Amazon goes all-in on AI

Hi this is ZipLaw! We explain how news stories impact law firms so you can stand out in your applications.

Here’s what we’re serving today:

- Amazon goes all-in on AI

- EU-China trade war resolved?

- Italy's bank tax U-turn

Are you new here? Get free emails to your inbox.

Amazon goes all-in on AI

In Short

Amazon is investing up to $4 billion in AI start-up Anthropic to make sure it's the cool kid on the AI block.

What's going on?

Amazon is investing an initial $1.25 billion in Anthropic for a minority stake, with the option to pump it up to $4 billion later. Think of it as Amazon sliding into Anthropic's DMs but with billions instead of emojis. Why? To get cozy with a hot AI start-up, just like Microsoft did with OpenAI. Anthropic will use Amazon's cloud and AI chips to build its models, making this a "you scratch my back, I'll scratch yours" kinda deal.

The need for chips

AI start-ups are like people at a party, scrambling for the last piece of pizza—or in this case, costly chips and data centre resources. Anthropic, last valued at nearly $5 billion, is in a high-stakes game with other big players like Inflection AI and Cohere. They're all vying for the crown of King in the AI world, and Amazon wants in on that action.

More competition

Amazon's hefty investment in Anthropic underscores the intensifying race in the AI sector among the tech giant. It's not just about developing AI in-house anymore; it's about strategically aligning with promising start-ups to gain an edge. This move by Amazon signals a clear intent to not only keep pace with but also challenge the likes of Microsoft, Google, and Nvidia in the AI arena. Each of these giants is vying for dominance, seeking partnerships, and pouring billions into AI ventures.

⚖️ How does this impact Law Firms?

Corporate and M&A:

- Due Diligence: Lawyers specialising in corporate and M&A law will be heavily involved in the due diligence process for Amazon's investment in Anthropic. This will include scrutinising financials, intellectual property, and existing contractual obligations of Anthropic to ensure that Amazon's investment is sound. Law firms can expect more M&A instructions as the AI market heats up.

- Shareholder Agreements: Given that Amazon is taking a minority stake with an option to increase its investment later, lawyers will need to draft intricate shareholder agreements. These agreements will outline the terms under which Amazon could increase its stake, as well as any exit strategies or buy-back options.

Intellectual Property (IP):

- Technology Transfer Agreements: IP lawyers will be instrumental in drafting and negotiating technology transfer agreements, especially since Anthropic will be using Amazon's cloud computing platform and dedicated AI chips. These agreements will specify the terms of use, licensing, and any revenue-sharing models.

- Patent Filings and Protections: As both companies are in the tech space and are likely to co-develop new technologies, IP lawyers will be needed to file for patents and ensure that any co-developed technologies are adequately protected against infringement.

Data Protection:

- Data Processing Agreements: Given that Anthropic is in the business of large language models and AI, which often require vast amounts of data, lawyers specialising in data protection will need to draft robust data processing agreements. These will outline how data will be collected, stored, and used, ensuring compliance with regulations like GDPR.

- Privacy Impact Assessments: As AI models become more sophisticated, there are increasing concerns about user privacy and data ethics. Lawyers in this department will be responsible for conducting privacy impact assessments to evaluate how the AI models impact individual privacy and to ensure that they are in line with existing data protection laws.

What trend can we pick out?

Big Tech's increasing investment in AI start-ups is creating a complex web of legal considerations that span across corporate governance, intellectual property, and data protection. Law firms will need to be proactive rather than reactive. With the stakes so high and the technologies so advanced, waiting for a legal issue to arise is not an option. They will need to be part of the strategic planning from the get-go, offering pre-emptive legal advice that can shape the direction of these collaborations and investments.

EU-China trade war resolved?

In Short

China and the EU are chatting about export controls, and China's promising to buy more EU agricultural goods and resolve a backlog of licences for European infant formula.

What's going on?

Picture this: You're at a party, and someone keeps hogging the aux cord, playing their own tunes and ignoring everyone else's playlist. That's kinda what the EU is saying China's doing in the global trade game.

Why is this happening?

