India's Stock goes up

Hi this is ZipLaw! We explain how news stories impact law firms so you can stand out in your applications.

Are you new here? Get free emails to your inbox.

Here’s what we’re serving today:

- 🇬🇧 Bank of England struggles with inflation

- 🇮🇳 India's stock market is booming

- 🔍 2 Law Firms lead on App Store case

💸 Economics

The Inflation Struggle

In Short

The Bank of England (BoE) is stuck between a rock and a hard place, not cutting interest rates like its banking pals abroad might next year. Stubborn inflation's the party pooper.

What is Going on?

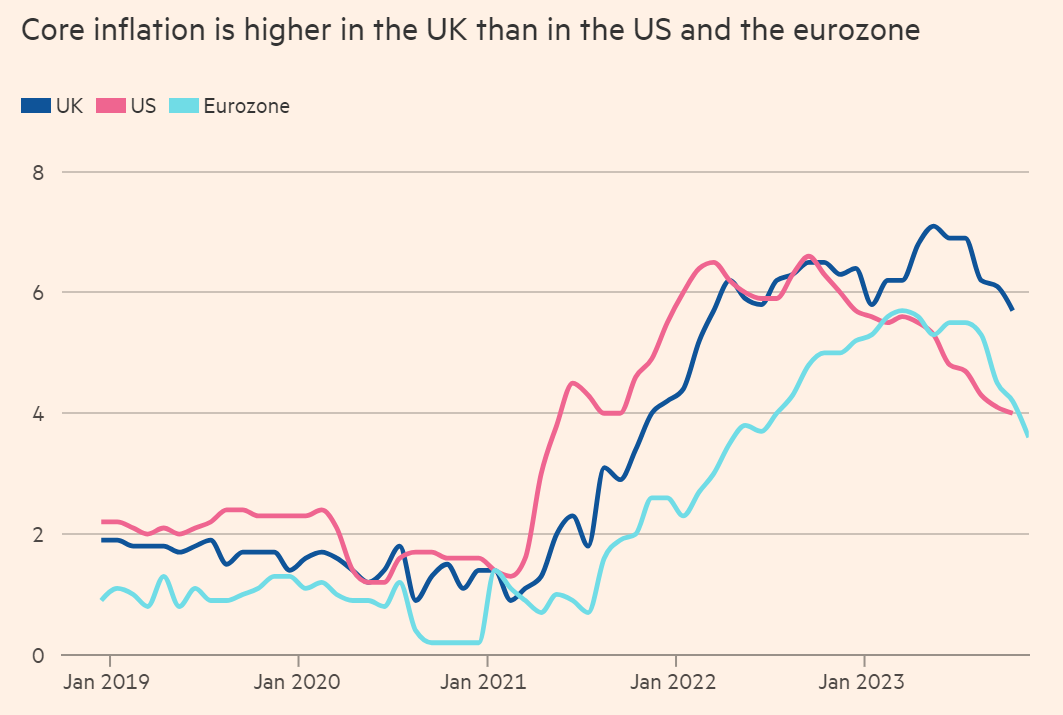

The BoE is playing it cool, keeping its critical rate at a whopping 5.25% - a 15-year high! The reason? They’re trying to keep a tight leash on borrowing costs. Meanwhile, around the globe, other big central banks are wrapping up their rate-hiking spree and might even hit the reverse gear in 2024 as inflation cools down.

But the UK's situation is a bit like trying to diet at a cake festival. Inflation is at 4.6%, way above the modest 2% target. While the Eurozone and the US are hinting at rate cuts between March and May 2024, the UK's BoE might hold off until June 2024. Even the BoE governor, Andrew Bailey, admits inflation is stickier than expected.

Why does it matter?

Well, high inflation means your pound doesn't stretch as far as it used to. Think less bang for your buck... or quid. And the BoE’s hesitation to cut rates? It's like keeping the brakes on while everyone else is hitting the gas.

