Weekly Memo: Budget Drama and Tech Jitters

It's the weekend and the last thing you wanna do is go back and read up on all the news you need to know to impress law firms.

Dw - that's what we're here for thanks to our weekly news memo.

Today we're covering budget and stock market drama, the record US shutdown, Paul Hastings' Tax Rebuild and more. Enjoy!

What happened? The UK’s Prime Minister and Chancellor were planning to raise income tax rates, but at the last minute, they decided not to go ahead with it. This major change happened just before an important Budget announcement.

Why did they change? They reversed their decision because they were worried about upsetting voters and causing more disagreements with their own party members. Raising income tax was seen as risky and unpopular.

How did the market react? Investors were surprised and unhappy about this sudden change, which led to a sharp fall in the value of UK government bonds (gilts) and a brief drop in the value of the pound. Markets like clear and stable plans, so this “U-turn” made them nervous.

What will they do now? The government still needs more money, so instead of raising tax rates, they are looking at other ways. This could include lowering the income level where higher tax rates start (so more people pay higher rates), freezing those thresholds for longer, and creating several smaller, specific tax increases, like new gambling taxes and higher property taxes.

Why does this matter? Lots of smaller tax increases might not be as good for economic growth, and it could make the government look less reliable to investors and experts. Some people think the government is focusing more on staying popular than on making strong financial decisions. All this is happening while there is political drama and uncertainty around the leadership of the Prime Minister.

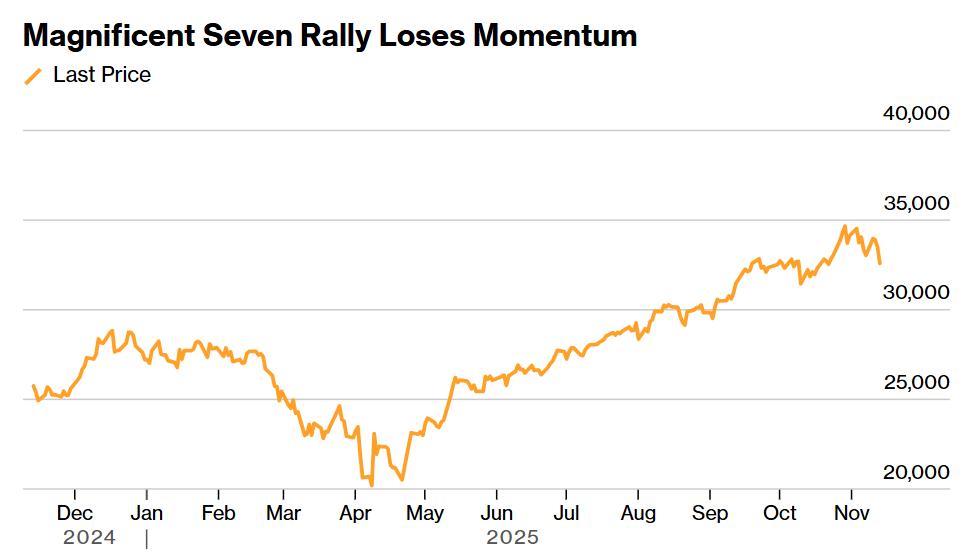

📊 Capital Markets

Market drops on tech jitters

Another big story this week was the stock market drop.

The culprit is a cocktail of rising costs, shaky confidence, and AI anxiety. Big tech firms have been announcing eye-watering jumps in their AI spending — think billions poured into chips, data centres, and infrastructure. Investors love the AI story, but they’re starting to worry about the bill. When companies ramp up spending faster than earnings grow, markets get jittery.

At the same time, SoftBank’s surprise sale of its Nvidia stake spooked traders who saw it as a vote of no confidence in the AI boom’s most inflated valuations. That added fuel to a broader sell-off in US tech stocks, dragging indices like the NASDAQ down by around 3% over the week. Add in weak economic signals from the UK and Europe — stagnant growth, rising unemployment, sluggish demand — and you get a market suddenly questioning whether valuations have run too far ahead of reality.

💡 Did you know? The "Magnificent Seven" refers to a group of seven huge tech companies in the US stock market Apple, Microsoft, Alphabet (Google's parent company), Amazon, Nvidia, Meta Platforms (Facebook's parent company) and Tesla.

Longest-ever US shutdown

What happened? The US government had a shutdown that lasted 43 days—the longest ever. This meant many government services stopped working and hundreds of thousands of federal workers didn't get paid.