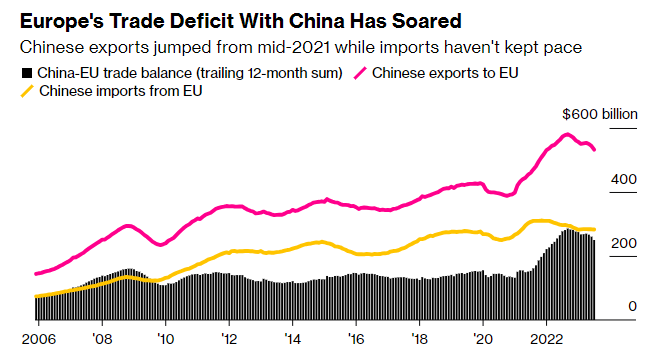

Check out the graph below. China is exporting a lot to the EU but the EU isn't doing much exporting to china. Result? Europe's in a trade deficit and that's bad news long term as it risks making the bloc too reliant on Chinese goods.

What's the latest on this?

The two are now setting up a "mechanism" (read: fancy chat room) to discuss export controls in a bid to avoid a trade war. To smooth relations even more, China agreed to buy more EU agricultural goods and to resolve issues including a backlog of licences for European infant formula.

The EU hopes these types of agreements will push up its exports to China to restore some balance in their trade relationship.

Anything else to note? We've got the whole semiconductor drama floating around in the background. In short, China's wasn't happy with the US-led restrictions on the sale of advanced semiconductor equipment to China. This led them to set up their own export control information exchange with the US. The EU counters that China is not innocent either having implemented export controls, specifically limiting the shipments of metals such as gallium and germanium. These metals are essential components in the production of semiconductors.

⚖️ How does this impact Law Firms?

International Trade and Export Control:

- Export Control Compliance: Lawyers in this department will be busy advising clients on how to navigate the new "mechanism" for export controls between the EU and China. This will involve ensuring that companies are in compliance with both EU and Chinese regulations, which could be a complex task given the differing stances on export controls.

- Trade Agreements and Licenses: These lawyers will also be involved in drafting and reviewing new trade agreements, especially for EU agricultural goods and infant formula makers. They'll be working to resolve the backlog of licences, ensuring that European companies can gain easier market access.

Intellectual Property (IP) and Technology:

- Semiconductor IP Issues: Given the focus on semiconductor exports, IP lawyers will be advising clients on how to protect their intellectual property rights when dealing with Chinese companies. This could involve patent filings, licensing agreements, or even litigation.

- Data Law Compliance: With the EU raising concerns over China's vague and cumbersome data laws, lawyers in this department will be advising European tech companies on how to operate within the Chinese legal framework without falling foul of EU data protection laws.

Dispute Resolution and Arbitration:

- Cross-Border Litigation: If the EU and China can't play nice in the sandbox, companies caught in the middle may resort to legal action. Lawyers in this department will represent clients in cross-border disputes, which could range from contract violations to unfair trade practices.

- Investor-State Dispute Settlements: Given the geopolitical shifts and the EU's new assertive stance, European companies investing in China might face new risks. Lawyers will be involved in preparing for and engaging in investor-state dispute settlements to protect the interests of their clients.

Italy's Bank Tax U-Turn

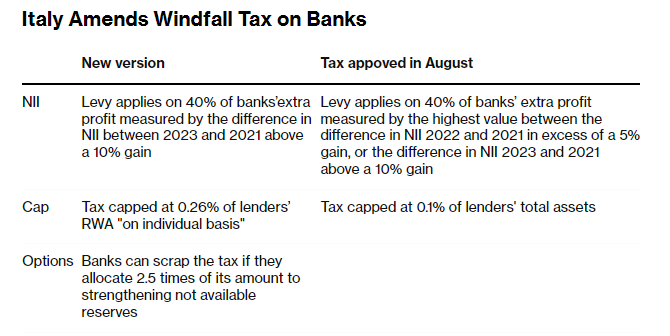

So, the Italian government tried to slap banks with a windfall tax. Think of it as the government saying, "Hey, you're making too much dough—time to share the pizza!" But then, the European Central Bank and Italian bank stocks didn't take it well and their stocks started crashing.

So redeem them, Giorgia Meloni's (Italy's Prime Minister) government gave banks two options: 1) Pay this new tax that's like a cover charge at a club nobody wanted to go to. 2) Skip the tax but stash away more money in their "rainy day fund" aka capital reserves.

Problem is banks are more interested in making it rain for their shareholders than hoarding cash. They'd rather pay the tax and keep the high-profit party going.

The new rules are still in the "will they, won't they" stage of parliamentary approval. But the government's still expecting to receive a cool €3 billion.

Why does this matter?

Since Brexit, financial centres in countries like France, Germany and Italy have become more important. That means these locations have become key for law firms clients therefore it is important (and very useful) to keep an eye on what happens here. Especially when it involves key sectors like banking.

👀 ZIPMEMES

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).