Harry Potter, DC films, HBO shows, the works.

🌏 China’s annual trade surplus smashed past $1 trillion for the first time, hitting $1.1tn in the first 11 months of 2025. China’s exports to the US collapsed thanks to tariffs, but Beijing simply shifted its customers especially toward the EU, where exports jumped.

🤖 Trump says he’ll let Nvidia sell its H200 chips in China if the US government gets a 25% cut of the revenue (zero details provided, obviously). The H200 is older tech than Nvidia’s Blackwell and Rubin chips, so Beijing isn’t too excited anyway. Chinese officials are now discussing how to reduce dependence on Nvidia altogether by pushing domestic semiconductor development.

Sector Focus

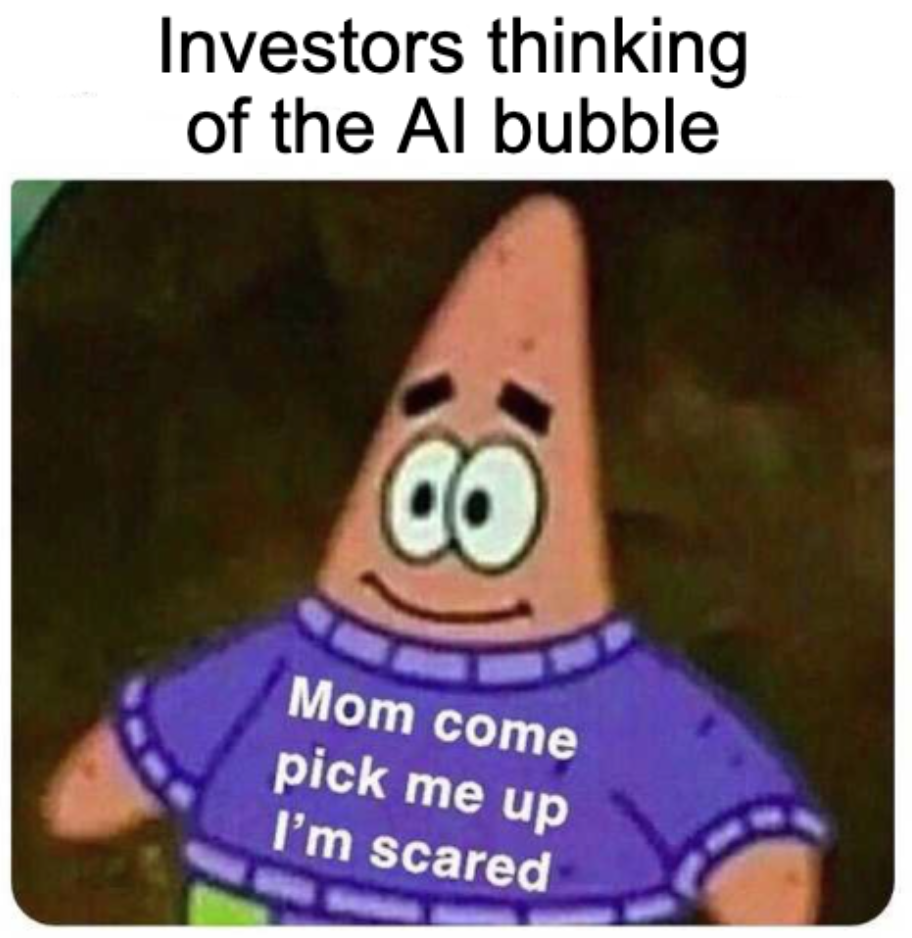

💻 Tech: Oracle scared Wall Street after reporting weak guidance for the quarter and announcing it will add another $15bn in data-center spending. Investors love AI growth but they’re getting nervous about how much cash big tech is burning to keep up (that's why you keep hearing about the risk of an AI bubble). Oracle’s miss reignited fears that the AI boom may not be boosting profits fast enough to justify the investment frenzy.

💸 Finance: The Federal Reserve cut rates by 0.25 percentage points to 3.5%–3.75%, exposing a split inside the bank: some want cuts to support the weak labour market, others want to stay tight to finish off inflation. It’s probably the last Fed meeting before Trump picks a successor to Jerome Powell. Rumour says he favours Kevin Hassett. Expect markets to get jittery — Fed chairs matter a lot.

🔋 Energy: A federal judge struck down Trump’s ban on new wind-power projects, calling the order “arbitrary” and lacking any valid justification. It’s a big win for the wind industry, though Biden-era clean-energy incentives are gone and the overall political environment is still hostile. Courts can protect projects but they can’t force Trump to like turbines.

Quick News

🛫 India ordered IndiGo, its biggest airline, to cut 10% of flights to stabilise operations after mass cancellations caused by a pilot shortage. The government even relaxed new rest-time rules specifically for IndiGo — infuriating the pilots’ union. It’s a messy look for an airline that normally dominates India’s skies.

✈️ Airbus CEO Guillaume Faury admitted Boeing will likely beat Airbus in aircraft orders this year for the first time in six years. Boeing’s comeback is powered by huge demand for its 787 jet and… Trump’s help in trade politics. Airbus still leads in deliveries, but Boeing now has momentum again.

🥤 PepsiCo struck a deal with activist hedge fund Elliott Management, agreeing to cut costs and lift margins to avoid a brutal proxy fight. Elliott won’t take a board seat, meaning Pepsi gets to keep control — but with a very loud, very watchful investor breathing down its neck.

🚀 SpaceX is planning an IPO as early as the second half of 2026, aiming to raise at least $25bn — one of the biggest listings ever. The timing may shift, but if it goes ahead, it will be the most-watched IPO in years. Space + hype + Musk = markets will lose their minds.

Law Firm News

Join ZipLaw+ to continue reading