This isn't just about numbers and percentages; it's about your wallet feeling lighter. The UK's inflation, especially in services and wages, is outpacing peers like the US and the Eurozone. This means prices are rising faster than in other countries, and wages aren't keeping up. The BoE is watching wages like a hawk, hoping not to fuel the inflation fire.

With an election looming, there's pressure on the BoE to ease up on rates if the economy keeps dragging its feet. But with inflation still being a sticky wicket, don't expect any rate-cutting parties soon. The BoE's next moves could shape not just the economy, but also your next grocery bill or mortgage payment.

⚖️ How does this impact Law Firms?

Restructuring and Insolvency:

- Corporate Restructuring Advisory: In response to the economic changes driven by the BoE's monetary policies, lawyers will be heavily involved in advising companies on restructuring their operations and financial arrangements. This includes renegotiating terms with lenders, creditors, and stakeholders, as well as advising on the legal implications of downsizing, selling off assets, or altering business models to adapt to the new economic environment.

- Insolvency Proceedings: Economic uncertainty and changing interest rates can push some companies towards insolvency. Lawyers specializing in this area will handle insolvency proceedings, including voluntary arrangements, administration, and liquidation. They will provide legal advice on the best course of action, represent companies in court, and ensure compliance with insolvency laws and regulations.

Employment and Labour Law:

- Wage Negotiation and Employment Contracts: With wage growth being a significant factor in the BoE’s decision-making, lawyers will guide employers in negotiating wages and restructuring employment contracts. They'll ensure that these contracts are fair and comply with the evolving economic environment, particularly in sectors directly impacted by the interest rate decisions.

- Dispute Resolution and Litigation: Economic changes often lead to disputes over employment terms, redundancies, and wage adjustments. Lawyers in this field will be busy resolving disputes between employers and employees and, if necessary, representing clients in employment tribunals or court proceedings.

Corporate and Commercial Law:

- Mergers and Acquisitions Advisory: Fluctuations in interest rates can lead to changes in market dynamics. High-interest rates generally make borrowing more expensive, which can cool the M&A market. Companies may become more cautious about leveraging debt to finance acquisitions. Flip that around and we could see an increase in mergers and acquisitions. Lawyers will be involved in advising on these transactions, conducting due diligence, and ensuring compliance with all regulatory requirements.

- Restructuring and Insolvency Advice: Economic instability may lead some businesses to restructure or face insolvency. Lawyers in this area will be essential in advising on restructuring processes, negotiating with creditors, and handling insolvency proceedings in a way that minimises financial and legal risks.

