Weekly Memo: Meet me in Alaska

Hi ZipLawyer! In today's weekly memo we're covering the Trump-Putin meeting, AI's race for funding, new tariffs and much more!

Meet me in Alaska?

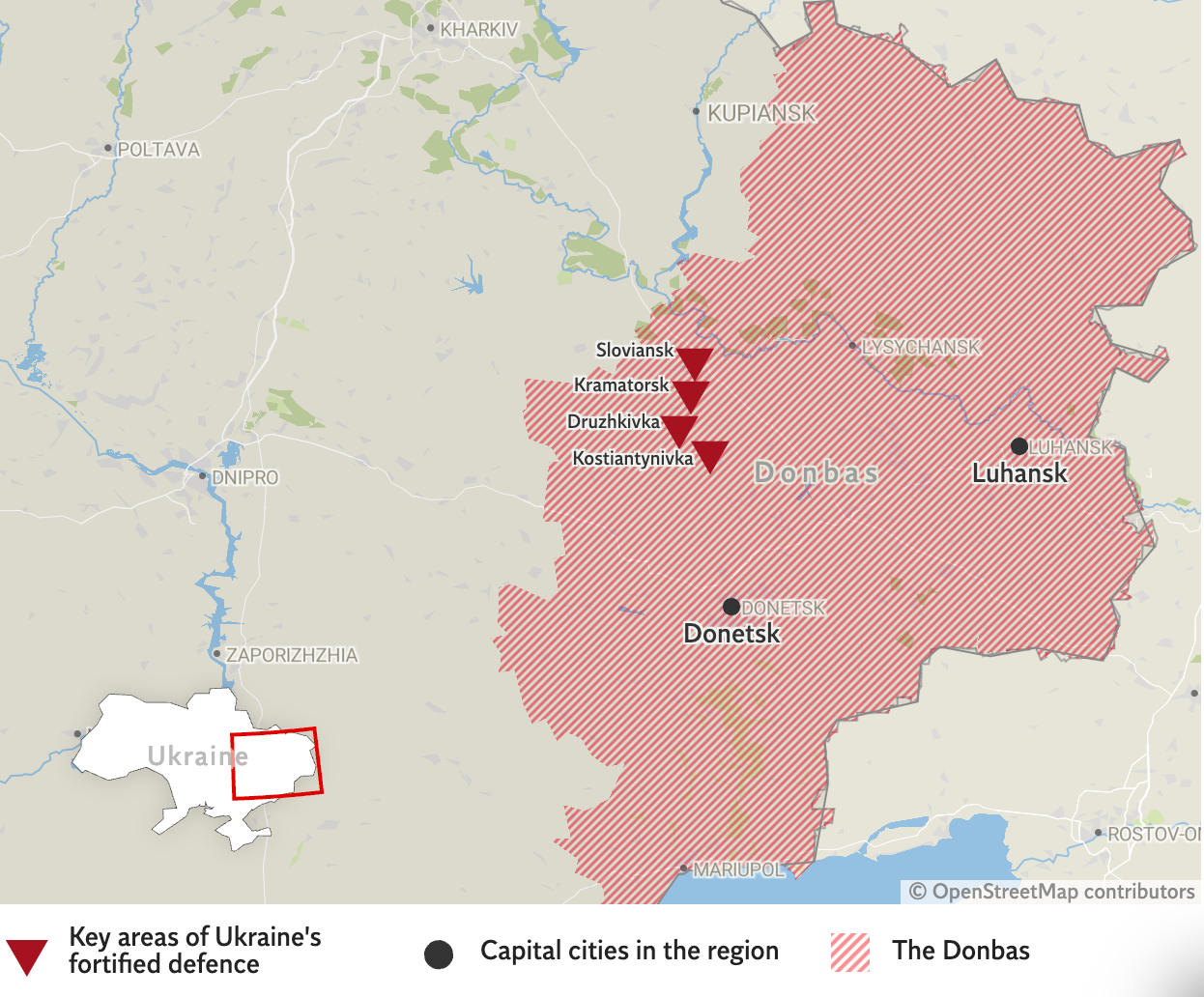

Trump’s Alaska hangout with Putin didn’t deliver a ceasefire, but it did crank up the pressure on Ukraine. Putin wants Kyiv to hand over the entire Donbas, and Trump seems more interested in a grand peace deal than a quick truce. That shift has Europe sweating — allies worry Putin just scored the bigger win by getting Trump to play ball. Zelenskiy, meanwhile, is flying into Washington D.C. tomorrow, already saying “no land for peace.” Watch this space.

- Why the Donbas? The Donbas is Ukraine’s eastern industrial hub, rich in coal and steel. Russia allegedly already controls most of it, but capturing the rest would hand Moscow full control of Ukraine’s energy powerhouse and its main defensive line.

