Why Law Firms should focus on Rare Earths

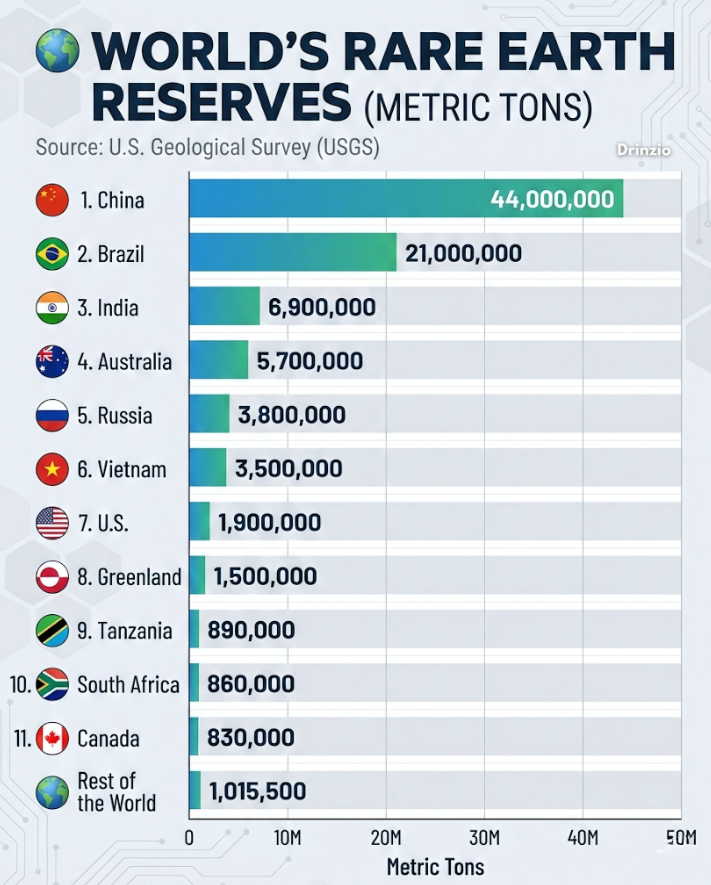

Despite the name, rare earths aren’t actually rare. They’re scattered across the planet in awkward, hard-to-extract places, and that’s the problem. As supply chains become pressure points, governments and companies are scrambling to lock down their own reserves.

Today, we look at why this rush is turning rare earths into a serious opportunity for Law Firms.

What are Rare Earths?

Rare earths are a group of 17 elements used to make the powerful magnets and components that sit inside everyday tech and high-end hardware alike. Your phone, satellites, fighter jets and missile guidance systems all rely on them.

The problem for the US (and much of the West) is concentration.

A large share of global rare earth mining and an even larger share of processing happens outside the US. That creates a strategic vulnerability. If supplies are disrupted, whole industries feel it and that's a big problem.

Why the US is stepping in with billions

The US government announced plans to pour $1.6bn into a domestic rare earths company (USA Rare Earth). This is a big move. Instead of relying on tax breaks or policy nudges, the government is stepping in directly with equity and debt funding.

The aim is simple but ambitious: reduce reliance on overseas supply chains and secure the raw materials needed for advanced manufacturing, technology and defence.

Why USA Rare Earth? Two reasons:

- The company is developing a large rare earths mine in Texas, with deposits covering most of the elements used in everyday tech and military hardware.

- But the more strategic move is downstream. It also plans to build a magnet manufacturing facility in Oklahoma, targeting one of the weakest links in the global supply chain.

Digging minerals out of the ground is only half the battle; processing them into usable components is where control – and vulnerability – really lies.

This intervention fits neatly into a broader push to reshore industries seen as essential to US economic and national security, driven by legislation like the CHIPS and Science Act. Rare earths are now being treated in the same category as semiconductors: foundational inputs that modern economies cannot afford to leave exposed to geopolitical disruption.

Why investors see a huge opportunity

Once governments start writing cheques, markets pay attention. The announcement has helped trigger a surge in investor interest, with USA Rare Earth’s shares more than doubling this year. The deal also required the company to raise substantial private funding, which it has done comfortably, showing how public money can unlock private capital at scale.

The opportunity goes beyond one company. Demand for rare earths is set to grow as electric vehicles, renewable energy, AI hardware and defence spending all expand at the same time. Supply, however, takes years to build. Mines, processing plants and manufacturing facilities are slow, expensive and politically sensitive.

That gap between rising demand and constrained supply is what makes rare earths so attractive right now. They are a strategic asset class, backed by governments, driven by technology, and increasingly central to how modern economies function.

How does this impact Law Firms?

Join ZipLaw+ to continue reading