📈 Capital markets

India's stock market is booming

In Short

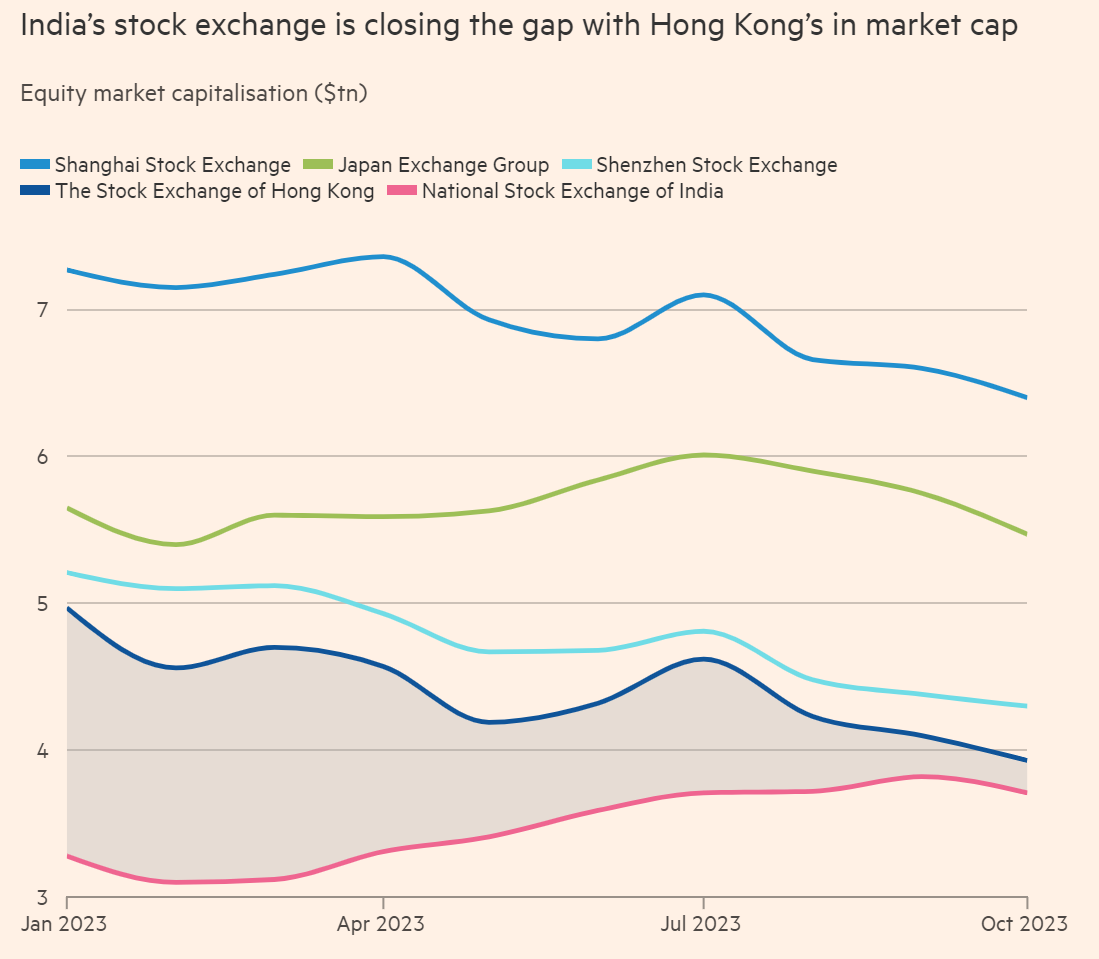

Move over Hong Kong, India's National Stock Exchange is strutting its stuff on the world stage, potentially snagging a spot among the global big leagues of trading venues.

What is Going on?

The National Stock Exchange of India (NSE) is doing a financial victory dance, eyeing Hong Kong's coveted spot in the world's largest trading venues. With a whopping $3.7 trillion market cap (as of October). And get this, since that data drop, Indian share prices have been partying hard, thanks to some stellar earnings and rosy growth forecasts.

Meanwhile, over in Hong Kong, things are looking a bit glum. Share prices are taking a tumble as China's economy hits the brakes. It's a tale of two cities, with India's Nifty 50 index leaping 8.1% to new heights, while Hong Kong's Hang Seng index is nursing a 6.7% drop, tripped up by a property sector crisis and shaky investor confidence.

Why does it matter?

Because it's not just a numbers game. This shift reflects a broader change in the global financial landscape. India is turning heads with its strong consumption, attracting investors like bees to honey. The country is showing off as the world's fastest-growing big economy, expected to expand by 6.3% this year. That's no small feat!

And there's more. India's political and policy stability seems to be on the upswing, thanks to recent local election wins for the ruling Bharatiya Janata party. This is like having a steady captain at the ship's helm, which investors love.

Also, did you hear? Big names like Apple and Tesla are eyeing India as the next big thing, shifting their supply chains and potentially setting up shop. So, while India's stock market rise is fuelled mostly by domestic money, international investors are now doing a double-take.

⚖️ How does this impact Law Firms?

Capital Markets:

- Debt and Equity Offerings: With the National Stock Exchange of India's growing prominence, lawyers in capital markets will see increased activity in debt and equity offerings. They will assist companies in issuing bonds or shares, ensuring compliance with regulatory requirements, drafting offer documents, and advising on the structure and pricing of these offerings.

