Why are US companies raising money in Europe?

In Short: American companies are hitting up Europe’s bond markets for cheaper borrowing costs and sweet deals for their mergers and acquisitions.

What's Going On?

US companies are flocking to Europe’s bond markets like kids to a candy store. They’re on pace to raise a whopping €85 billion this year in these so-called "reverse Yankee" deals.

What’s a reverse Yankee deal? It’s when US companies issue bonds in euros instead of dollars. Think of it as borrowing money in euros because it’s cheaper and more attractive right now.

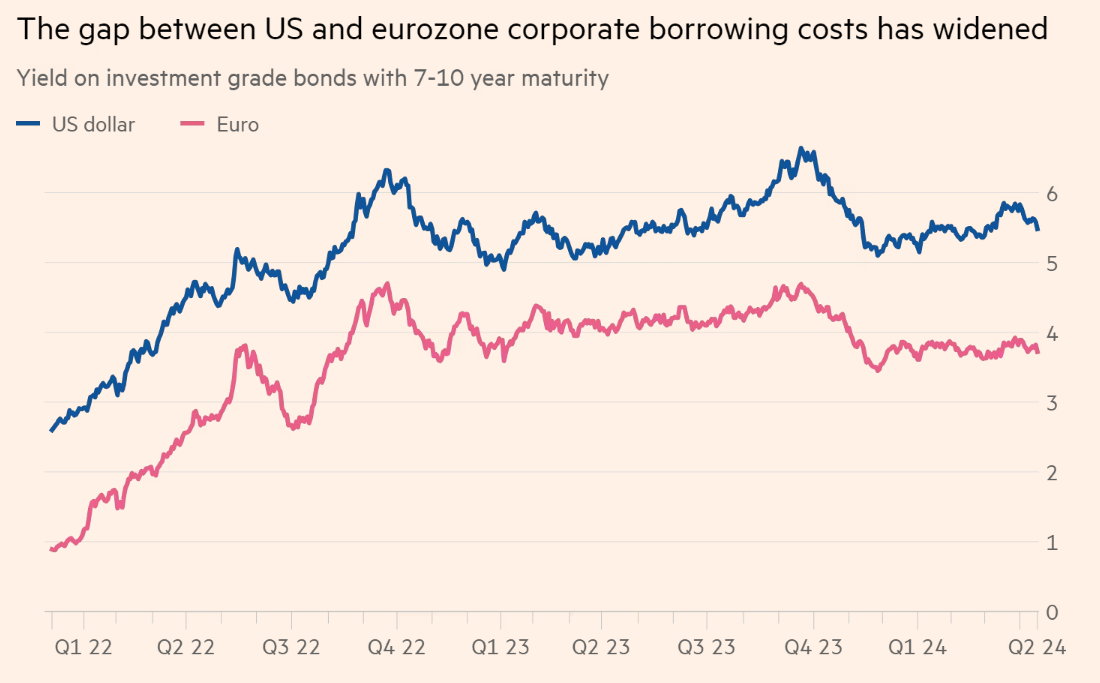

So why is Europe the hot spot? Two big reasons: lower interest rates and a flurry of cross-border M&As (that’s mergers and acquisitions for the uninitiated). Big names like Johnson & Johnson and Booking Holdings are diving in headfirst, grabbing euros while the getting’s good. Investors are betting that the European Central Bank (ECB) will start cutting interest rates before the US Federal Reserve does, making European debt much cheaper. We’re talking almost 2 percentage points cheaper than in the US.

What Does This Mean?

For American companies, it’s like finding a sale on everything they need. They’re saving big bucks and spreading their borrowing across different markets. If you’ve got sales all over the globe, borrowing in euros helps balance out currency risks. Plus, it just looks smart on the balance sheet.

This trend is all about making the most of diverging monetary policies. The ECB is expected to lower rates sooner, so borrowing in euros now is a no-brainer. That’s why we’re seeing a flood of these reverse Yankee bonds, almost reaching the record highs of 2019.

Why now? Well, it’s partly because of all the merger and acquisition action. Companies need cash for their big moves. Take Johnson & Johnson, for instance—they’re using these euro bonds to help fund their $13.1 billion buyout of Shockwave. It’s like using your low-interest credit card for a big purchase because the interest is way better.

How does this impact Law Firms?

Join ZipLaw+ to continue reading