Looking for Funding

Sam Altman wants to spend trillions (yes, with a T) to build the infrastructure for AI — if he can figure out how to actually raise it. He hinted OpenAI is cooking up a funding model “the world has not yet figured out.” For now, OpenAI’s already fronting a $500bn four-year moonshot project called Stargate. Meanwhile, Zuck is busy too: Meta just locked in $29bn from private credit heavyweights Pimco and Blue Owl to build a mega AI data centre in Louisiana.

Saudi Gas Play

BlackRock inked an $11bn deal with Saudi Aramco to lease natural-gas processing facilities, a big win for Riyadh’s push to lure foreign capital. Aramco hailed the move as proof of its global appeal, but the backdrop is less glossy: Saudi Arabia is facing mounting fiscal pressure and has struggled to attract serious investment beyond oil and gas. The deal underscores a familiar pattern — when it comes to drawing foreign money, the kingdom’s energy assets remain the only game in town.

In Tariff News

Trump is cranking up the tariff talk — this time targeting semiconductors. He said he'll slap levies on chips “next week or the week after,” floating rates as high as 200–300%. Trump hasn’t explained how exemptions would work, though Apple (which pledged $600bn in US manufacturing) may get a pass. The move could reshape global supply chains, spook AI firms, and rattle consumer electronics.

Meanwhile, the US and China hit snooze on new tariffs for 90 days. Deadline reset: 10 November. Meanwhile, Nvidia & AMD agreed to give the US 15% of their China chip sales just to keep selling. That’s not a tax — that’s a subscription fee. Beijing told domestic firms to avoid Nvidia’s H20 chips (but didn’t outright ban them). Translation: both sides are circling, nobody’s throwing a knockout punch yet.

Like our roundup? Join ZipLaw+ to get one like this every day of the week!

Worth Knowing

🇬🇧 UK GDP = Meh, But Not Bad: Britain’s economy grew 0.3% in Q2. Not fireworks, but not a recession either. April and May were ugly, but June carried the team. Taxes went up, trade stayed messy, and yet… growth! The government is breathing again, but economists are still side-eyeing 2025 like, “don’t get too comfortable.”

🇦🇺 Aussie Rate Cut: Australia’s central bank cut rates by 0.25% to 3.6%. Inflation’s calming down, so they pulled the trigger. Markets weren’t shocked — the surprise was in July when they didn’t cut. Big picture: Aussies still have pricey mortgages, China’s buying less, and commodities are wobbling.

📊 US Inflation Steady, Wall St Party: US inflation stuck at 2.7% in July, but core inflation ticked up to 3.1% thanks to pricier services (airfares jumped 4% in a month). Markets loved it — S&P and Nasdaq hit record highs on hopes the Fed cuts rates in September.

👀 Keep an eye on

Perplexity Shoots Its Shot

AI search darling Perplexity just lobbed a $34.5bn offer to buy Google’s Chrome browser. The pitch: if antitrust regulators ever force Google to sell Chrome, we’re first in line.

Reality check: Chrome is Alphabet’s crown jewel, controlling two-thirds of global browsing — it’s not going anywhere. But the move wasn’t about closing a deal; it was about grabbing headlines. Perplexity is signalling, “We’re not scared of Google, we want a seat at the table.” Bold flex, free PR, and not a dime spent.

Unlock 400+ cases, deals, news about your favourite law firms to impress in applications and ACs!

➡️ Week Ahead

Sunday: Bolivia holds a general election.

Monday: Zelenskiy meets Trump in Washington; Chile and Thailand release GDP figures.

Tuesday: Canada reports inflation; US housing starts data; earnings from Home Depot and Xiaomi.

Wednesday: Fed minutes from its last meeting; rate decisions in Indonesia, Sweden, New Zealand and Israel; inflation data from the UK, eurozone and South Africa; earnings from Target, Lowe’s and Baidu.

Thursday: Walmart reports earnings; Fed’s Jackson Hole gathering begins.

Friday: Fed chair Powell delivers his keynote at Jackson Hole; Germany releases GDP; Japan reports inflation.

💡 Quiz

- Which two leaders met in Alaska this week, with talks focused on Ukraine?

- UK inflation fell again in July — what policy move are markets now expecting from the Bank of England?

- Which UK online fashion retailer’s shares plunged after warning on profits due to weak consumer spending?

- Which greeting card retailer bought Funky Pigeon from WH Smith for £24m?

- Which Wall Street bank announced a major restructuring of its investment banking division to cut costs and boost profitability?

Reply to this email with your answers! We'll send out solutions on our next newsletter 😄

Term of the Week: Rights Issue

Think of a rights issue like this: your gym needs money to build a fancy new sauna. Instead of borrowing, it asks current members to chip in extra cash — but offers them the new membership at a discount as an incentive.

👀 Real-world example: Ørsted, a leading wind energy company, is doing exactly that — asking shareholders for $9bn to keep its renewable projects alive. Investors can buy new shares at a lower price, but only if they believe the wind farms will actually get finished. The move caused political backlash and a massive drop in Ørsted's shares.

🙋 Did you find this helpful? If so, please let us know by voting below!