- Securities Regulatory Compliance: The rise of the NSE and increased activity in the capital markets will necessitate stringent compliance with securities regulations. Lawyers will provide crucial guidance on compliance with the rules set by market regulators, such as the Securities and Exchange Board of India (SEBI), and assist in navigating the complexities of listing requirements, disclosure obligations, and corporate governance standards.

Funds and Investment Management:

- Fund Formation and Structuring: Lawyers will be essential in forming and structuring investment funds, including private equity, venture capital, and mutual funds, particularly those focusing on Indian equities and assets. This involves advising on legal structures, drafting fund documents, and ensuring compliance with financial and investment regulations.

- Regulatory Advice and Compliance for Fund Managers: As investment in Indian equities increases, fund managers will require legal guidance on a range of regulatory issues. This includes adherence to financial promotion rules, compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, and navigating the evolving landscape of international investment regulations.

Intellectual Property (IP) and Technology:

- IP Strategy and Protection for Tech Companies: With technology companies like Apple and Tesla exploring Indian manufacturing and the rise of tech startups in India, IP lawyers will be in demand to develop robust IP strategies. This includes patent filing, trademark registration, and protecting trade secrets, particularly in cross-border contexts.

- Technology Transfer and Licensing Agreements: Lawyers will facilitate technology transfer and licensing agreements, ensuring that tech companies' IP rights are safeguarded while collaborating with Indian firms. They will draft and negotiate agreements that comply with both Indian and international IP laws, addressing complex issues related to technology collaboration and licensing.

🔍 ZipTracker

App Store Drama

In Short: The UK Court of Appeal has allowed the Competition and Markets Authority (CMA) to reopen its investigation into Apple and Google's mobile browser and cloud gaming services, overturning a prior decision that restricted the CMA's investigative authority.

Case Background and Current Status: The CMA aimed to scrutinize Apple and Alphabet (Google’s parent company) over their dominant roles in mobile browsers and cloud gaming services. Initially, the Competition Appeal Tribunal (CAT) halted the CMA's probe, accepting Apple's argument that the CMA had missed a critical deadline under the Enterprise Act 2002. However, Justice Nicholas Green of the Court of Appeal found this interpretation problematic, potentially weakening the CMA's oversight capabilities.

What are the parties arguing?

- Apple and Google: They relied on the Enterprise Act 2002, arguing that the CMA missed the statutory deadline for initiating its investigation, and therefore, the investigation was invalid.

- CMA: The CMA countered that their delayed investigation was still within their jurisdictional powers and necessary to address the duopolistic control Apple and Google hold over mobile browsers and cloud gaming services. (A duopoly is a situation where two companies together own all, or nearly all, of the market for a given product or service.)

Key Legal Points to discuss in applications & interviews:

1. Interpretation of Statutory Deadlines: The case hinged on how the Enterprise Act 2002’s deadlines are interpreted. The CMA argued that their investigation, though delayed, was still lawful, highlighting the flexibility in statutory interpretation.

2. Market Dominance and Consumer Protection: The CMA's investigation focuses on the market dominance of Apple and Google, emphasizing consumer protection and fair competition. This point illustrates the ongoing global scrutiny over the market power of tech giants.

3. Powers and Scope of Regulatory Authorities: The case underlines the extent of powers held by regulatory authorities like the CMA. Justice Green's decision reinforces the CMA's ability to initiate investigations even beyond strict statutory timelines, which is significant in the evolving landscape of digital markets and antitrust law.

⚖️ Which law firms are advising on this?

Find out now and unlock hundreds of cases and deals at your fingertips. Join ZipLaw+ and get unlimited access to the ZipTracker database of court cases, deals and news featuring 80+ law firms to stand out in applications.

Don't forget...

🙏 Our work is reader-supported. You can get a membership for cheap!

🎥 Follow us on Instagram here or TikTok here.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).