Why did it happen? The shutdown was caused by a disagreement in Congress over what the government should spend money on, especially about healthcare tax credits. Both the Republican and Democratic parties blamed each other for causing the shutdown.

How did it end? President Trump signed a bill to fund the government and end the shutdown. The bill passed through Congress with a close vote. Most Republicans and just a few Democrats (mainly in districts that support Trump) voted for it.

Now what? Government offices and services will reopen. Federal workers who didn’t get paid during the shutdown will now receive back pay. Services like welfare payments and air travel (which was heavily disrupted) will start working normally again.

🤖 Tech

More AI, less iPhones

Foxconn’s pivot toward the AI gold rush is paying off. For the second consecutive quarter, revenues from AI servers and data-centre equipment surpassed its traditional consumer-electronics segment, including iPhone assembly. The shift underscores how rapidly demand for AI infrastructure is reshaping global supply chains. The company teased an upcoming deal with OpenAI, hinting at deeper integration into the AI hardware ecosystem. The moment marks a strategic transformation for one of the world’s most important manufacturers — less reliant on consumer cycles, more embedded in the backbone of AI computing.

🧬 Life Sciences

Pfizer wins $10bn bidding war

The race for dominance in the weight-loss drug market escalated dramatically as Pfizer outbid Novo Nordisk to acquire Metsera for up to $10bn. The process briefly spilled into court when Pfizer attempted to block Novo’s rival offer, though judges refused to intervene. Metsera criticised the litigation as “nonsense” but ultimately sided with Pfizer, citing concerns that Novo’s proposal risked antitrust complications. The deal underscores the incredible value now flowing into obesity treatments, an industry reshaping global pharma pipelines and competition dynamics as demand for GLP-1-style drugs explodes.

⚖️ Law

BHP liable In £36B Brazil Dam Collapse Case

A High Court judge has ruled that BHP is liable in the £36 billion group claim over the 2015 Fundão Dam collapse in Brazil, marking a major victory for more than 640,000 claimants. Pogust Goodhead, instructing counsel from One Essex Court, Twenty Essex, Temple Garden Chambers, Cornerstone Barristers, Serle Court, Essex Court, and Blackstone Chambers, successfully argued that BHP was strictly liable under Brazilian environmental law and at fault for continuing to raise the dam despite known structural risks. Slaughter and May, instructing barristers from One Essex Court and Blackstone Chambers, defended BHP, which intends to appeal. A compensation trial is set for October 2026.

Paul Hastings' Tax Rebuild

The US firm has hired Jenny Doak from Weil Gotshal and Catherine Richardson from Cadwalader to strengthen its London tax team. The hires follow the departure of global tax heads Arun Birla and Jiten Tank to White & Case, signalling an intense lateral battle among US firms in the City. Doak brings heavyweight experience in M&A and capital markets, while Richardson specialises in structured credit and advised BNP Paribas on Europe’s first middle-market private credit CLO. Chair Frank Lopez said the hires reflect Paul Hastings’ ambition to build a “premier tax practice” — and with London revenue up 70% in two years, they’ve got momentum to match.

Freshfields, White & Case lead on £2B bookbuild

SSE has announced plans to raise up to £2 billion through an accelerated bookbuild, issuing new shares to help fund its £33 billion, decade-long upgrade of the U.K.’s electricity network. The FTSE 100 utilities giant is being advised by Freshfields, led by partners Nick Jones and Julian Pritchard. The banks — including Morgan Stanley, UBS, Barclays, BNP Paribas, JPMorgan, Merrill Lynch, Santander and RBC — are receiving U.K. and U.S. legal advice from White & Case, led by partners Inigo Esteve and Laura Sizemore. SSE’s shares jumped 12% on the announcement, reflecting investor confidence in its large-scale infrastructure strategy.

- 💡 Did you know? A bookbuild (or bookbuilding) is a process used in capital markets when a company wants to raise money by issuing new shares. In a bookbuild, the company (with the help of banks, called underwriters) invites potential investors to submit offers indicating how many shares they want to buy and at what price. Based on this demand, the final price at which the shares will be sold is determined. The process usually happens quickly and is often called an accelerated bookbuild if it takes place in just a few hours or overnight.

Term of the Day: Structured Credit

Structured credit refers to complex financial instruments — like collateralised loan obligations (CLOs) — that repackage loans or debt into tradable securities. Investors receive slices (or “tranches”) of these products, each with different risk and return levels.